About the Project - The University of Redlands Small Business

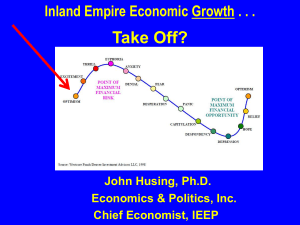

advertisement

Home | About the Project Context The U.S. Small Business Administration awarded a grant (SBAHQ-06-I-0046) to the School of Business at the University of Redlands. The grant began in September 2006 and originally was for two years; it was extended to a third year, expiring in August 2009. The stated goal was: The University of Redlands (University) is proposing to work in partnership with the Small Business Administration (SBA) to develop an extension program to assist small businesses in southern California’s Inland Empire. This extension program will be conducted by the University’s School of Business as applied research, working directly with local SBA staff and a diverse group of small businesses to transfer the theory, methods and tools of geographic information science (GIS) toward improving business operations. Early stages included building the infrastructure and capacity to deliver the envisioned products and services, as well as discussions with the Inland Empire Small Business Development Center to better understand local markets and candidate small and medium-sized enterprises (SMEs). The first year involved a series of Literature Reviews on spatial thinking in business Logistics, Marketing, and Strategy, and of Training Workshops to expose SBA personnel, small business owners, private investors, and other interested parties to the art of spatial thinking, the potential value of spatial thinking in identifying business opportunities and guiding business analyses, and to the science of spatial-enabling technologies. The workshops introduced concepts and sources of spatial data, and demonstrated geographic information systems (GIS). Case Studies also were initiated during the first year, and continued throughout the grant period. Three primary case studies involved School of Business faculty working directly with owners and employees of an individual small business, applying GIS to one or more critical elements of the enterprise. The ABC Blinds case demonstrates analyses of competitors, of customers, and of distribution routes. The Jacobs Appraisal case considers the utility of handheld devices for collection of real-time spatial data for subsequent GIS analysis. The BODAS Bridal Magazine case documents the role of GIS in a start-up operation, exploring market potential and identifying optimal product distribution strategies. In a different vein, the Inland Empire Minority Business Enterprise Center case attempts to “train the trainers”, working with personnel who then work with approximately 100 client SMEs to apply GIS to their business. Grant activity also included co-hosting (with ESRI, Inc.) the annual GIS Business Summit (2008 in Chicago; 2009 in San Diego), and development of this Small Business Spatial Resource Center. All grant activities are documented at the Virtual Portal (Vortal) Spatial Business Knowledge Repository, which also includes an extensive library of on-line business GIS resources. RIGHT-HAND SIDE BUTTONS: Operating Model Small Business Inland Empire Business Atlas IMAGE SOURCES: http://faculty.ksu.edu.sa/adosari/Pictures%20Library/GIS-1.jpg Microsoft ClipArt http://business.redlands.edu/atlas/about/ http://www.uflib.ufl.edu/fefdl/gisday07/ Operating Model Regardless of definition varieties, the overwhelming majority of businesses, in the United States as elsewhere, are SMEs. The primary goal of small businesses, especially during its early stages, simply is survival. Examination of Survival Rates indicate that (1) after four years from inception, only about 1/2 survive, whereas about 1/6 close as successes and 1/3 close as failures, and (2) this outcome is largely invariant across industries and prevail without regard to the relative maturity or level of technological or other disruption within the industry. SMEs can most be helped by increasing their survival rates. One approach is to incorporate survival rates directly, as a proxy measure of risk exposure, and this approach is demonstrated by industry in Survival Rate Costs of Capital. Another, less direct, approach follows. We construct SME Turnover Rates for each of the “51 states” (50 + D.C.), dividing business starts by the sum of business bankruptcies and terminations in a given period. The national rate for 2006 was 1.15, suggesting a growth rate of 15% in the SME sector of our economy. However there were marked differences among regions and among states. The index equaled a robust 2.62 in Nevada, 1.76 in Colorado and 1.64 in New Mexico, with these three states experiencing the greatest growth, down to 0.68 in West Virginia. The State of California index was not dissimilar from West Virginia, at 0.78. Plausible explanations are not difficult to find, based on State Rankings. California ranks 1st in personal income tax rate, capital gains tax rate, and 5-year government spending growth rate. It ranks 2nd in gasoline taxes, 5th in per capita government expenditures, 7th in electrical utility costs, 7th also in the number of health insurance mandates, and so on. California seems not friendly to small businesses. Of course, there are other rankings, and other criteria for assessing SME-friendliness perceptions and reality. According to the State Innovation Index, a careful compilation across multiple measures of entrepreneurial readiness and support, California ranks 5th (whereas West Virginia remains lowest). Why might this matter? In A Matter of Life and Death, a study of 3,275 SMEs reveals that (1) innovators are more likely to survive than are non-innovators, and (2) process innovators increase their probability of survival more than do product innovators. This is crucial to the purposes of this grant, since spatial thinking and GIS technology represent process innovations in the internal conduct of SME activity. In working with small businesses, our operational model has been that those enterprises most likely to benefit from what we have to offer are (1) amenable to recasting their business opportunities and threats through a spatial lens, (2) inclined toward innovation, and (3) willing to share both time and internal information with independent outside researchers. Given that, our task was to work with them to (1) provide value-added to the business by injecting spatial thinking into their core business model, (2) sustain that value so that the enterprise can continue to benefit without further intervention from the researchers, and (3) spread the word on our experiences so other SMEs might benefit as well. Small Business In the United States, the Small Business Administration (www.sba.gov) recognizes at least 37 definitions of what constitutes a “SME” (Small or Medium-sized Enterprise, or “Small Business”). The Small Business Act states that a small business is “one that is independentlyowned and which is not dominant in its field of operation”. The SBA has established a table of size standards, but applies the standards differently to different industries. Different parts of the world apply different standards in defining SMEs and/or small businesses. The European Union has adopted a single definition for each of three categories of SME. A business can be classified as “Micro” if its headcount is less than 10, or its turnover is less than € 2m, or its balance sheet total is less than € 2m; as “Small” if its headcount is less than 50, or its turnover is less than € 10m, or its balance sheet total is less than € 10m; or as “Medium-sized” if its headcount is less than 250, or its turnover is less than € 50m, or its balance sheet total is less than € 43m. All European countries that are members of the EU abide by these definitions. By contrast, Asian countries have no such agreement. For China, an SME has less than 100 employees, but the exact standard varies by industry. Japan has a general requirement of less than 300 employees or less than ¥ 10m in assets, but then it adjusts this standard for wholesale (50, but ¥ 30m) or retail (50, ¥ 10m) operations. Thailand applies eight measures, with employee and capital limits for each of the production, service, wholesale and retail sectors of the economy. Korea applies a single criterion: an SME is an enterprise of less than 300 employees. Sometimes there even are disagreements in a country. For example, Industry Canada defines an SME as a business with fewer than 500 employees, and a “Small Business” as that subset of SMEs for which the number of employees is less than 100 (if goods-producing) or 50 (if servicebased). However, Statistics Canada adds the requirement that an SME must also have gross revenues less than $50m. Given this array of acceptable definitions, we rather loosely refer to “SMEs” throughout this project, ascribing or inferring different definitions at different times, in different places. SOURCES: http://www.sba.gov/contractingopportunities/officials/size/index.html http://www.sba.gov/idc/groups/public/documents/sba_homepage/serv_sstd_tablepdf.pdf http://sbinfocanada.about.com/od/businessinfo/g/SME.htm http://ec.europa.eu/enterprise/enterprise_policy/sme_definition/index_en.htm pirun.ku.ac.th/~fsciang/km4sme/library/SME/Eng/Annex%202.doc Inland Empire Given that it not a formally-recognized jurisdiction, it may not surprise you that there are various definitions of which geographic entities collectively comprise the “Inland Empire” of Southern California. The general idea is that “greater Los Angeles” ends somewhere to its east and south, flowing into what once was a plethora of orange groves. Indeed the general area once was known as the “Orange Empire(1)”. As Orange County developed and urbanized following the opening of Disneyland in 1955, remaining orange groves were those inland from both Los Angeles and Orange counties, but generally bound by the San Gabriel Mountains and by the desert lands leading to Palm Springs, the name naturally morphed into “Inland Empire”. Of course, the “empire” claim is more problematic. History records the Persian Empire, the Roman Empire, the Han Empire, the Byzantine Empire, the German Holy Roman Empire, the Russian Empire, and so on. These invariably were formal states, usually ruled by a monarch or oligarchy. There is no “Inland Empire” in that sense, as the region is comprised of autonomous governmental entities (counties, cities, special districts) and, of course, has no ruler. The most commonly used definition of “Inland Empire” is simply the two counties of Riverside and San Bernardino. Among the 3,143 counties in the United States, a count that varies slightly based on definitions), these two rank #47 and #12, respectively, in land area; the 11 largest all are in Alaska. In terms of population (in 2006), they rank #11 and #12, respectively. However, in terms of density (population per square mile, also in 2006), Riverside stands at 281, and San Bernardino at 100 – well below the 234 average for the entire State of California. Combined, the two counties provide 1.2 million jobs, and generate 20 million square feet of new industrial space each year. Clearly, this is a potent and significant economic region. But an Empire? No. Another label, less used but perhaps more accurate, is the “San Bernardino Valley”. Other definitions of the “Inland Empire” tend to spill into Los Angeles and Orange counties. This Atlas offers a precise economic geography definition (see About | Where is the Inland Empire?), based on job centers and work migration patterns, rather than historical political boundaries. REFERENCES and SOURCES: (1) Sackman, Douglas Cazaux, Orange Empire: California and the Fruits of Eden, University of California Press, 2005 http://astore.amazon.com/rxsq-20/detail/0520238869 http://www.inlandempire.us/news/2006/01/how-inland-empire-got-its-name.html http://www.census.gov/statab/ccdb/ccdbstcounty.html http://www.busjournal.com/ Business Atlas The Business Atlas is a community resource focused on better understanding business basics, constraints and opportunities in the Inland Empire. Given the differing definitions of just what constitutes the “Inland Empire”, and recognizing that, in any event, the region cannot be understood in isolation from the dynamic surrounding markets that collectively constitute what we loosely define as Southern California, most Atlas data includes all eight of these counties: Imperial Riverside Kern San Bernardino Los Angeles San Diego Orange Ventura. In a related attempt to standardize Atlas information, it was decided that primary focus would be on collecting, displaying and analyzing data at the 5-difit zip code level. This represents a compromise between representations at the county level (highly aggregated data) and at the block group level (highly disaggregated data). There are departures from this norm, for example when examining school data, where school district boundaries are more appropriate. The Business Atlas provides background information on Where is the Inland Empire? and a History of the Inland Empire. It examines information on its People, using demographic data regarding population, age distributions, race and ethnicity, education attainment levels, and various health and lifestyle characteristics. It looks at Income and Employment, including as well consumer expenditure levels and patterns. It investigates Housing in the Inland Empire, looking at profiles of these markets and the dynamics of changes over time. The core section on Business and Industry identifies the major sectors and industries, and then focuses on particular sectors (Not-for-Profits, School Districts), industries (Aeorospace), or characteristics (employment concentration; poverty; logistics centers; job centers; minority markets). The concluding section ponders Our Future, surmising possible ranges of projected growth. It also should be noted that there is a Resources and Tools section for those seeking more information on spatial data sources, GIS software choices, and selective topics in spatial analysis. Please note that there is a companion Global Trade and Competitiveness Atlas, which takes a macro-view to explore seemingly distant international trends that, nonetheless, quite likely have a direct impact on your particular sector, industry and business. There is data for about 800 industries, for each of 200 countries, over about a 20-year span.