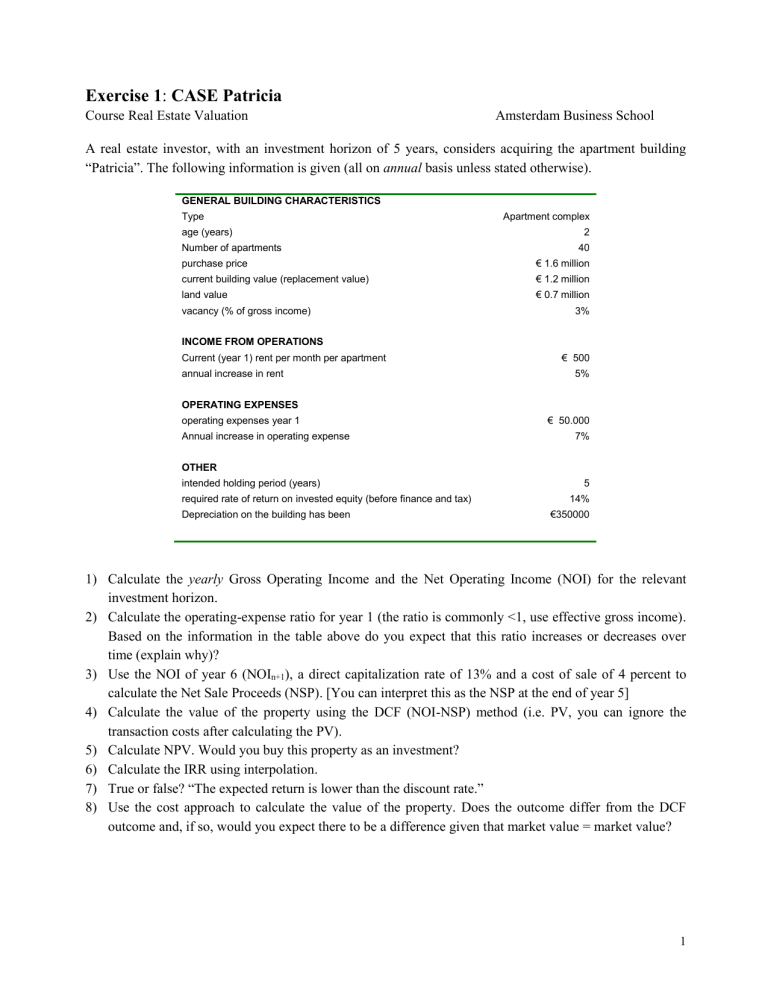

Exercise 1: CASE Patricia Course Real Estate Valuation Amsterdam Business School A real estate investor, with an investment horizon of 5 years, considers acquiring the apartment building “Patricia”. The following information is given (all on annual basis unless stated otherwise). GENERAL BUILDING CHARACTERISTICS Type age (years) Number of apartments Apartment complex 2 40 purchase price € 1.6 million current building value (replacement value) € 1.2 million land value € 0.7 million vacancy (% of gross income) 3% INCOME FROM OPERATIONS Current (year 1) rent per month per apartment annual increase in rent € 500 5% OPERATING EXPENSES operating expenses year 1 Annual increase in operating expense € 50.000 7% OTHER intended holding period (years) required rate of return on invested equity (before finance and tax) Depreciation on the building has been 5 14% €350000 1) Calculate the yearly Gross Operating Income and the Net Operating Income (NOI) for the relevant investment horizon. 2) Calculate the operating-expense ratio for year 1 (the ratio is commonly <1, use effective gross income). Based on the information in the table above do you expect that this ratio increases or decreases over time (explain why)? 3) Use the NOI of year 6 (NOIn+1), a direct capitalization rate of 13% and a cost of sale of 4 percent to calculate the Net Sale Proceeds (NSP). [You can interpret this as the NSP at the end of year 5] 4) Calculate the value of the property using the DCF (NOI-NSP) method (i.e. PV, you can ignore the transaction costs after calculating the PV). 5) Calculate NPV. Would you buy this property as an investment? 6) Calculate the IRR using interpolation. 7) True or false? “The expected return is lower than the discount rate.” 8) Use the cost approach to calculate the value of the property. Does the outcome differ from the DCF outcome and, if so, would you expect there to be a difference given that market value = market value? 1

![Personal-Finance-Project[1]](http://s3.studylib.net/store/data/006625348_1-c8d6ffecfae5499cadbd8fcd703c8eae-300x300.png)