chapter 3 - Admissions in India

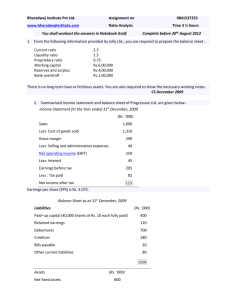

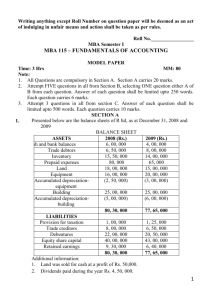

advertisement