Credit and the City Ledger

advertisement

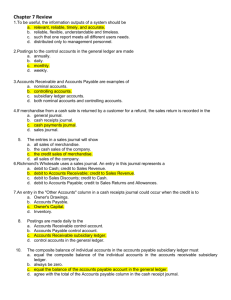

Credit and the City Ledger Chapter 11 The City Ledger The city ledger references the accounts receivable of all non-registered guests. Other types of accounts receivable are in the city ledger such as: travel agents, wholesalers, client companies. Fees- Credit card companies charge merchant/hotels discount fees, bank cards charge at a lower range, 1% to 2% of the transaction. Swiping cards and point-of-sale terminals lower processing fees. Debit cards electronically transfer funds out of a person’s checking account. Merchants automatically receive the funds with a debit purchase. Debit cards are the first step toward the cashless society that futurists predict. Smart Cards are miniature computers almost indistinguishable from standard cards. Smart Cards carry a quantity of information: credit or debit cards, ATM cards, Identification, electronic door keys, medical and insurance records, and more. Cards can also be used to track customer preferences and demographics. Master Accounts accumulate charges for groups. Including overnight rooms, incidentals and function charges. Billing discrepancies need to be resolved as quickly as possible in order to receive payment on time Travel agencies can become accounts receivable in the city ledger if guests stays are paid in advance. Banquet sales are also an account in the city ledger, most events end with a balance remaining in the ledger. Late Charges are departmental charges that appear after the guest has checked out. It is easy to charge these amounts if the guest uses express check out, the additional charges are added on to the final bill. Delinquent accounts are accounts that may not be receivable, also called bad debts. Executive accounts are accounts for hotel executives that use the hotel for personal reasons within the guide lines of company policy Due bills are trade out balances with other hotels restaurants or other businesses. Components of Credit Management Extending Credit: Direct Billing Application Procedures- no magic formula for picking the safe risks from the poor ones. Minimizing Chargebacks: hotels fall to collect in nearly half of all credit-card challenges. Monitoring Credit Credit Card Companies establish a dollar ceiling called a “floor”; a max the hotel can charge to any one guest. Credit Alerts & Alerts: typical skipper is a 30-35 yr old male with light baggage and vague info. Heavy tipper and friendly. No phone calls and false address. Scribbles the reg card. Collecting Receivables: Billing and Chasing Receivables are amounts owed the hotel by guests who have not yet paid for services received. Hotels follow a three day billing cycle for city ledger accounts. Following up on unpaid bills is the duty of one person in the accounting department. The worst of bad debts ends up with the collection agencies. Mechanics of the Entry Total debits to city ledger must equal total credits from the guest ledger both daily and cumulatively. The transfer is made and billing takes place from the city ledger. Settlement is received and the debt is cleared and the check (cash) is deposited. These types of settlements generate cash, but some have different formats Travel Agency Records:Vouchers are used instead of cash. Frequent Guest Programs:Points are used instead of cash. Split folios are used to process the awards that are tendered. Incidentals are not covered by points. Electronic Draft Capture Covers credit card charges that are not posted to a folio (ie- payment for breakfast with cc in the restaurant). These charges become part of the departmental cashier’s daily turn-in of cash and credit-card sales.