File

advertisement

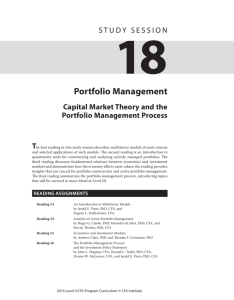

Chartered Financial Analyst (CFA) “Whereas there are tens of thousands of finance degrees available around the world, ranging from excellent to the worthless, there is only one CFA [designation] . . . . It used to be just an American qualification. But explosive growth has made it, in effect, a global currency. ” The Economist Statistics • Over 93,000 investment professionals, including the world’s 79,000 CFA • charterholders, in 134 countries: 85% are charterholders; 15% are noncharterholders. • •30% work for Investment Companies/Mutual Funds • •6% work for Hedge Funds/Fund of Hedge Funds • •7% work for Commercial Retail or Mortgage Banks • •4% work for Insurance Companies • •2% work for Pensions and Foundations • •11% work as Private Client Wealth Manager/Advisor • •16% are employed by investment banks/broker dealers. • •24% work for other organizations, such as consultancy, governmen t/regulatory, academic or research firms The CFA ®Program • • • • • • Administered by CFA Institute Program was established in 1962 The accepted benchmark for technical excellence in the financial markets, due to: Relevance of the syllabus Rigor of the exam High standards of professionalism it demands • • • • • • • • • Entry Requirement US Bachelor’s (or equivalent) degree or 4 years of qualified Work experience Final year of degree program Earn the credential Passing three sequential, six-hour exam ¾Working as an investment professional for a minimum of 4 years ¾Commit to abide by the CFA Institute Code of Ethics and Standards of Professional Conduct Exam Fee Examinations • • • • Multiple choice:individual multiple choice questions 1 question = 1.5 minutes exam = 240 questions = 360 points Level I all Item set: vignette with set of related multiple choice questions (items) • 1 question = 3 minutes, 1 item set = 6 questions • Level II exam = 20 item sets = 360 points • Level III PM = 10 item sets = 180 points • Level II all and Level III PM Pass rate Exam Content • The CFA Program includes a series of three exams that are offered in test centers around the world. These three exams — Level I, Level II, and Level III — must be passed sequentially as one of the requirements for earning a CFA charter • the Level I exam asks you basic knowledge and comprehension questions focused on investment tools; some questions will require analysis. • the Level II exam further emphasizes analysis along with applying your knowledge. • the Level III exam focuses on synthesizing all of the concepts and analytical methods in a variety of applications for effective portfolio management and wealth planning. Body of Knowledge • • • • • • • • • • • Investment Tools Ethical and Professional Standards Quantitative Methods Economics Financial Statement Analysis Corporate Finance Asset Valuation Analysis of Equity Investments Analysis of Debt Investments Analysis of Derivatives Analysis of Alternative Investments • • Portfolio Management Portfolio Management and Performance Presentation Curriculum • The topic focus and learning focus differ at each level Level 1 Level 2 Level 3 Topic Focus Investment Tools & Ethical Standards Asset Valuation & Ethical Standards Portfolio Management & Ethical Standards Learning Focus Knowledge Comprehension Application Analysis Synthesis Evaluation • The curriculum at each level is organized into 18 study sessions 10 Topic Areas SS 1 2-3 4-6 7-10 11 12 13-14 15-16 17 18 Topic Ethics Quantitative Method Economics Financial Statement Analysis Corporate Finance Portfolio Analysis Equity Fixed Income Securities Derivatives Alternative Investment # of Questions 36 29 24 % 15% 12% 10% 48 19 12 24 29 12 7 20% 8% 5% 10% 12% 5% 3%