Testing semi strong form of efficient market hypothesis of

advertisement

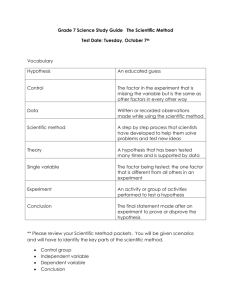

Dr. Ranawat & TV Raman Page 1 2/9/2016Page |1 Research Paper On TESTING SEMI STRONG FORM OF EFFICIENT MARKET HYPOTHESIS OF SELECTED STOCKS OF BSE Dr. Mahendra Ranawat Principal, BNPG Girls College, MLS University, Udaipur, Rajasthan T. V Raman Research Scholar, Department of Economics, MLS University, Udaipur, Rajasthan 0120-4392335, tvraman@abs..edu, 98680 40240 Dr. Ranawat & TV Raman Page 2 2/9/2016Page |2 ABSTRACT In the major stock market of the world , it is the forces of demand and supply that sets prices. There are hundreds of analysts and thousands of traders, receiving new information on a company through electronic and public media. The Efficient Market Hypothesis (EMH)implies that a if a new information is revealed about a firm it will be incorporated into the share price rapidly and rationally , with respect to the direction of the share price movement and the size of the movement. Market efficiency is directly or implicitly tested in the study, which is performed to identify stock price reaction to certain events such as budget announcement ,policy announcement and diwali. It can be studied under weak form, semi strong form and strong form of market hypothesis. This paper is an attempt to study the semi strong form of hypothesis that the prices or movements in share prices are affected by the past and publicly available information. The present study examined the behavior of daily stock returns for 7 prominent companies listed on Bombay Stock Exchange (SENSEX) from Jan 1st to Dec 31st,2010. Three major events were taken into consideration to evaluate the effect of publicly available information on stock prices. The study revealed that the market instantaneously absorbs all the relevant information as it becomes publicly available which indicates that the semi strong form are inefficient during the study period. The study depicted that SENSEX is weak form during the selected period. Finally, it concluded that stock market efficiency does not mean that investors have perfect powers of prediction: all it means is that the current level is an unbiased estimate of its true economic value based on information revealed. Dr. Ranawat & TV Raman Page 3 2/9/2016Page |3 INTRODUCTION The share price movement is analyzed broadly with two approaches namely: Fundamental analysis and technical analysis. Fundamental approach analyses the share price based on economic, industry and company statistics. The Technical analyst mainly studies the stock price movements of the stock prices. An “Efficient Market” is defined as a market where there are large number of rational profit makers actively competing with each trying to predict future market values of individual securities, and where important current information is almost freely available to all the participants. The efficient market hypothesis is concerned with the behavior of prices in asset markets. It suggests that profiting from predicting price movements is very difficult and unlikely. The main engine behind price changes is the arrival of new information. A market is said to be efficient if prices adjust quickly and on average without bias, to new information. As a result, the current prices of securities reflect all available information at any give point in time. There are various forms of market efficiency. Weak Form: Under weak form of efficiency, the current prices reflects the information contained in all past prices, suggesting that charts and technical analysis that use past prices alone would not be useful in finding undervalued stock. The weak form of the efficient markets hypothesis asserts that the current price fully incorporates information contained in the past history of prices only. That is, nobody can detect mispriced securities and “beat” the market by analyzing past prices. Semi Strong Form: Under semi strong form of efficiency, public information includes not only past prices, but also data reported in a companies financial statements, earnings and dividend announcements, announced merger plans , the financial situation of companies competitors, expectations regarding macroeconomic factors (such as inflation , unemployment etc.) Semi Strong form efficiency implies that share prices adjust to publicly available new information very rapidly and in an unbiased fashion, such that no excess returns can be earned by trading on that information and neither fundamental analysis nor technical analysis techniques will be available to reliably produce excess returns. Dr. Ranawat & TV Raman Page 4 2/9/2016Page |4 To test for semi strong form efficiency, the adjustment to previously unknown news must be of a reasonable size and must be instantaneous. To test for this, consistent upward or downward adjustments after the initial changes must be looked for. If there are any such adjustments it would suggest that investors had interpreted the information in a unbiased fashion and hence in an inefficient manner. The assertion behind semi strong market efficiency is still that one should not be able to profit using something that “everybody else knows” (the information is public). Nevertheless, this assumption is far stronger than that of the weak form of efficiency. Semi Strong efficiency of market requires the existence of market analysis who are not only financial economists able to comprehend implications of vast financial information, but also macro economists, experts adept at understanding processes in product and input markets. In effect, the semi strong form of market hypothesis maintains that as soon as information becomes publicly available, it is absorbed that and reflected in stock prices. Furthermore, even while the correct adjustment is taking place, the analyst cannot obtain consistent superior returns. Strong Form: The strong form of market efficiency hypothesis states that the current price fully incorporates all existing information, both public and private (sometimes called inside information). The main difference between the semi strong and strong efficiency hypothesis is that in latter case, nobody should be able to systematically generate profits even if trading on information not publicly known at the time. The rationale for strongform market efficiency is that the market anticipates, in an unbiased manner, future developments and therefore the stock price may have incorporated the information and evaluated in a much more objective and informative way than the insiders. OBJECTIVE OF THE STUDY: To indicate whether prices of stocks consider past information and information publicly available as required by the semi strong form of Market Efficiency Theory To identify the relationship between SENSEX and Different companies taken in sample To study the variation caused in the return of the Index and the companies taken in the sample Dr. Ranawat & TV Raman Page 5 2/9/2016Page |5 RESEARCH METHODOLOGY: The study was descriptive in nature. The population of the study was seven prominent companies listed in Bombay Stock Exchange (SENSEX).Data was collected from the secondary sources. Daily price data of the stock prices of SENSEX and seven companies was collected from the website of BSE. The sampling frame of the study was for the period from 1st January, 2010 to December 31st, 2010.To test the difference between Returns and announcement date T-Test was applied, to identify the degree of relation and to establish relationship between stock prices and publicly available information, Regression was applied, and to study the difference in variation of means between the returns of SENSEX and seven companies, ONE WAY ANOVA was applied. HYPOTHESIS Weak Form: Ho: The price movements in the share prices in the SENSEX are not affected by past prices. Semi Strong Form: H1: The security prices do not fully reflect all publicly available information. FINDINGS OF THE STUDY: Analysis of T Test: The question of whether the excess returns around the announcement date are different from zero is answered by estimating the T value for each event. T statistics is used to compare the returns of the stocks 15 days before and 15 days after the event. In this study I have taken 5 % level of significance. T VALUE MONETAR Y DEV POLICY TCS TATA T CRITICAL VALUE BUDGE T MONETAR DIWAL Y I DEV POLICY BUDGE T DIWAL I 0.926 -0.291 0.123 2.060 2.069 2.064 -0.199 -1.773 -0.362 2.056 2.052 2.052 Dr. Ranawat & TV Raman Page 6 2/9/2016Page |6 POWER RCOM 0.983 -1.347 2.669 2.056 2.052 2.048 MARUTI -3.053 1.246 -0.282 2.048 2.080 2.052 INFOSYS 0.132 1.092 -1.952 2.056 2.060 2.052 ICICI BANK -0.321 1.204 0.564 2.069 2.064 2.064 0.482 -1.037 2.052 2.064 2.069 HDFC BANK 0.311 P-Value TCS 0.363 0.773 0.903 TATA POWER 0.843 0.088 0.720 RCOM 0.335 0.189 0.013 MARUTI 0.005 0.227 0.780 INFOSYS 0.896 0.285 0.061 ICICI BANK 0.751 0.240 0.578 HDFC BANK 0.758 0.634 0.311 In the table given above T value has been calculated and T critical value is the tabulated value. If the computed T value is less than the tabulated T value we reject our null hypothesis and accept alternate hypothesis i.e. there is significance difference between the return of Sensex and each of the seven companies. Correspondingly we will also check the P Value , in case if we are rejecting our null hypothesis , The computed P value has to be larger than 0.05 % level of significance. Dr. Ranawat & TV Raman Page 7 2/9/2016Page |7 Taking the first event into consideration i.e. the monetary development policy announcement on July 26, 2010, all the companies value of T is less than the tabulated value of T critical , except for Maruti which is out side the range of +/- 2.048 also the P value is smaller than 0.05 , thus we find that there is no significant relationship between the returns of Sensex and 6 companies other than Maruti with the announcement of Monetary Development Policy. All the 6 six companies show T value less than the T critical value and also show P value larger than 0.05 hence in all the cases except for Maruti we are accepting our null hypothesis i.e. there is no significant relationship between the returns around the announcement date, while there was a significant relationship between the returns for Maruti’s stock around the announcement date. Taking the second event into consideration i.e. Budget announcement on Feb 28, 2010, It is observable from the given table that for all the 7 companies the computed T value is less than the tabulated T critical value also the P value for all the companies is larger than 0.05, hence we can say that there is no significant relationship between the returns of Sensex and seven companies around the announcement date. Hence we accept our null hypothesis and reject our alternate hypothesis. Taking the third event into consideration i.e. Diwali on Nov 5, 2010, it is observable from the table above that for all the companies except Reliance Communication the calculated T value is less than the Tabulated T critical value, also we can see that the the calculated P value is larger than 0.05 for all except RCOM , hence we can say that there is no significant relationship between the returns of Sensex and 6 companies other than Reliance Communication around Diwali. The T value for RCom is larger than the tabulated T critical value and also P value is smaller than 0.05, hence in case of RCom, there is a significant relationship between the return of Sensex and RCom around Diwali. Thus to conclude we can say that in all the sample events except for 2 our Null hypothesis is accepted that the security prices of almost all the companies does not fully reflect all the publicly available information. Analysis of Regression: Regression analysis is done to find out whether stock prices adjust with the publicly available information or not. In this analysis, the dependant variable is seven different prominent companies listed in SENSEX , which were taken into the sample and the independent variables are the events where the days prior to events are valued as zero and the days after the event are valued as one, the other independent variable is the return of SENSEX. Y= alpha+ B1X+ B2D* Dr. Ranawat & TV Raman Page 8 2/9/2016Page |8 Where, Y= Return of the company Alpha= Constant B1= Beta for X X= Sensex B2= Beta for D* D*= Budgetary Impact/ Social impact (Diwali) Statistical significance of regression is estimated by t statistic for each coefficient. In this study 14 events wise equation of regression were formed: BUDGET ANNOUNCEMENT Company Equation for Excess Return T statistic TCS RETURN 1.742+ 0.014 (SENSEX RETURN ) + 1.631 (BUDGET ) 1.259 TATA RETURN -9.057+0.098 (SENSEX RETURN) + 10.780( BUDGET) 3.329 RCOM RETURN -0.834 + 0.01 ( SENSEX RETURN ) + 1.090 (BUDGET) 2.823 MARUTI RETURN 3.232 +0.088 (SENSEX RETURN) -13.389 (BUDGET) 2.799 INFOSYS RETURN 13.473+ 0.074(SENSEX RETURN) -7.974( BUDGET) 2.172 ICICI RETURN 1.618 + 0.077(SENSEX RETURN) -2.420( BUDGET) 6.836 HDFC RETURN 8.409 + 0.088(SENSEX RETURN) -0.044( BUDGET) .330 SOCIAL EVENT: DIWALI Dr. Ranawat & TV Raman Page 9 2/9/2016Page |9 The T value calculated after regression is to be compared with the critical value of +/_ 1.96. We can see from the above table that the effect of Diwali on the stock prices taken into observations were not significant except for TCS and TATA Power, while the impact of Budget announcement in all the sample companies except TCS and HDFC Bank were significant. With this result it can be analyzed that most of the companies do not react much in their stock returns with the happening of some prominent event, which proves the null Company Equation for Excess Return T statistic TCS RETURN 4.348 + .047(SENSEX RETURN) -0.128 (DIWALI) 3.729 TATA RETURN -3.438 +0.047(SENSEX RETURN) +1.954 (DIWALI) 3.955 RCOM RETURN -0.520 +0.023(SENSEX RETURN) -8.823 (DIWALI) 1.083 MARUTI RETURN -8.062 + 0.187 (SENSEX RETURN) -68.544(DIWALI) .933 INFOSYS RETURN -19.045 +0.449(SENSEX RETURN) -131.374(DIWALI) 1.049 ICICI RETURN 3.254 +0.188(SENSEX RETURN) -64.552(DIWALI) 1.131 HDFC RETURN -12.10 +0.352(SENSEX RETURN) -103.323(DIWALI) 1.083 hypothesis of the study that does not fully reflect all publicly available information. As per semi strong form of market efficiency the publicly available information do affect the stock returns but only in very shorter span the market absorbs all the available information and does not allow the investor to earn abnormal returns. Only few insiders can earn a profit on a short run price changes rather than the investors who adopt the naïve buy and hold policy. Dr. Ranawat & TV Raman Page 10 2 / 9 / 2 0 1 6 P a g e | 10 Analyses of One Way ANOVA: One Way ANOVA has been used in order to see as there is any significant relation between the return of SENSEX and those of 7 companies in the sample . And also to identify the difference in the mean values of both the dependant as well as independent variable which have been impacted on account of a single factor, i.e. the occurrence of event. Dependant variable is the return of different companies taken in the sample size and the independent variable is return of SENSEX. Company Name F Value F Critical P Value TCS 5.05 4.07 0.03 TATA POWER 5.17 4.07 0.03 RELIANCE COMM 5.64 4.07 0.02 MARUTI 5.24 4.07 0.03 INFOSYS 3.09 4.07 0.08 ICICI BANK 4.73 4.07 0.03 HDFC BANK 3.91 4.07 0.052 Here we compare the calculated F Value with F critical value , if F value is larger than the F Critical value and the corresponding P Value is less than 0.05 which is the level of significance, it means that there is significant relation between the means of two data. Hence we can analyze that for all the companies taken in sample except for Infosys and HDFC bank result shows that there is significant relation, implying that budget announcement has not left much impact on the returns of these companies and it is possible to predict the behavior of these stocks. Dr. Ranawat & TV Raman Page 11 2 / 9 / 2 0 1 6 P a g e | 11 RECOMMENDATIONS: Large investors have clout over the companies and can get the information they desire for decision making, where as small investors do not have such a privilege and are often deprived of important information. Large investors can also afford to have professional analysis but small investors have to depend on the publicly available information. Channeling small investors saving into corporate investment is vital for economic growth of developing countries. And to create in small investors, it is important to provide relevant, reliable and ready to use information. The investors should keep the following points in mind before investing: Read and properly understand the risk associated with investing in securities before undertaking transactions. Assess the risk – return profile of the investment as well as the liquidity and safety aspects before making your investment decision. Invest, based on sound reasoning after taking into account all publicly available information and on fundamental. Try to understand the risk involved in the investment and take down the important points associated with the risk before making any investment decision. Don’t be misleading by the rumors circulating in the market, as these rumors could make an impact over a good investment strategy. Try not to be influenced into buying stocks of fundamentally unsound companies based on sudden spurts in trading volumes or prices or non- authentic favorable looking articles/ stories. Don’t be mislead by so called ‘hot tips’, as this would not be a good strategy to rely on someone else thinking for investing your money. CONCLUSION At the end of this research work, it would not be hard enough to understand that the markets cannot be easily demarcated as highly efficient or low efficient. Any market cannot be a perfect one around the globe. The markets can be highly efficient but only to an extent. What we can say easily that the markets around the world have both the features of an efficient market as well as an inefficient market. And the common phenomenon which can be seen in terms of both the markets is that the investors and traders with more knowledge about the market are able to surpass the investors or traders who do not have either access or supply of the knowledge, Dr. Ranawat & TV Raman Page 12 2 / 9 / 2 0 1 6 P a g e | 12 Most classical investment theories have tends to stereotype the whole phenomenon of the market working. There work are based on one assumption viz. investors always act in a manner that maximizes their returns. But there has been incidence to prove them wrong I their assumptions. There are volumes of research work that shows that the investors are not so rational and logical at times. Psychological studies, for example, have repeatedly demonstrated that the pain of losing money from investments is nearly three times greater than the joy of earning money. There have been many research showing that even though there are many stocks which promise a lot of returns for the investors yet they tend to be risk averse and put money in a lower risk stock. When taken into reference the semi strong hypothesis says that stock prices accurately reflect all publicly available information regarding a company, or any news announced in the market. All information regarding the firm’s balance sheet, earnings, dividends, etc. have already been taken into account in the company’s current market price. New information on companies , industry, economy, and so on arrive in a random fashion , therefore changes in the stock market prices also take on a random pattern. It then follows that since the resulting changes in the price occur randomly, investors can not use the information to earn above average returns. This means that when stocks are traded, prices are accurate signals for capital locations and there is no one who can take the advantage of that in order to enhance his/her returns and be able to capitalize the market. The study reveals that Indian stock market (SENSEX) taken in the sample does not have semi strong form of market efficiency and the effect of sample events was random as different methods used in the research work shows different result on different events occurred. Some of this methods & tools used shows that market is efficient while other says that it is perfectly inefficient. So we can say that it is not possible to say that a Indian stock market is strong efficient market or semi strong efficient market or weak form of efficient market, the efficiency remains in the market for a short period of time as the value of T and regression is close to critical value. The result of this research work is only suggestive and no special generalization can be drawn. Further the exclusive and extensive research can also be made for the general events of the companies like dividend announcement, merger, bonus issue, stock split etc. Another trait of the successful investor is the ability to stick with their investment choices and let their profits run. On the other hand unsuccessful investors tend to follow fads and sell out too soon. Finally, successful investors tend to invest in what they know industries and companies with which they are already familiar. Dr. Ranawat & TV Raman Page 13 2 / 9 / 2 0 1 6 P a g e | 13 REFERENCES: The Random Walk Hypothesis and Technical Analysis Author : George E.Pinches Year : Apr 1970 Market Reaction to Stock Market Splits: Evidence from India: Amitabh Gupta and Gupta.O.P Year :May 2007 Security Prices Behaviour Associated with Rights Issue – Related Events : Srinivasan.R ,Year :Aug 1997 A brief history of market efficiency : Elroy Dimson and Massoud Mussavian,Year : Apr 1998 A Market Movement Phenomenon: Analysis of Market Effciency: Dr. Gerald S. Williams Year: 1998 Behavioral Finance: Impact of Sentiments on the Stocks Movement: Charan D. Wadhwa , Year :2008 Market Imperfections have an Impact on Movement of Stocks: Sayuri Shirai, Year :2007 A Study Of The Market In The Light of Risk and Return: Don U A Galagedera and Piyadasa Edirisuriya, Year :2004 Study Of Market Efficiency: Research On The Factors Affecting The Movement Of Market: Christian Roland, Year :1996 Technical Analysis on Prediction of Market: Impact of Random Walk Theory: Mr. A.K. Purwar , Year :2003 Impact of Reforms on the Movement of Market: Dr. Susane M. Margett, Year :2007 Review of the Movement of Market : Dr. Sumitra Kesar Pant, Year :2002