Bharadwaj Institute Pvt Ltd. Assignment on 9841537255 www

advertisement

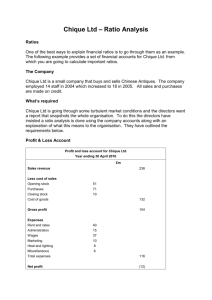

Bharadwaj Institute Pvt Ltd. Assignment on www.bharadwajinstitute.com Ratio Analysis 9841537255 Time 3 ½ hours Complete before 20th August 2012 You shall workout the answers in Notebook itself. 1. From the following information provided by Jolly Ltd., you are required to prepare the balance sheet : Current ratio Liquidity ratio Proprietary ratio Working capital Reserves and surplus Bank overdraft 2.5 1.5 0.75 Rs.6,00,000 Rs.4,00,000 Rs.1,00,000 There is no long-term loan or fictitious assets. You are also required to show the necessary working notes. CS December 2009 2. Summarised income statement and balance sheet of Progressive Ltd. are given below : Income Statement for the Year ended 31st December, 2009 (Rs. ’000) Sales 1,600 Less: Cost of goods sold 1,310 Gross margin 290 Less: Selling and administration expenses 40 Net operating income (EBIT) 250 Less: Interest 45 Earnings before tax 205 Less : Tax paid 82 Net income after tax 123 Earnings per share (EPS) is Rs. 3.075. Balance Sheet as at 31st December, 2009 Liabilities (Rs. ’000) Paid–up capital (40,000 shares of Rs. 10 each fully paid) 400 Retained earnings 120 Debentures 700 Creditors 180 Bills payable 20 Other current liabilities 80 1500 Assets Net fixed assets (Rs. ’000) 800 Inventory 400 Debentures 175 Marketable securities 75 Cash 50 1500 Market Price per share is Rs.15. Industry’s average ratios are : Current ratio (i) .......... 2.4 Quick ratio .......... 105 Sales to inventory .......... 8.0 Average collection period .......... 36 days Price per share/book value of share .......... 1.6 Debts to assets .......... 40% Times interest earned .......... 6 Profit margin .......... 7% Price to earnings ratio .......... 15 Return to total assets .......... 11% Progressive Ltd. would like to borrow Rs.5,00,000 from a bank for less than a year. Evaluate the firm’s current financial position by calculating ratios that you feel would be useful for the bank’s evaluation. (ii) What problem areas are suggested by your ratio analysis ? What are the possible reasons for them ? (iii) Do you think that the bank should give the loan ? (iv) If Progressive Ltd.’s inventory utilisation ratio (sales to inventory) and average collection period were reduced to industry average, what amount of funds would be generated ? CS June 2010 3. Following are the ratios to the trading activities of National Traders Ltd.: Debtor’s velocity 3 months Stock velocity 8 months Creditor’s velocity 2 months Gross profit ratio 25% Gross profit for the year ended 31st December, 2009 amounting to Rs.4,00,000. Closing stock of the year is Rs.10,000 more than the opening stock. Bills receivable amount to Rs.25,000. Bills payable amount to Rs.10,000. Find out (i) (ii) (iii) (iv) Sales; Sundry debtors; Closing stock and; Sundry creditors. CS June 2011 4. From the following information pertaining to ABC Ltd., prepare its trading, profit and loss account for the year ended 31st March, 2011 and summarised balance sheet as at that date : Current ratio = 2.5 Quick ratio (quick assets/quick liabilities) = 1.3 Proprietary ratio (fixed assets/proprietary funds) = 0.6 Gross profit to sales ratio = 10% Debtors velocity = 40 days Sales = Rs. 7,30,000 Working capital = Rs. 1,20,000 Bank overdraft = Rs. 15,000 Share capital = Rs. 2,50,000 Closing stock = 10% more than opening stock Net profit = 10% of proprietary funds. CS December 2011 5. From the following information relating to ND Ltd, prepare a Balance Sheet as on 31.12.2007. Current Ratio — 2 Reserve & Surplus/share capital — .25 G.P. Ratio — 25% Net working Capital — Rs. 4,00,000 Fixed Assets/shareholders’ net worth — .60 Average Debt collection period — 2 months Cost of sales/closing stock — 9 times Liquid Ratio — 1.5 CWA Inter December 2008 6. The following extracts of financial information relate to Complex Ltd: (Rs. in lakhs) Balance Sheet as at 31st March 2008–09 2007–08 Rs. Rs. 10 10 Share Capital 30 10 Reserves and Surplus 60 70 Loan Funds 100 90 Fixed Assets (Net) 30 30 (Rs. in lakhs) Balance Sheet as at 31st March 2008–09 2007–08 Rs. Rs. Current Assets: Stock Debtors Cash at Bank Others Current Assets Less: Current Liabilities Net Total Assets Sales (Rs. lakhs) 30 30 10 30 100 30 70 100 270 20 30 20 10 80 20 60 90 300 (i) Calculate for the two years Debt Equity Ratio, Quick Ratio and Working Capital Turnover Ratio. (ii) Find the Sales volume that should have been generated in 2008–09 if the company were to have maintained its Working Capital Turnover Ratio. Note: All Current Liabilities are quick liabilities. CWA Inter June 2009 7. From the following information, you are required to calculate the amount of net worth, current liabilities, long– term debt. fixed assets, current assets, inventory and debtors: Current ratio — 2.5 : 1 Sales/Net worth — 4 times Sales to Inventory — 20 times Annual sales — Rs. 40,00,000 Reserves and surplus — Rs. 3,50,000 Net worth/current liabilities — 5 times Fixed assets to net worth — 75% Total debts to Proprietors’ ratio — 50% Debtors velocity — 12 times Fictitious assets — Rs. 50,000 75% of sale were on credit. CWA Inter June 2011 8. Using the following information, complete the.Balance Sheet of Shekhar Ltd. as on 31st March, 2011: (i) Sales Rs. 36,00,000 (ii) Gross Profit Ratio 25%; (iii) Total Assets Turnover: 3 times (iv) Fixed Assets Turnover: 5 times (v) Current Assets Turnover: 7.5 times (vi) Inventory Turnover: 20 times (vii) Debtors' Turnover: 18 times (viii) Current Ratio 1.8 : 1 (ix) Total Assets/Net worth-2.25 : 1 (x) Debt (long term)–Equity 0.75: I Turnover ratios are based on cost of goods sold except Debtors’ turnover Balance Sheet as on 31 st March, 2011 Liabilitites Equity (net worth) Long term Debt Current liabilities Amount Rs. Assets Amount Rs. Fixed Asset Current Assets Inventories Debtors Cash in hand & bank CWA Inter December 2012