chap005Answers

advertisement

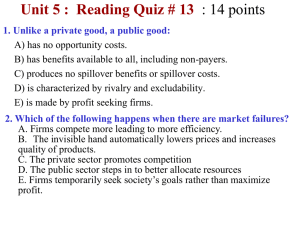

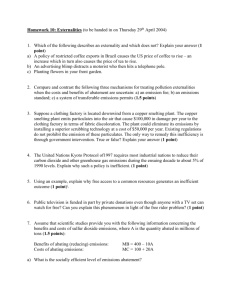

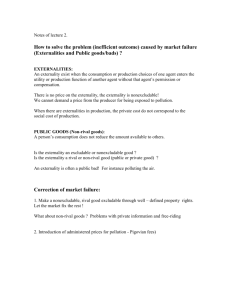

Market Failure: A Role for Government CHAPTER FIVE MARKET FAILURE: A ROLE FOR GOVERNMENT ANSWERS TO END-OF-CHAPTER QUESTIONS 5-1 Use the characteristics of private goods to explain why firms can profitably offer them for sale. Why do competitive firms tend to produce private goods at minimum average cost? What do economists mean when they say that private goods tend to be produced in the “right” amounts? Private goods are “rival,” so goods purchased by one consumer are not available for others to buy and consume. They are also “excludable,” meaning benefits of the good can be restricted to those who pay for the product. If rivalry and excludability hold, and assuming the good is desirable to a sufficient number on consumers, there is potential for profitable sale. Producing private goods at minimum average cost (“productive efficiency”) maximizes the potential profit from those goods. Producing goods in the “right” amounts means we have “allocative efficiency;” the socially optimal level of the good is being produced. Allocative efficiency is achieved when the marginal benefit of the last unit produced equals the marginal cost of producing that unit. 5-2 Contrast the characteristics of public goods with those of private goods. Why won’t private firms produce public goods? Public goods are nonrival (one person’s consumption does not prevent consumption by another) and nonexcludable (once the goods are produced nobody—including free riders—can be excluded from the goods’ benefits). If goods are nonrival, there is less incentive for private firms to produce them – those purchasing the good could simply allow others the use without compensation. Similarly, if goods are nonexcludable, private firms are unlikely to produce them as the potential for profit is low. Private firms would face the free-rider problem of people benefiting from the public good without contributing to the cost. 5-3 The accompanying table relating to a public good provides information on the prices Young and Zorn are willing to pay for various quantities of some public good. Young and Zorn are the only two people in the society. Determine the price that society is willing to pay for the public good at each quantity of output. If the government’s marginal cost of providing this public good is constant at $7, how many units of the public good should government provide? Why not less? Why not more? 53 Market Failure: A Role for Government Young Price Qd $8 7 6 5 4 3 2 1 0 0 0 1 2 3 4 5 Price Zorn Qd Society Price Qd $8 7 6 5 4 3 2 1 1 2 3 4 5 6 7 8 $13 11 9 7 5 3 2 1 1 2 3 4 5 6 7 8 Society’s willingness to pay for each quantity of the public good appears as the underscored values in the “society” price column. If the marginal cost is $7, government should provide 4 units of the public good. If the government provides less, society is missing out on the net benefits of those last units (MB>MC at Q = 3). Government should not provide more, because any units beyond 4 would cost more than they would benefit society. 5-4 The following table shows the total costs and total benefits in four different antipollution programs of increasing scope. Use cost-benefit analysis to determine which program should be undertaken. Explain. Program Total Cost Total Benefit A B C D $ 3 7 12 18 $ 7 12 16 19 Program B since the marginal benefit no longer exceeds marginal cost for programs that are larger in scope. Plan B is where net benefits—the excess of total benefits over total costs ($9)— are maximized. 5-5 Why are negative externalities and positive externalities also called spillover costs and spillover benefits? Show graphically how a tax can correct for a negative externality and a subsidy to producers can correct for a positive externality. How does a subsidy to consumers differ from a subsidy to producers in correcting for a spillover benefit? Negative externalities are called spillover costs because they “spill over” the market transaction onto third parties, who suffer a reduction in utility. Positive externalities are also called spillover benefits because they “spill” benefits onto people not directly in the transaction, increasing their utility. See Figures 5.2 and 5.3 to show the tax and subsidy. Compare (b) and (c) in Figure 5.3 to see how subsidizing consumers (b) differs from subsidizing producers (c). 5-6 An apple-grower’s orchard provides nectar to a neighbor’s bees, while a beekeeper’s bees help the apple grower by pollinating the apple blossoms. Use Figure 5.1b to explain why this 54 Market Failure: A Role for Government situation might lead to an underallocation of resources to apple growing and to beekeeping. How might this underallocation get resolved via the means suggested by the Coase theorem? Using Figure 5.1b in the text the following can be said. The market demand curves for apples and honey, Da and Dh, would not include the positive externalities accruing to the production of the other good. The total benefits associated with the consumption and production of each good could be shown by Dat or Dht and the optimal outputs for each good would be Qao and Qho. Both of these outputs are greater than equilibrium outputs, Qae and Qhe, leading to an underallocation of resources to both apple-growing and beekeeping. Using the Coase theorem, we note that it will be to the advantage of individual apple growers and beekeepers to negotiate so that beekeepers (whose hives can be moved) locate their production in or near orchards. This negotiation will occur as long as property ownership is well defined, only a few people are involved, and bargaining costs are low. For example, an apple grower who owns an orchard could allow a beekeeper to use a portion of his or her land, charging below-market rents so that both parties gain from the agreement. 5-7 Explain: “Without a market for pollution rights, dumping pollutants into the air or water is costless; in the presence of the right to buy and sell pollution rights, dumping pollution creates an opportunity cost for the polluter.” What is the significance of this fact to the search for better technology to reduce pollution? The rights to air and water are held in common by society. Without markets for the use of these rights, private individuals will not restrict their polluting activities because there is no monetary incentive to do so. Once these markets are established, the right to pollute will be restricted and have a positive price associated with it. The price represents an explicit monetary cost to polluters, providing them with a tangible incentive to seek ways to cut pollution. This will create potential profits for those who can successfully develop new types of pollution-abatement equipment, accelerating the rate of technological development in this area. 5-8 Explain the following statement, using cost-benefit analysis: “The optimal amount of pollution abatement for some substances, say, water from storm drains, is very low; the optimal amount of abatement for other substances, say, cyanide poison, is close to 100 percent.” Reducing water flow from storm drains has a low marginal benefit. If graphed, the MB curve would be located far to the left, and will intersect the MC curve at a low amount of pollution abatement, indicating the optimal amount of pollution abatement (where MB = MC) is low. Any cyanide in public water sources could be deadly. Because each unit of cyanide is potentially lethal, the marginal benefit from abating each unit (and avoiding fatalities) will be extremely high. Graphically, the MB curve would be located to the extreme right where it would intersect the MC curve at or near 100 percent. 5-9 Explain how marketable emissions credits add to overall economic efficiency, compared to across-the-board limitations on maximum discharges of air pollutants by firms. If company A can reduce pollution by 1 ton at less cost than company B, then company B should buy emission credits from company A. In doing this, society is using fewer resources (spending fewer dollars) to achieve the same level of pollution reduction. 5-10 Contrast the benefits-received principle and ability-to-pay principles of taxation. Which of the following taxes mainly adhere to the benefits-received principle? Which mainly apply to the ability-to-pay principle? a. an admission tax on tickets to sporting events at public stadiums b. the Federal personal income tax 55 Market Failure: A Role for Government c. a sales tax applied only to certain luxury goods such as expensive automobiles, yachts, and private airplanes d. a toll charge required to drive on a public highway e. the Federal and state gasoline tax The benefits-received principle holds that governments should supply public goods and services in much the same manner as does private business. Those who make use of government services should pay for them. The ability-to-pay principle of taxation assesses tax liability based on a person’s ability to pay: The higher one’s income, the higher the tax and the higher the percentage of one’s income paid in tax. Benefits-received: (a), (d), (e). Ability-to-pay: (b) and (c) (assuming the sales tax revenue on (c) is not used specifically to benefit the users of those goods). 5-11 Suppose in Fiscalville there is no tax on the first $10,000 of income, but a 20 percent tax on earnings between $10,000 and 20,000 and a 30 percent tax on income between $20,000 and $30,000. Any income above $30,000 is taxed at 40 percent. If your income is $50,000, how much will you pay in taxes? Determine your marginal and average tax rates. Is this a progressive tax? Explain. Total tax = $13,000; marginal tax rate = 40% average tax rate = 26%. This is a progressive tax; the average tax rate rises as income goes up. 56