HOUSEHOLD BUDGET PROJECT

advertisement

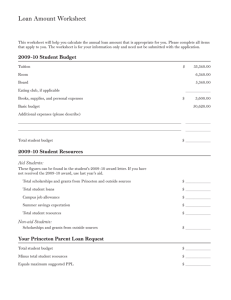

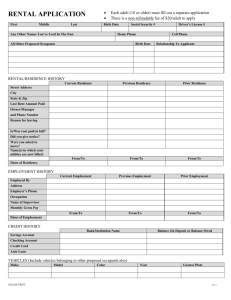

HOUSEHOLD BUDGET PROJECT (150 Points) The Household Budget Project has been designed to give you an example of what it will be like when you either graduate from high school or from a higher educational experience. 1. Students who decide to turn in the project without either a job description section or a typed, completed budget will not receive any credit for this project. 2. All projects should be turned in on the due date – you will have only one extra day to turn in the project. (An excused absence is still considered late) 3. Make sure you use a calculator for all mathematical problems. Double check your work as errors can prove costly. 4. Two people (both must be in my current classes) may live together and, in turn, share the cost of certain expenses equally. However, each person must turn in an individual project. 5. You will be graded on accuracy of math, thoroughness of budget preparation, neatness, spelling and your reaction paper. This project must be typed! 6. The completed project must be in a 1-11/2 inch three-ring binder with tabs dividing each section. 7. Most sections will need an overview paragraph introducing the information. 8. This project is worth 10% of your semester grade -- TAKE YOUR TIME! GOOD LUCK! HOUSEHOLD BUDGET PROJECT You are responsible to do a budget showing your gross annual income, fixed costs and variable costs. It is very important to be realistic when figuring out your budget. Remember this will probably be the first time out on your own so the cost will seem somewhat high. Input: Yearly gross income = $_________________ Deductions from paycheck: Federal Tax Withholding Social Security Medicare State Tax Withholding Profit Participation (401K) Health Insurance 12.2% 6.20% 1.45% 3.00% (Illinois) 6.00% $52.00 per month Other expenses include: College loan payment Auto insurance Life insurance $220.00 per month ______ per month $25.00 per month Income: This will include all wages, interest earnings from savings and dividends from your stocks. Fixed Cost: This will include bills that will be the same every month. Usually include: housing (rent or mortgage), car payments, car insurance and loan payments. Variable Cost: This will include bills that may change on monthly basis. Usually includes: transportation cost (gas, oil, wash…), food, personal care, phone bill, gifts, clothing, drugs, entertainment, vacations and recreation. You are about to embark on the great unknown, life after high school. The following components are geared to help you prepare for the “unknown.” You are 24 years old when creating this budget!! Components of your project: 1. Job Description**: To begin this project you must first find a career or job that will allow you the opportunity to earn enough money to live “self-sufficiently.” You will need to find a career/job through the use of many outside resources (some listed below) to document needed job skills, training and the all important salary. The teacher has the final approval of what level of experience will be accepted and your salary. Possible Career Sites to use www.bls.gov/oco Careercruising.com careerbuilder.com 2. Budget Layout: This is a very important step. This should be a layout that includes your gross income – fixed expenses – variable expenses. This will let you know how much money you have at the end of the project. Category Minimums Housing 10% Food 6% Car Payment 7% Gasoline 6% Savings 6% 3. Rent an apartment, house, or condo**. Look at listings in newspapers, apartment guides, internet, etc. and choose one that you may consider living in and also is affordable to your needs. If your utilities are not included (gas, electric, and water) allow 20% of rent to cover these items. If you share an apartment, both of you must pay 10% of rent. Documentation is needed!!! Make sure you have proof of rent by printing it off the internet and/or clipping an ad out of the newspaper and include it in your project. 4. Furnish your apartment. Moving in to a new apartment will require you to purchase furniture and other accessories. You will need to purchase five different items (more than $25 in cost each – maximum total price of $1000) to bring to your new residence. Show documentation of items you will purchase. If you share an apartment, both of you must include a minimum of 3 items. 5. Keep a checkbook and checkbook register: Record all deposits and check activity starting with your monthly take home pay as an opening balance. Write at least (5) checks in payment of rent, loan payment, food, etc…. **Overview Paragraph Needed 6. Car Payment**: You must look into buying a new or used reliable automobile. You will need a loan to cover the cost of the automobile. Finance calculator you must use: Go to www.yahoo.com Click on “autos” Click on “finance” (next to TRUECAR) Click on “monthly loan payment calculator” ***You must show documentation of your finance calculator results*** 7. Complete a credit card application. 8. Complete a loan application. 9. You must find a quote on car insurance; documentation is required. Insurance companies to consider using: Progressive State Farm Geico 10. Situation cards**: You will be choosing a card that will have actual situations you will need to deal with and incorporate into your budget. The situation will require research, documentation and a summary. 11. Complete a federal 1040EZ Tax Form. 12. Complete a State of Illinois Tax Form. 13. Complete one pie graph showing: Total expenses (Combination of Fixed and Variable Expenses) 14. In a minimum of a one-page summary, evaluate your experience in this project. (Be honest) Was this project realistic? Was it difficult to plan your budget? Did you have any money left at the end of the project or were you short money? If you were short on money, what might be some options for you so you can balance your budget? Was it easy or hard working with a partner, if you had one? Explain your observations. Do you have suggestions to improve or change this project? Any parents comments? Remember, points will be deducted for neatness and will not be accepted if not typed! Mr. Allen – revised: Oct. 29, 2013 **Overview Paragraph Needed

![Personal-Finance-Project[1]](http://s3.studylib.net/store/data/006625348_1-c8d6ffecfae5499cadbd8fcd703c8eae-300x300.png)