Budgeting Assignment

advertisement

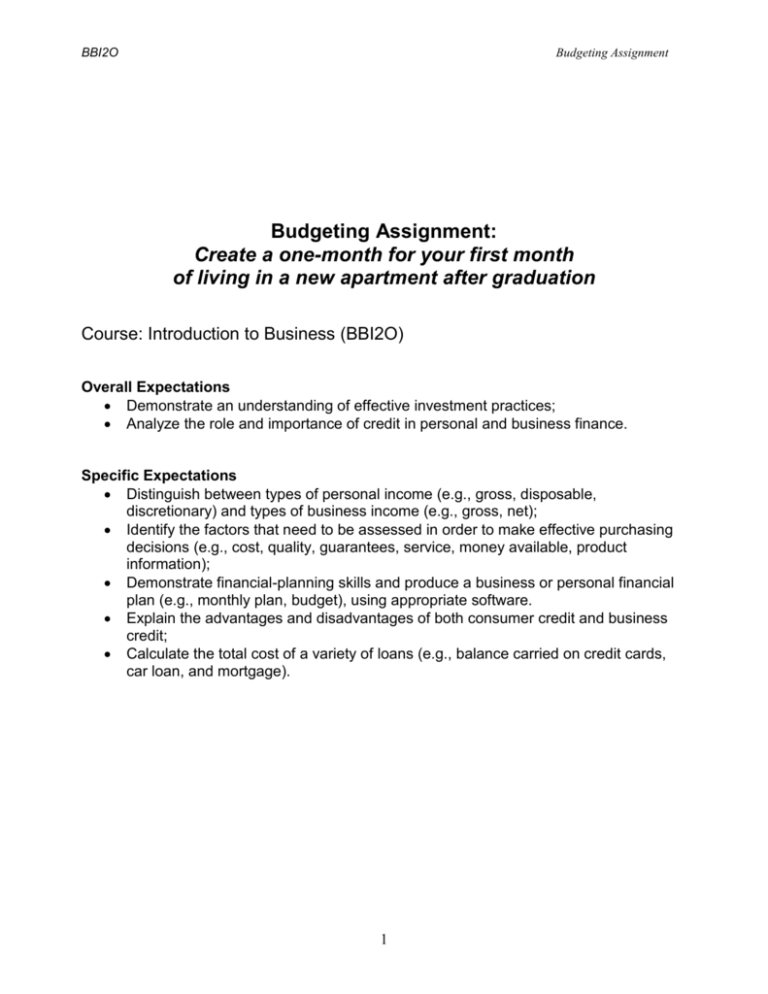

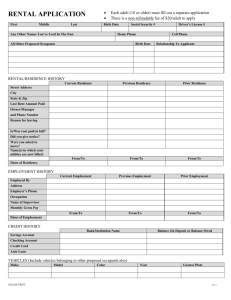

BBI2O Budgeting Assignment Budgeting Assignment: Create a one-month for your first month of living in a new apartment after graduation Course: Introduction to Business (BBI2O) Overall Expectations Demonstrate an understanding of effective investment practices; Analyze the role and importance of credit in personal and business finance. Specific Expectations Distinguish between types of personal income (e.g., gross, disposable, discretionary) and types of business income (e.g., gross, net); Identify the factors that need to be assessed in order to make effective purchasing decisions (e.g., cost, quality, guarantees, service, money available, product information); Demonstrate financial-planning skills and produce a business or personal financial plan (e.g., monthly plan, budget), using appropriate software. Explain the advantages and disadvantages of both consumer credit and business credit; Calculate the total cost of a variety of loans (e.g., balance carried on credit cards, car loan, and mortgage). 1 BBI2O Budgeting Assignment Budgeting Assignment You are to prepare a budget for one month. You can work in groups of two or three providing there is more work done. You have just graduated from College or University and you are making $30,000 a year. Divide this by 12 to come up with a monthly income. Subtract 25% for compulsory deductions (CPP, EI, income taxes, union dues) from each pay cheque to come up with the net income, which is the amount, you have to work with. Remember to add 6% (GST) and 8% (PST) for all purchases other than groceries. Look through flyers, newspaper, and/or Internet to find items to purchase for your first apartment. Use the following categories for your planning. 1. Apartment □ Provide the advertisement for your apartment. □ Describe your apartment in detail. □ Give you location or area of the city and the retail fee. □ Describe what is included in the rent: heat, hydro, water, cable, furniture, and appliances. □ Provide a floor layout of your apartment. □ Explain how this apartment will satisfy your needs and wants. 2. Big Item List □ List the larger purchases that you must purchase one time. Examples: furniture, table and chairs, microwave, vacuum cleaner, appliances, etc… □ Describe the items in detail. □ Create a table to show how you will be paying for these items. □ If you are working in a group, you will need to consider if each member is paying equally for the big items. Using excel, make separate tables for what each member is paying for. Sample Big Item Table Product Description Price Prices after Total price per Interest and taxes month In order to complete the above table and calculate the price and the price after interest and taxes, you will need to consider how you will be paying for these big items. Include: total price of items, administration or delivery fee, down payment, GST, PST and interest. Calculate the cost of credit at a reasonable interest rate over a reasonable time period. You may see some financing options in the flyers or you can phone the store. 3. Small Item List □ List the smaller one time purchases for the household like: dishes, pots, cutlery, etc… □ Describe the items in detail. □ Create a table to show the cost of these products. Remember to show your calculations if you are financing any of these items or paying from them on credit. □ If you are working in a group, you will need to consider if each member is paying equally for the small items. Using excel, make separate tables for what each member is paying for. 2 BBI2O Budgeting Assignment Sample Small Item Table Product Description Price Price after tax 4. Monthly Itemized grocery list □ List the items and the quantity that you will be purchasing for the month. Remember there are no taxes on grocery items. □ If you are working in a group, the members will need to decide if groceries are paid for together or individually. Using excel, make separate tables for what each member is paying for. Sample Grocery List Item Quantity Cost per item Total Cost 5. List of Items you will be bringing to the apartment □ Create a list of the items you will be bringing to the apartment from home. These can be stuff your parents will give you or things you own. 6. Monthly Budget □ Include the big item list total □ Include the small item list total □ Include the monthly itemized grocery list total □ Transportation. Consider whether or not you will own a car or take the bus. If you own a car, you will need to pay 7. Reasoning □ Give a brief explanation as to why you put the items into the categories you did. □ If you were working in a group, why did you separate the items the way you did? 8. Conclusion □ Individually, write a conclusion of your experience. Did you encounter any problems? What would you change if you could do it over again? What will you do with the extra money left over? If you worked in a group, each member must write their own conclusion, as it will be marked separate. Evaluation Presentation (cover page, overall appearance, extra details, grammar, spelling) Rent/description and layout of apartment Big items list and appropriate calculations Small items list and appropriate calculations Monthly grocery list Monthly Budget Reasoning Conclusion 3 20 10 15 10 10 20 5 10

![Personal-Finance-Project[1]](http://s3.studylib.net/store/data/006625348_1-c8d6ffecfae5499cadbd8fcd703c8eae-300x300.png)