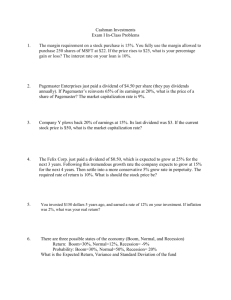

Bonds and Stocks Homework: Finance Problems & Solutions

advertisement

Fin 5219

Bonds and Stocks Homework

1. The bonds issued by Jensen & Son bears an 8% coupon, payable semiannually. The

bond matures in 8 years and has a $1,000 face value. Currently, the bond sells at par.

What is the yield to maturity?

A bond will only sell at par when its coupon payment equals its yield to maturity.

8%

2. The MerryWeather Firm wants to raise $10 million to expand its business. To

accomplish this, it plans to sell 30-year, $1,000 face value zero-coupon bonds. The bonds

will be priced to yield 8%. What is the minimum number of bonds it must sell to raise the

$10 million it needs?

The price of each bond will be 1000 / 1.0830 = 99.38

MerryWeather needs 10,000,000

Therefore MerryWeather needs to sell 100,624 bonds: 10,000,000/ 99.38

3. A corporate bond with a face value of $1,000 matures in 4 years and has an 8%

coupon paid at the end of each year. The current price of the bond is $901. What is the

yield to maturity for this bond?

N

=4

I/Y = ?

PV = -901

PMT = 80

FV = 1,000

I/Y = 11.2%

4. Weisbro and Sons common stock sells for $19 a share and pays an annual dividend

that increases by 5% annually. The market rate of return on this stock is 9%. What is the

amount of the last dividend paid by Weisbro and Sons?

19= Div1 / (.09-.05)

Div1 = 19 * (.04) = 0.76

However this is the next dividend not the last one

Div1 = Div0 * (1 + g)

0.76 = Div0 * (1.05)

Div0 = 0.76 / 1.05 = 0.72

5. Can’t Hold Me Back, Inc. is preparing to pay its first dividends. It is going to pay

$1.00, $2.50, and $5.00 a share over the next three years, respectively. After that, the

company has stated that the annual dividend will be $1.25 per share indefinitely. What is

this stock worth to you per share if you demand a 5% rate of return?

First, we can get the value of the stock, when it is

acting like a perpetuity (D4 and beyond)

1.25 / .05 = 25.00 This is a year 3 value, as the first payment is in year 4

Discount back the three specified dividends and the year 3 value of the perpetuity

1 / 1.05 + 2.50 / 1.052 + 5 / 1.053 + 25.00 / 1.053

29.14

6. Now or Later, Inc. recently paid $1.10 as an annual dividend. Future dividends are

projected at $1.14, $1.18, $1.22, and $1.25 over the next four years, respectively. After

that, the dividend is expected to increase by 3% annually. What is one share of this stock

worth to you if you require an 8% rate of return on similar investments?

First, we can get the value of the stock, when it is acting like perpetuity

(Div4 and beyond: treat the 1.25 as the first perpetuity payment)

1.25 / (.08-.03) = 25 @ year 3

Then discount back the 5 cash flows

1.14 / 1.08 + 1.18 / 1.082 + 1.22 / 1.083 + 25 / 1.083

22.88

7. Mother and Daughter Enterprises is a relatively new firm that appears to be on the

road to great success. The company paid its first annual dividend yesterday in the amount

of $0.28 a share. The company plans to double each annual dividend payment for the

next three years. After that time, it is planning on paying a constant $1.50 per share

indefinitely. What is one share of this stock worth today if the market rate of return on

similar securities is 9.5%?

Part 1: The Growing Annuity

(A) PV0 = 0.56/(0.095-1) * {1-(2/1.095)3} = 3.15

Part 2 is the Growing Perpetuity

1.5 / .095 = 15.79 @ year 3

(B) PV0 = 15.79/(1.0953) = 12.03

The price of the stock today is 15.18

8. BC ‘n D just paid its annual dividend of $0.60 a share. The projected dividends for

the next five years are $0.30, $0.50, $0.75, $1.00, and $1.20, respectively. After that time,

the dividends will be held constant at $1.40. What is this stock worth today at a 4%

discount rate?

First, we can get the value of the stock, when it is

acting like a perpetuity (Div6 and beyond)

1.4 / .04 = 35.00 @ year 5

Then discount back the six cash flows

0.3 / 1.04 + 0.5 / 1. 042 + 0.75 / 1. 043 + 1 / 1. 044 + 1.2 / 1. .045 + 35.00 / 1. 045

32.03

9. The Felix Corp. projects to pay a dividend of $0.75 next year and then have it grow

at 12% for the following 3 years before growing at 8% indefinitely thereafter. The equity

has a required return of 11% in the market. The price of the stock should be ____.

Year 1

0.75

Year 2

0.75*1.12

Year 3

0.75*1.122

Year 4

0.75*1.123

Part 1 is the Growing Annuity

PV0 = 0.75/(0.11-0.12) * {1-(1.12/1.11)4} = 2.74

Part 2 is the Growing Perpetuity

Div5 = 0.75 * 1.123 * 1.08 = 1.14

PV4 = 1.14/(0.11-0.08) = 38

Part 3 Bring it back to time 0

PV0 = 38/(1.114) = 25.03

Part 4 Add them together

PV = 25.03 + 2.74 = $27.77

Year 5

0.75*1.123*1.08

10. Doctors-On-Call, a newly formed medical group, just paid a dividend of $0.50. The

company’s dividend is expected to grow at 20% for the next 5 years and at 4% thereafter.

What is the value of the stock if the appropriate discount rate is 12%?

Year 0

0.5

Year 1

0.5*1.2

Year 2

0.5*1.22

Year3

Year 4

3

0.5*1.2 0.5*1.24

Year 5

0.5*1.25

Part 1 is the Growing Annuity

PV0 = (0.5*1.2)/(0.12-0. 2) * {1-(1.2/1.12)5} = 3.089547

Part 2 is the Growing Perpetuity

Div6 = 0. 5 * 1.25 * 1.04 = 1.293926

PV5 = 1.293926/(0.12-0.04) = 16.17408

Part 3 Bring it back to time 0

PV0 = 16.17408/(1.125) = 9.17761

Part 4 Add them together

PV = 3.089547+ 9.17761 = 12.27

Year 6

0.5*1.25*1.04