Ways that you may be able to reduce your prescription drug costs

advertisement

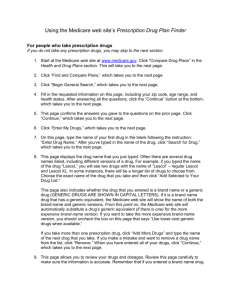

Ways that you may be able to reduce your prescription drug costs Consider these steps regardless of the type of drug coverage you have 1) Use the lowest-cost refill schedule. In many plans, mail-order (or 90-day) refills are less expensive than retail pharmacy (or 30-day) refills. In a few plans, though, the retail refill schedule is less expensive. If you take several drugs, you may be surprised the amounts you can save by using the lower-cost schedule. If you do switch to a different refill cycle, you will need new prescriptions from your physician(s). Consider using lower-priced substitute drugs for some brand-name prescriptions. A substitute drug is not necessarily the same as a generically equivalent drug. You can ask your physician if there are substitute drugs for any expensive medications you’re taking. You can also use the Consumer Reports Best Buy Drugs web site to find less expensive substitute drugs. If there are any, you may wish to discuss them with your physician. Consider pill-splitting for certain brand-name drugs. This involves buying a twice-aslarge dosage of the medication you are taking and using a pill-splitter to divide the tablets in half. As one example, according to Costco.com, a 30-day supply of Lipitor 20mg tablets costs the same as a 30-day supply of Lipitor 40mg tablets -- $156. If you had no drug coverage, you would save more than $930 a year by purchasing the 40mg tablets and then splitting them. If you have prescription drug insurance, your savings will likely be $300-$500 a year. The Consumer Reports Shopper’s Guide to Prescription Drugs recommends pillsplitting as a way to save money, as do the Harvard Men’s Health Watch (November, 2008) and some insurance plans. But some people may have difficulty dividing the tablets exactly in half (even with the help of a pill-splitter). Last year the FDA issued a consumer update warning of the risks of pill-splitting, recommending that patients discuss it with their physicians (who will need to prescribe the larger dosage). There are about 20 brand-name drugs that are candidates for pill-splitting. One way to see if you can save money with this tactic is to look up a drug on a web site such as costco.com or drugstore.com. If there is a dosage that’s twice as large as the one you take and it costs less than twice as much, you may be able to save money, subject to the restrictions noted in the next paragraph. Some medications should not be split. As the Harvard Men’s Health Watch says: “Small pills and medications with complex shapes are much harder to split accurately. Medications that require a very precise dosage should not be split. And you should never split capsules, pills with enteric (stomach-protective) coatings, pills with extended-, slow-, or time-release formulations, or pills that contain combinations of two or more medications.” Consider these additional steps if you have a Medicare Part D plan (either a stand-alone plan or a Medicare Advantage plan that includes Part D benefits) During each year’s annual open enrollment you should find the plans for the coming year that will have the lowest-cost for the drugs that you take. You can call 800MEDICARE or contact your local state health insurance counseling program to do the search for you. If you want to use the Medicare web site to conduct your own drug plan search, you can use our Medicare Part D Plan Finder instructions. Unless you don’t take any prescription drugs, ignore a plan’s premiums. It’s not unusual for a higher-premium plan to be the lowest-cost choice for a particular set of drugs. The Medicare web site takes into account all costs – premiums, deductibles, co-payments, and co-insurance – when it lists the lowest-cost plans for a set of drugs. If you are enrolled in a Medicare Advantage plan that has high costs for your drugs, you may want to consider switching plans (the Medicare web site also shows Advantage plan’s costs for the drugs you take). But before changing plans, you should consider these two questions: 1) Can you continue to see your present physicians in the plans with lower drug costs? 2) Can you save money by switching to a Medigap policy and a stand-alone drug plan? In a few cases if your prescription drug costs in an Advantage plan are very high, you might break even or even save money by changing to a Medigap policy, which allows you to see any physician who accepts Medicare. If two or more plans have similar prices, consider each plan’s quality ratings. You may wish to enroll in a superior-rated plan even though it costs you slightly more each year.