BSE_Sensex_Update_1

advertisement

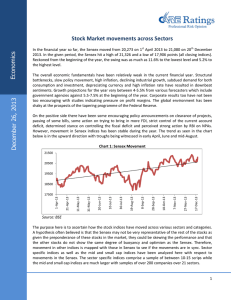

BSE Sensex (CMP 17404) 01/04/2012 Chart 1 – Daily Candlestick Chart Looking at the daily chart of BSE Sensex above (chart 1) one may observe following things: Price Action – After touching a high of 18523 from 15136 sensex has retraced almost 50% of this rise. On Friday it completed a morning star pattern (encircled in red) thus confirming the end of fall from 18523. So price action is up. Volume Action – AccDist indicator has broken above downward sloping trendline (green color) on Friday. So volume action is up. Momentum Action – RSI after touching a high of 78.5 in mid Feb. has retraced in the current fall and has been consolidating above 40 level since, thereby respecting the 80-40 bullish range and moved above 9 DEMA and 50 level on Friday to generate a buy signal. Stochastic after moving to oversold levels has turned up alongwith giving a bullish divergence signal (orange line). So momentum action is also up. Chart 2 – Weekly Candlestick Chart Looking at the weekly chart of BSE Sensex above (chart 2) one may observe following things: Price Action – Week ended 11th March formed a bullish hammer candlestick pattern, week ended 1st April formed a doji. Price action of both these weeks combined formed a tweezer bottom signaling end of downmove. So price action is up. Volume Action – AccDist indicator has taken support and moved from the downward sloping trendline which acted as resistance earlier and was breached in early March. So volume action is up. Momentum Action – RSI is neutral and Stochastic is moving down from overbought territory. So momentum action is down to neutral. Chart 3 – Monthly Candlestick Chart Looking at the monthly chart of BSE Sensex above (chart 3) one may observe following things: Price Action – After penetrating and closing above 15 month old down sloping resistance line in the month of February, sensex has spend time in the month of March consolidating above this line. Also combining the price action of first three months of this calendar year given us a pattern called as upward gapping tasuki which is a continuation pattern (upward in this case). Although the pattern formed is not exactly text book style (as it’s difficult to get gap ups on monthly chart) but still looks very similar to the ideal pattern. So price action is up. Volume Action – Since the fall from 21000, AccDist indicator has just been consolidating at it’s all time highs and has not moved down or given any bearish divergence. So volume action is up. Momentum Action – The movement of monthly RSI is similar to daily RSI. Stochastic has also turned positive in the month of March after many months. So momentum action is also up. To sum up the likely price direction considering various time frames: Price Volume Momentum Daily U U U Weekly U U D/N Monthly U U U So, BSE Sensex can be expected to resume it’s upmove in coming days after a brief pause witnessed in the month of March.