Most microeconomic models assume that decision makers wish to

advertisement

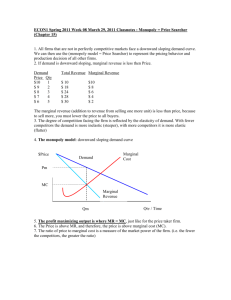

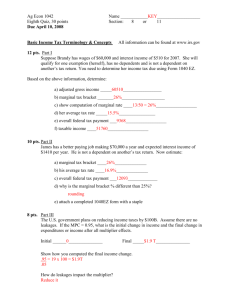

姓名: 學號: Microeconomics II Homework#5 Spring, 2008 Due day: 6/5 I. Multiple choices(40%) 1) In the short run, the competitive firm will hire more labor if A) the wage rate increases. B) the price the firm receives for the output increases. C) the price the firm receives for the output decreases. D) a specific tax is imposed on the output. 2) The demand for a monopoly's output is p = 100 - Q. The firm's production function is Q = 2L. Which of the following is the firm's demand for labor? A) w = 200 - 8L B) w = 200 - 4L C) w = 100 - L D) w = 2L 3) The steeper the labor supply curve A) the higher the wage the monopsonist pays. B) the lower the wage the monopsonist pays. C) the smaller the difference between the wage and the marginal expenditure on labor. D) the better off workers are. 4) Monopolization of the labor market restricts output because A) fewer workers offer their services. B) the higher wage raises the firm's marginal cost. C) monopolized workers are less productive. D) a monopolized labor market means there is also a monopolized output market. 5) A firm may decide to vertically integrate backward if A) the transaction costs of dealing with the supplier are very low. B) the transaction costs of dealing with the supplier are very high. C) the cost of managing the new division would be very high. D) there are many suppliers from which to choose. 6) In general, an externality is created when A) people are affected (other than by price) by a transaction which they were not part of. B) when firms produce a product of low quality and consumers don't like it. C) When firms have to pay for pollution the environment. D) When the government subsidizes education. 7) In the presence of an negative externality, a specific tax can achieve the social optimum because A) output is reduced to zero as a result. B) it internalizes the external cost. C) it directly charges the producer for polluting. D) the price of the good rises by the full amount of the tax. 8) If both a monopoly and a competitive market with the same marginal cost would produce a quantity that is greater than the social optimum in a market because of externalities, then A) welfare is the same for both market structures. B) welfare is greater under competition. C) welfare is greater under monopoly. D) the social optimum must be zero. 9) The Commons Problem arises because A) firms don't maximize profits. B) social and private incentives are not aligned and property rights are missing. C) social cost equals private cost and property rights are missing. D) social benefit equals private benefit and property rights are missing. 10) The total demand for a public good is found by A) finding the demand from the median voter. B) dividing the marginal cost of the good by the number of voters. C) horizontally summing all individual demands. D) vertically summing all individual demands. 1 2 3 4 5 6 7 8 9 10 B A B B B A B C B D II. Problems(60%) 1) Assume that the market demand for a good is p = 100 - Q. Assume that the marginal product of labor is 1 and the firm can get all the labor it needs at a wage equal to 5. Compare the quantity of labor hired if the output market is competitive with the quantity hired if the output market is a monopoly. Answer: If the output market is competitive, then price will equal marginal cost, which is 5. Output is 95, requiring 95 units of labor. If a monopoly controls the output market, the firm sets w = 5 = (100 - 2L), or L = 47.5. Thus, the monopoly hires half as much labor and produces half as much output as a competitive market would. 2) Suppose a monopoly producer is also a monopsonist in the labor market. Demand for the output is p = 100 - Q. The production function is Q = L, and the labor supply curve is w = 10 + L. How much labor does the firm hire? What wage is paid? Answer: The firm's marginal revenue product of labor is MRP = 100 - 2L. Marginal expenditure is 10 + 2L. Setting them equal yields 10 + 2L = 100 - 2L or L = 90/4 = 22.5 units of labor, for which the firm will pay a wage of (10 + L) = 32.5. 3) Suppose that in the market for paper, demand is p = 100 - Q. The private marginal cost is MCP = 10 + Q. Pollution generated during the production process creates external marginal harm equal to MCe = Q. What specific tax would result in a competitive market producing the socially optimal quantity of paper? Answer: The socially optimal quantity of paper is found by setting MCP + MCe = p or 10 + Q + Q = 100 - Q. Rearranging yields Q = 30. At this level of output society incurs an external cost of 30. This is the specific tax that would yield the socially optimal quantity. To check, set MCP + tax = 100 - Q. This yields Q = 30. 4) The above figure shows the marginal benefit from pollution for two firms. If both firms receive a marketable permit to pollute 25 units of pollution each, how much will each firm pollute and how much will a permit for one unit of pollution be worth? Answer: Firm B will sell permits to firm A until the marginal benefits are the same for both firms. Firm A will generate 37 tons of pollution and firm B will generate 13 tons of pollution. The market value of a permit will be $5.