Historical Trajectories and Corporate Competences in Wind Energy Working Paper

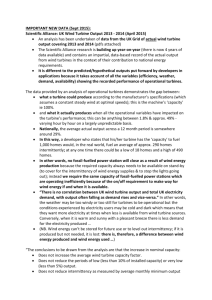

advertisement