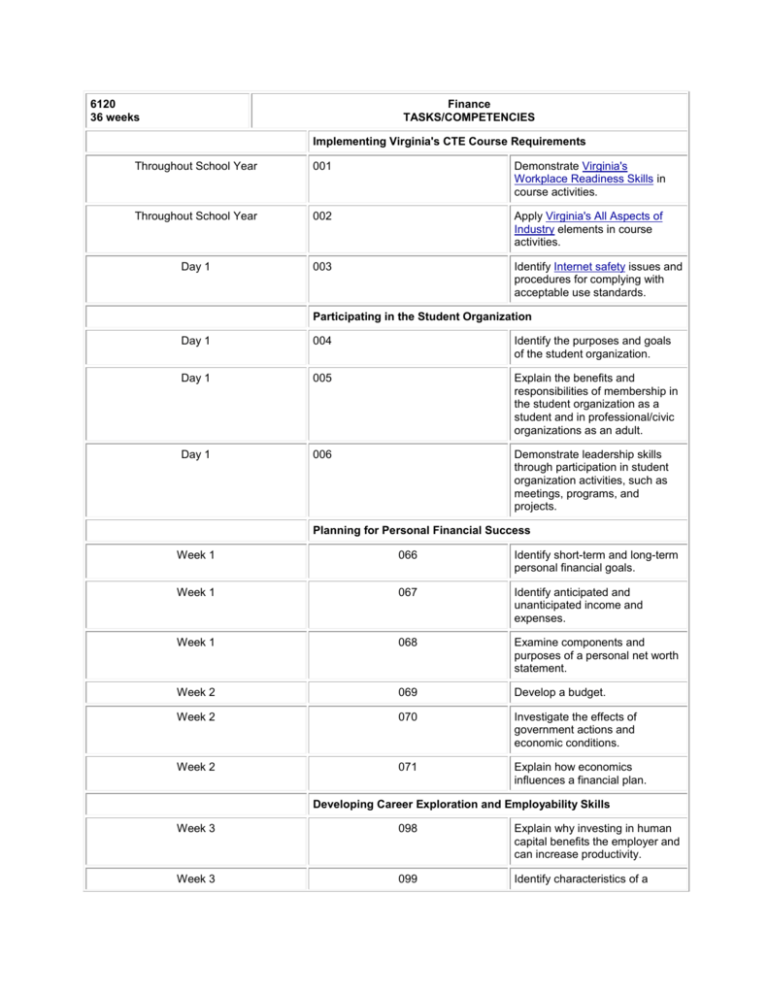

Pacing Guide

advertisement

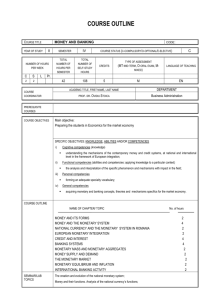

6120 36 weeks Finance TASKS/COMPETENCIES Implementing Virginia's CTE Course Requirements Throughout School Year 001 Demonstrate Virginia's Workplace Readiness Skills in course activities. Throughout School Year 002 Apply Virginia's All Aspects of Industry elements in course activities. Day 1 003 Identify Internet safety issues and procedures for complying with acceptable use standards. Participating in the Student Organization Day 1 004 Identify the purposes and goals of the student organization. Day 1 005 Explain the benefits and responsibilities of membership in the student organization as a student and in professional/civic organizations as an adult. Day 1 006 Demonstrate leadership skills through participation in student organization activities, such as meetings, programs, and projects. Planning for Personal Financial Success Week 1 066 Identify short-term and long-term personal financial goals. Week 1 067 Identify anticipated and unanticipated income and expenses. Week 1 068 Examine components and purposes of a personal net worth statement. Week 2 069 Develop a budget. Week 2 070 Investigate the effects of government actions and economic conditions. Week 2 071 Explain how economics influences a financial plan. Developing Career Exploration and Employability Skills Week 3 098 Explain why investing in human capital benefits the employer and can increase productivity. Week 3 099 Identify characteristics of a successful entrepreneur. Week 3 100 Explain how the economy benefits from entrepreneurship. Week 4 101 Investigate career opportunities. Week 4 102 Identify personal interests, aptitudes, and attitudes related to the characteristics found in successful workers. Week 4 103 Prepare a professional portfolio. Week 5 104 Research a company in preparation for a job interview. Week 5 105 Participate in mock interviews to refine interviewing techniques. Week 5 106 Prepare employment-related correspondence. Developing Consumer Skills Week 6 007 Examine basic economic concepts and their impact on product prices and consumer spending. Week 6 008 Analyze how wages and prices are determined in different markets. Week 6 009 Identify steps in making a purchase decision, using mathematical skills and a decision-making model as needed. Week 7 010 Describe common types of contracts. Week 7 011 Demonstrate comparison-shopping skills. Week 7 012 Interact effectively with salespersons and merchants. Week 8 013 Differentiate between consumer protection regulations and assistance agencies. Week 8 014 Develop a filing system for personal finance records. Week 8 015 Examine the impact of advertising and marketing on consumer demand and decision-making in the global marketplace. Week 9 016 Access financial information from a variety of sources. Week 9 017 Explain consumer rights, responsibilities, and remedies. Handling Banking Transactions Week 9 023 Describe the types of financial institutions. Week 10 024 Examine how financial institutions affect personal financial planning. Week 10 025 Evaluate services and related costs associated with financial institutions in terms of personal banking needs. Week 10 026 Differentiate among types of electronic monetary transactions. Week 11 027 Prepare all forms necessary for opening and maintaining a checking and a savings account. Week 11 028 Reconcile bank statements. Week 11 029 Compare costs and benefits of online and traditional banking. Week 12 030 Explain how certain historical events have influenced the banking system and other financial institutions. Week 12 031 Identify the functions of the Federal Reserve System. Week 12 032 Compare the U.S. monetary system with the international monetary system. Handling Credit/Loan Functions Week 13 033 Calculate payment schedules for a loan, using spreadsheets, calculators, and online tools. Week 13 034 Evaluate the various methods of financing a purchase. Week 13 035 Analyze credit card features and their impact on personal financial planning. Week 14 036 Identify qualifications needed to obtain credit. Week 14 037 Identify basic provisions of credit and loan laws. Week 14 038 Compare terms and conditions of various sources of consumer credit. Week 15 039 Complete a sample credit application. Week 15 040 Identify strategies for effective debt management. Week 15 041 Analyze sources of assistance for debt management. Week 16 042 Explain the need for a sound credit rating. Week 16 043 Compare the costs and conditions of secured and unsecured loans. Week 16 044 Explain the implications of bankruptcy. Planning for Transportation, Housing, and Leisure Expenses Week 17 018 Compare the costs and benefits of purchasing vs. leasing a vehicle. Week 17 019 Analyze the process of renting housing. Week 17 020 Describe the process of purchasing a home. Week 18 021 Compare the advantages and disadvantages of renting vs. purchasing a residence. Week 18 022 Calculate the cost of utilities, services, maintenance, and other housing expenses involved in independent living. Devising an Investment and Savings Plan Week 19 072 Compare the impact of simple interest vs. compound interest on savings. Week 19 073 Compare and contrast investment and savings options. Week 19 074 Explain costs and income sources for investments. Week 20 075 Examine the fundamental workings of the Social Security System and the system's effects on retirement planning. Week 20 076 Contrast alternative retirement plans. Week 20 077 Explore how the stock market works. Earning and Reporting Income Week 21 052 Differentiate among sources of income. Week 21 053 Calculate net pay. Week 21 054 Investigate employee benefits and incentives. Week 22 055 Complete a standard W-4 form. Conducting Tax Functions Week 23 056 Describe the types and purposes of local, state, and federal taxes and the way each is levied. Week 23 057 Compute local taxes on products and services. Week 24 058 Explore potential tax deductions and credits on a tax return. Week 24 059 Examine a standard W-2 form. Week 25 060 Complete a state income tax form, including electronic formats. Week 25 061 Complete short and itemized federal income tax forms, including electronic formats. Analyzing Insurance as Risk Management Week 26 045 Evaluate insurance as a risk management strategy. Week 26 046 Distinguish among the types of automobile insurance coverage. Week 26 047 Distinguish among the types of property coverage. Week 27 048 Distinguish among the major types of life insurance coverage. Week 27 049 Distinguish among the types of health insurance coverage. Week 27 050 Distinguish among the types of professional liability insurance. Week 28 051 Explain the roles of insurance in financial planning. Examining the Financial Implications of an Inheritance Week 28 062 Explain the similarities and differences between state and federal taxation of inheritances. Week 29 063 Define the terminology associated with inheritance. Week 29 064 Compare investment options for a monetary inheritance. Week 29 065 Examine types and purposes of estate planning. Planning Financial Aspects of a Business Enterprise Week 30 078 Compare the various types of business ownership. Week 30 079 Examine the impact of a company's goals on the financial planning of the business. Week 30 080 Describe the major factors in production. Week 31 081 Identify sources of financial capital. Week 31 082 Analyze the financial position of a business. Week 31 083 Investigate government regulations affecting financial aspects of a business. Week 32 084 Analyze the impact of the global economy on American business. Week 32 085 Analyze characteristics of major economic systems. Managing Financial Activities for a Business Enterprise Week 33 086 Complete daily business forms. Week 33 087 Record cash receipts. Week 34 088 Record receipts and payments in journals and ledgers. Week 34 089 Prepare a proof of cash. Week 35 090 Maintain a petty cash system. Week 35 091 Prepare payroll journals. Week 35 092 Analyze spreadsheet data. Exploring Management Functions Week 36 093 Analyze the effects of ethics on business and financial management decisions. Week 36 094 Explain the need for confidentiality in the workplace. Week 36 095 Identify the short- and long-term options for financial planning and working capital management. Week 36 096 Prepare a business plan. Week 36 097 Describe the effects of group dynamics on decision making and consensus building.