Tyson Banbury - University of Illinois at Urbana

advertisement

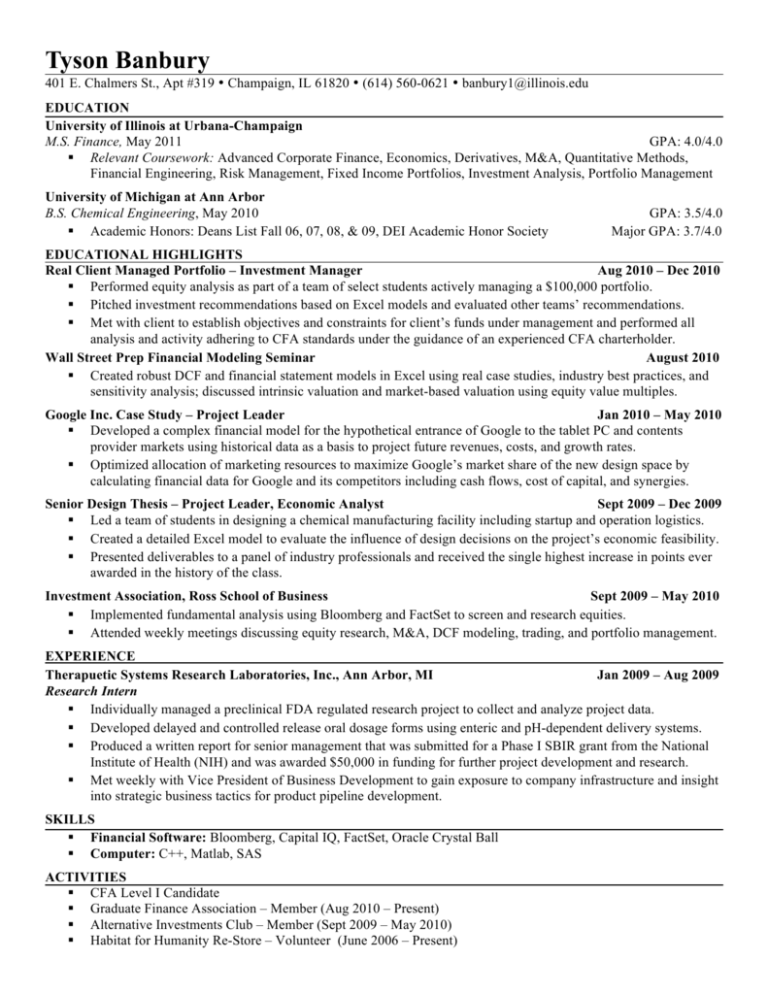

Tyson Banbury 401 E. Chalmers St., Apt #319 • Champaign, IL 61820 • (614) 560-0621 • banbury1@illinois.edu EDUCATION University of Illinois at Urbana-Champaign M.S. Finance, May 2011 GPA: 4.0/4.0 Relevant Coursework: Advanced Corporate Finance, Economics, Derivatives, M&A, Quantitative Methods, Financial Engineering, Risk Management, Fixed Income Portfolios, Investment Analysis, Portfolio Management University of Michigan at Ann Arbor B.S. Chemical Engineering, May 2010 Academic Honors: Deans List Fall 06, 07, 08, & 09, DEI Academic Honor Society GPA: 3.5/4.0 Major GPA: 3.7/4.0 EDUCATIONAL HIGHLIGHTS Real Client Managed Portfolio – Investment Manager Aug 2010 – Dec 2010 Performed equity analysis as part of a team of select students actively managing a $100,000 portfolio. Pitched investment recommendations based on Excel models and evaluated other teams’ recommendations. Met with client to establish objectives and constraints for client’s funds under management and performed all analysis and activity adhering to CFA standards under the guidance of an experienced CFA charterholder. Wall Street Prep Financial Modeling Seminar August 2010 Created robust DCF and financial statement models in Excel using real case studies, industry best practices, and sensitivity analysis; discussed intrinsic valuation and market-based valuation using equity value multiples. Google Inc. Case Study – Project Leader Jan 2010 – May 2010 Developed a complex financial model for the hypothetical entrance of Google to the tablet PC and contents provider markets using historical data as a basis to project future revenues, costs, and growth rates. Optimized allocation of marketing resources to maximize Google’s market share of the new design space by calculating financial data for Google and its competitors including cash flows, cost of capital, and synergies. Senior Design Thesis – Project Leader, Economic Analyst Sept 2009 – Dec 2009 Led a team of students in designing a chemical manufacturing facility including startup and operation logistics. Created a detailed Excel model to evaluate the influence of design decisions on the project’s economic feasibility. Presented deliverables to a panel of industry professionals and received the single highest increase in points ever awarded in the history of the class. Investment Association, Ross School of Business Sept 2009 – May 2010 Implemented fundamental analysis using Bloomberg and FactSet to screen and research equities. Attended weekly meetings discussing equity research, M&A, DCF modeling, trading, and portfolio management. EXPERIENCE Therapuetic Systems Research Laboratories, Inc., Ann Arbor, MI Jan 2009 – Aug 2009 Research Intern Individually managed a preclinical FDA regulated research project to collect and analyze project data. Developed delayed and controlled release oral dosage forms using enteric and pH-dependent delivery systems. Produced a written report for senior management that was submitted for a Phase I SBIR grant from the National Institute of Health (NIH) and was awarded $50,000 in funding for further project development and research. Met weekly with Vice President of Business Development to gain exposure to company infrastructure and insight into strategic business tactics for product pipeline development. SKILLS Financial Software: Bloomberg, Capital IQ, FactSet, Oracle Crystal Ball Computer: C++, Matlab, SAS ACTIVITIES CFA Level I Candidate Graduate Finance Association – Member (Aug 2010 – Present) Alternative Investments Club – Member (Sept 2009 – May 2010) Habitat for Humanity Re-Store – Volunteer (June 2006 – Present)