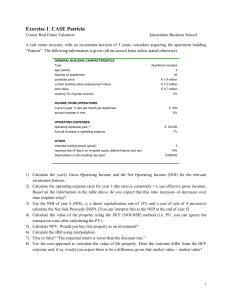

Personal-Finance-Project[1]

advertisement

![Personal-Finance-Project[1]](http://s3.studylib.net/store/data/006625348_1-c8d6ffecfae5499cadbd8fcd703c8eae-768x994.png)

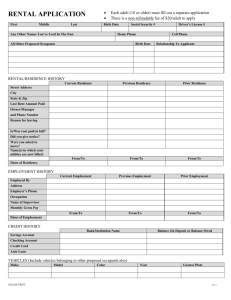

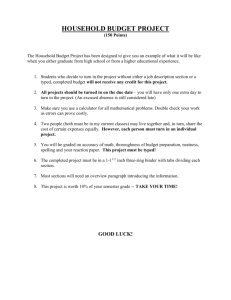

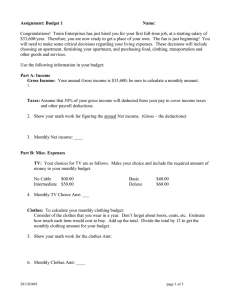

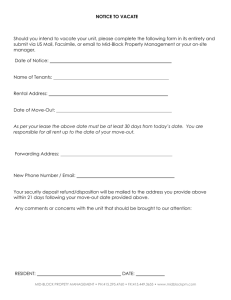

Personal Finance Project Congratulations! You are now 18 years old, and a legal adult. You can now join the military and buy lottery tickets On top of that; you are now entitled to all the benefits of being an adult. The bad news – your parents have decided that they are sick of supporting you, and you must move out of your parents’ home, taking only your clothing (no exceptions). You must now become fully self-supporting. While you have graduated from high school, you did not secure any financial aid or scholarships for college. If you choose to attend college, you must pay for all tuition and fees yourself. The following are the steps you must follow in order to become that “grown-up” you have always wanted to be. Each of the steps counts for a daily grade, has a specific due date, and must be followed in the order specified. The final project (including reflection questions) will count as a test grade, and is due: ___________________ Welcome to Adulthood, and Good Luck! The Steps to Self-Sufficiency (Please note that each step has a due date and counts as a daily grade) Step 1: GET A JOB!!!! (Due _____________) You must find a currently available position for which you are qualified; something that actually exists in the real world. You may find your job with the aid of the newspaper want ads, an online job search, or by obtaining an application from a place of business. If you are hired for the position, you must then estimate your monthly income. Assume that you work a 40 hour week. Calculate your gross monthly pay by taking your hourly wage, multiplying by 40 and then by 4 weeks. You must then calculate your withholding taxes (both Federal Income Tax and FICA) and subtract them from your gross income to get your net income. By now you know what this rate is. You will also need to if any benefits are included with your job…health care, discounts, etc. Include a resume – if you don’t have one already this is a good time to create one (you will need it!) Step 2: Find an apartment and furnish it. (Due ______________) You must find a currently available apartment. You may find your housing with the aid of newspaper ads, an online search, or by obtaining an application from an apartment complex. You may not have a roommate. Explain why you chose the apartment you did. Was it the location, affordability, availability, etc.? Now is the time to find out if there is a security deposit. What are the rules or regulations? Does it come with a washer & dryer or microwave? How much are the average utilities each month? How will you furnish your apartment? Include the cost of all items that you would purchase out of your savings – furniture, supplies, decorations, appliances, etc. Specifically list all items, their costs, and where you would buy them from. Don’t forget to calculate sales tax on each item @ 8.25% (or .0825) You have “saved” $1,000.00 and will use this for any deposits and to purchase furnishings. Step 3: Prepare Your Monthly Budget (Due May _________) You must now calculate all of your monthly living expenses. You have to take into account all of your fixed (i.e. rent), variable (i.e. electricity) and occasional expenses (i.e. doctors visit). The following is a list of things to consider. You must document your sources for each of the following categories: All prices must be real and sources for your information documented. Rent Utilities (gas, water, electric, garbage) Phone/Cell Phone Cable Internet Transportation (car payment, gas, garage/parking fees) Insurance (car, life, health, renter’s, dental – include amount of coverage and deductibles) Groceries and incidentals Entertainment Education Savings (Pay Yourself First – you must save!) Charitable giving Miscellaneous – clothing, shoes (may be required for job) Your budget must balance! Use your net monthly income that you figured in Step 1. The Curve Ball (Due May __________) When you have turned in Step 3 completed, you will receive a “Curve Ball” – something that will upset your carefully crafted budget, and require you to borrow money. #1 You will have to research the costs involved and determine the amount of the loan as well as the payments/interest, etc. in order to pay for this item/event. #2 You will research and report on the 3 “C’s” of credit – you can find this information in your textbook. You won’t know what specific situation you will face until you have turned in Step 3! Reflection Questions – detailed responses with complete sentences! 1. How many times did you have to adjust your budget to get it to work out? 2. What did you have to give up, to make your budget balance? 3. What have you learned about the support (or economic subsidy!) provided by your parents? What’s the impact on your standard of living having lost your parents’ help? 4. What would be your opportunity cost of moving out? 5. How much did the “curve ball” affect your attitude toward saving? How much will the credit payments affect your budget? 6. In reality, how will your “real-life” budget be different than the one you created for this project? 7. In conclusion, what have you learned? Highlight at least three specific things you learned or were surprised about. Suggested Resources: Craigslist.com Monster.com ETC If you find a particularly useful website, please let me know about it so I can add it to the list! Name_______________________________ Class Period___________ Rubric for Personal Finance Project These are things that should be included in your final project! _____ Cover sheet with name and class period _____ Written description of your job, including wage and benefits _____ Copy of the job listing, want ad or an application/note from the employer _____ Your resume _____ Your gross monthly income, Federal Income and FICA taxes and net income (show your work!) _____ Copy of the apartment listing or rental application _____ Explanation of why you chose the apartment, the rent and any deposits/fees _____ A list of all items you will bring with you (with pictures if possible) _____ A list of all items you will purchase and where you are buying them from (pictures are nice) _____ The total of all move in costs. Include taxes and shipping on items you purchase. _____ Your budget – show your total income minus your total expenses _____ Documentation of all your expenses (i.e print-out of your insurance, your source of info., etc.) _____ The three Cs of credit _____ Your Monkey Wrench analysis _____ Your completed credit application The above are worth 4 points each, for a total of 60 percent of your grade. _____ Your Reflection Questions – answered thoroughly and thoughtfully! The Reflection questions are worth 40 points total, or 40% of your grade. Final Project Grade _________ Name: ______________________________________________ Class period: ____________ Part 1 – Personal Finance Project Job Information Company: Location: Job Title & Description: Salary Information Hourly rate: $ X 40 (hours worked in a week) = $ Weekly Pay X 4 = - . Monthly Gross Pay $ FICA (calculate 7.65% of your monthly pay and subtract it) $ Federal Income Tax (calculate 17% of your monthly pay and subtract it) = Monthly Net (“take home pay”) Name: ______________________________________________ Class period: ____________ Part 2 – Personal Finance Project Use this form to help you list the items you will buy for your apartment Item Source (store?) Price Apartment Deposit Sales Tax At 8.25% -0- Total Cost TOTAL SPENDING You cannot spend more than you have! Subtract the total amount you will spend from the $1,000. you started with in savings. $1,000.00 ____________ $