Practice problems P`s And A`s

advertisement

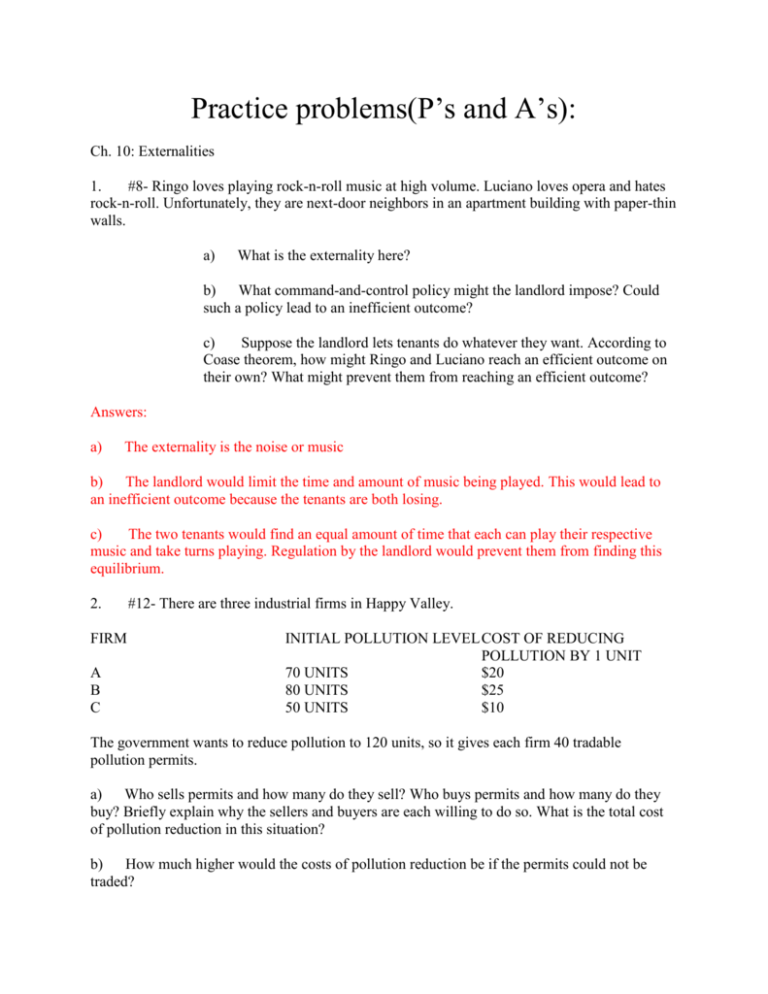

Practice problems(P’s and A’s): Ch. 10: Externalities 1. #8- Ringo loves playing rock-n-roll music at high volume. Luciano loves opera and hates rock-n-roll. Unfortunately, they are next-door neighbors in an apartment building with paper-thin walls. a) What is the externality here? b) What command-and-control policy might the landlord impose? Could such a policy lead to an inefficient outcome? c) Suppose the landlord lets tenants do whatever they want. According to Coase theorem, how might Ringo and Luciano reach an efficient outcome on their own? What might prevent them from reaching an efficient outcome? Answers: a) The externality is the noise or music b) The landlord would limit the time and amount of music being played. This would lead to an inefficient outcome because the tenants are both losing. c) The two tenants would find an equal amount of time that each can play their respective music and take turns playing. Regulation by the landlord would prevent them from finding this equilibrium. 2. FIRM A B C #12- There are three industrial firms in Happy Valley. INITIAL POLLUTION LEVEL COST OF REDUCING POLLUTION BY 1 UNIT 70 UNITS $20 80 UNITS $25 50 UNITS $10 The government wants to reduce pollution to 120 units, so it gives each firm 40 tradable pollution permits. a) Who sells permits and how many do they sell? Who buys permits and how many do they buy? Briefly explain why the sellers and buyers are each willing to do so. What is the total cost of pollution reduction in this situation? b) How much higher would the costs of pollution reduction be if the permits could not be traded? Answers: a) Firm C sells permits because it has the lowest pollution level and the lowest cost to reduce; Firm B would but permits because it has the highest pollution and highest cost to reduce; Total cost is unknown for you would need to know the price of a permit, which is unknown. b) This is unknown because you need permit price to determine cost in the first place. Ch. 11: Public Goods and Common Resources 1. #1- Think about the goods and services provided by your local government. a) Using the classification in Figure 1, explain which category each of the following goods falls into: Police Protection Snow plowing Education Rural roads City streets b) Why do you think the government provides items that are not public goods? a) . Answers: Police protection= Natural Monopoly Snow plowing= Common Resource Education= Public Good Rural roads= Public Good City streets= Common Resource b) They provide non public goods to gain revenue and because not everyone agrees with the government. 2. #3- Charlie loves watching Teletubbies on his local public TV station, but he never sends any money to support the station during its fundraising drives. a) What name do economists have for Charlie? b) How can the government solve the problem caused by people like Charlie? c) Can you think of ways the private market can solve this problem? How does the existence of cable TV alter the situation? Answers: a) Charlie is known as a Free Rider b) The government would need to privatize channels so viewers have to pay to view them. c) The private market could solve the problem through taxation. The tax revenue would be used to support the TV station. The presence of cable alters this because cable has to be paid for. Ch.12-The Design of the Tax System 1. #10- Any income tax schedule embodies two types of tax rate: average tax rates and marginal tax rates. Proportional Tax Income Amount of Percent of Tax Income $50,000 $12,500 25% $100,000 $25,000 25% $200,000 $50,000 25% Regressive Tax Amount of Percent of Tax Income $15,000 30% $25,000 25% $40,000 20% Progressive Tax Amount of Percent of Tax Income $10,000 20% $25,000 25% $60,000 30% a) The average tax rate is defined as total taxes paid divided by income. Using the proportional tax system in the table above, what are the average tax rates for people earning $50,000, $100,000, and $200,000? What are the corresponding average tax rates in the regressive and progressive tax systems? b) The marginal tax rate is defined as the extra taxes paid on additional income divided by the increase in income. Calculate the marginal tax rate for the proportional tax system as income rises from $50,000 to $100,000. Calculate the marginal tax rate as income rises from $100,000 to $200,000. Calculate the corresponding marginal tax rates for the regressive and progressive tax systems. c) Describe the relationship between average tax rates and marginal tax rates for each of these three systems. In general, which rate is relevant for someone deciding whether to accept a job that pays slightly more than their current job? Which rate is relevant for judging the vertical equity of a tax system? Answers: a) Proportional- $50,000=25%, $100,000=25%, $200,000=25%; Regressive- 30%, 25%, 20%; Progressive- 20%, 25%, 30% b) Proportional- $50,000 to $100,000= 25%, $100,000 to $200,000= 25%; Regressive- 20%, 15%; Progressive- 30%, 35% c) For the middle incomes, Average and Marginal tax rates are the same; The marginal tax rate is most relevant for this situation; The average tax rate is most relevant for judging vertical equity. 2. #7- Suppose that your state raises its sales tax from 5 percent to 6 percent. The state revenue commissioner forecasts a 20 percent increase in sales tax revenue. Is this plausible? Explain. Answers: This is not plausible. It is impossible that a 1% increase of taxation won’t increase revenue by 20%.