Practical Guide to Estimating - Subcommittee on Design

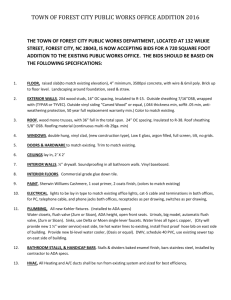

advertisement