Graduate Course Macroeconomics

advertisement

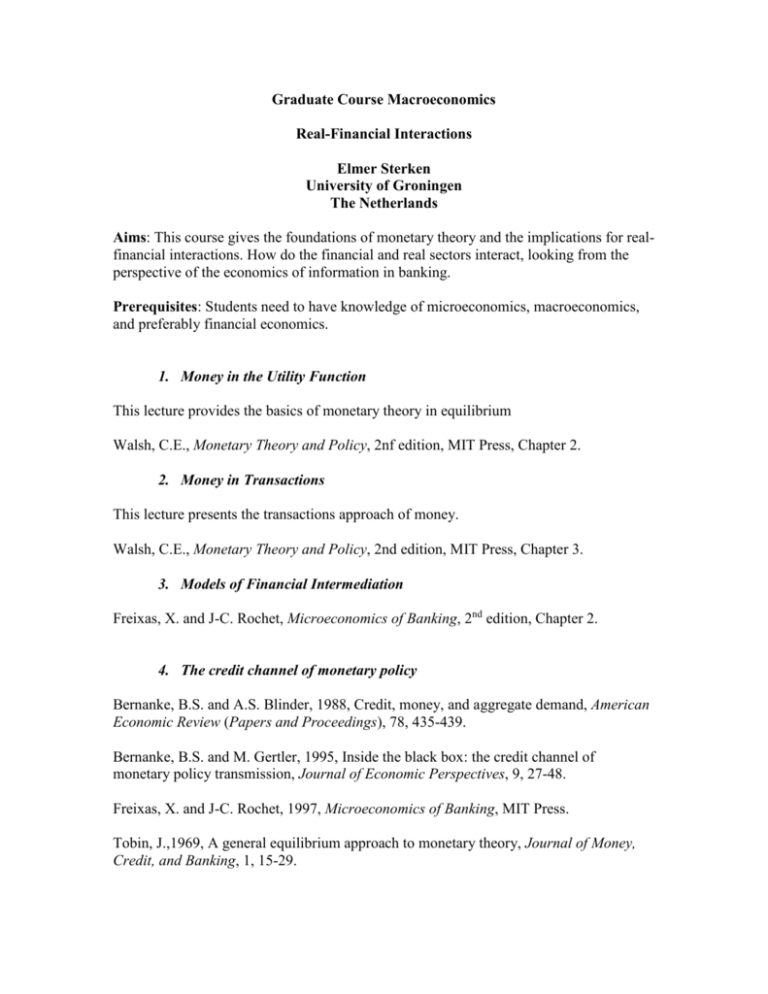

Graduate Course Macroeconomics Real-Financial Interactions Elmer Sterken University of Groningen The Netherlands Aims: This course gives the foundations of monetary theory and the implications for realfinancial interactions. How do the financial and real sectors interact, looking from the perspective of the economics of information in banking. Prerequisites: Students need to have knowledge of microeconomics, macroeconomics, and preferably financial economics. 1. Money in the Utility Function This lecture provides the basics of monetary theory in equilibrium Walsh, C.E., Monetary Theory and Policy, 2nf edition, MIT Press, Chapter 2. 2. Money in Transactions This lecture presents the transactions approach of money. Walsh, C.E., Monetary Theory and Policy, 2nd edition, MIT Press, Chapter 3. 3. Models of Financial Intermediation Freixas, X. and J-C. Rochet, Microeconomics of Banking, 2nd edition, Chapter 2. 4. The credit channel of monetary policy Bernanke, B.S. and A.S. Blinder, 1988, Credit, money, and aggregate demand, American Economic Review (Papers and Proceedings), 78, 435-439. Bernanke, B.S. and M. Gertler, 1995, Inside the black box: the credit channel of monetary policy transmission, Journal of Economic Perspectives, 9, 27-48. Freixas, X. and J-C. Rochet, 1997, Microeconomics of Banking, MIT Press. Tobin, J.,1969, A general equilibrium approach to monetary theory, Journal of Money, Credit, and Banking, 1, 15-29. 5. General equilibrium models: the role of net worth Bernanke, B.S. and M. Gertler, 1989, Agency costs, net worth, and business cycle fluctuations, American Economic Review, 79, 14-31. Kiyotaki, N. and J. Moore, 1997, Credit cycles, Journal of Political Economy, 105, 211248. 6. New-Keynesian models: credit frictions Bernanke, B.S. and M. Gertler, Financial fragility and economic performance, Quarterly Journal of Economics, 105, 87-114. Bernanke, B.S., M. Gertler, and S. Gilchrist, 1999, The Financial Accelerator in a Quantitative Business Cycle Framework, in J.B. Taylor and M. Woodford, eds., Handbook of Macroeconomics. Amsterdam: North-Holland, chapter 21, 1341-1393. Blanchard, O.J. and N. Kiyotaki, 1987, Monopolistic competition and the effects of aggregate demand, American Economic Review, 77, 647-666. 7. Banking and monetary transmission Kashyap, A.K. and J. Stein, 1995, The impact of monetary policy on bank balance sheet, Carnegie-Rochester Conference Series on Public Policy, 42, 151-195. Stein, J.C., 1998, An adverse selection model of bank asset and liability management with implications for the transmission of monetary policy, RAND journal of economics, 29, 466-486. Van den Heuvel, S., 2002, The bank capital channel of monetary policy, Wharton Business School, Mimeo. 8. Empirics of the credit view: the bank lending channel Kashyap, A.K. and J.C. Stein, 2000, What do a million of observations on banks balance sheets say about the transmission of monetary policy?, American Economic Review, 90, 407-428. Kashyap, A.K., J.C. Stein and D.W. Wilcox, 1993, Monetary policy and credit conditions: Evidence from the composition of external finance, The American Economic Review, 83, 78-98. Oliner, S.D. and G.D. Rudebusch, 1996a, Is there a broad channel for monetary policy?, Federal Reserve Bank of San Francisco Economic Review, 1, 4 - 13. Van den Heuvel, S., 2001, Banking conditions and the effects of monetary policy: evidence from US states, Wharton Business School, Mimeo. 9. Banking and growth Bencivenga, V.R. and B.D. Smith, 1991, Financial intermediation and endogenous growth, Review of Economic Studies, 58, 195-209. Levine, R., N. Loayza and T. Beck, 2000, Financial intermediation: causality and growth, Journal of Monetary Economics, 46,31-77. Beck, T. and R. Levine, 2004, Stock markets, banks and growth: panel evidence, Journal of Banking and Finance, 28, 423-442.