Methode Electronics, Inc (NYSE:MEI)

advertisement

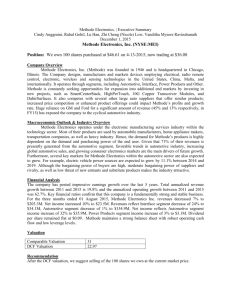

Methode Electronics. | Executive Summary Martin Maurer, Devopama Pant, Melanie Tan, Yunlu Liu April 9, 2015 Recommendation: Buy 100 shares at market Methode Electronics, Inc (NYSE:MEI) Company Overview Headquartered in Chicago, IL. Methode Electronics is a mid-cap company founded in 1946 with $1.8 billion market capitalization. It designs and manufactures electronic components and systems for a wide range of end markets, and it has design, manufacturing, and administrative offices on 4 continents. It consists of four business segments – Automotive, Interconnect, Power, and Other products. The major strengths of this company include its ability to design and manufacture custom-engineered solutions for their client base and their low cost manufacturing facilities. A key risk of this firm is its current dependence on 2 large clients (GM and Ford), which generate approximately half of Methode’s revenues. Industry Overview Methode Electronics belongs to the electronic manufacturing services industry within the technology sector. Most of their products are used by automobile manufacturers, home appliance makers, heavy industry, as well as by transportation companies. This means that they are a cyclical company and that demand for their products is highly dependent on demand and purchasing power by the end user. Given that 68% of their revenues currently come from the automotive segment, the state of the automotive industry in general, and the demand for new cars in particular is a key determinant of Methode’s success. The overall trends in the automotive industry are currently favorable. Global automotive sales by unit are expected to increase from 91.3 million units in 2015 to 100 million units in 2018. Furthermore several key markets for Methode Electronics within the automotive sector also expected to grow. For example electric vehicle power sources are expected to grow by 11.1% between 2014 and 2019. On a macro level, the increase in U.S. disposable income and the resulting increase in purchasing power are also seen as growth drivers. Financial Analysis The company has posted impressive earnings growth over the last 5 years. Total annualized revenue growth between 2010 and 2014 is 15.4% and annualized operating growth between 2010 and 2014 was 47.6%. Key financial ratios confirm that this company is a fundamentally strong and stable business. For instance, operating profit margins increased from 4.5% to 9.7% from 2013 to 2014 and net margins have increased from 7.8% to 12.4% in the same period. 2014 ROE was a record 27.4% compared to 15% in the previous year. This rise was the combined result of improvements in the asset turnover rate and the increase in the operating profit margin. Similarly the company’s return on capital employed (EBIT/Tangible Assets) went from 11.7% in 2013 to 30.4% in 2014. Valuation Our valuation approach included both a DCF and comparable company analysis. Our discount rate calculation for our DCF included a 10.09% WACC with a 0.5% business risk premium, for a total discount rate of 10.59%. Our DCF utilized a terminal growth rate of 3%. After subtracting debt (including capital lease obligations) and employee stock options from the enterprise value DCF resulted in an implied share price of $50.30 based on our assumptions. Our comparable company analysis featured six companies. Three of them possess a similar product mix and serve similar end markets (AVX Corp., CTS Corp., and Amphenol Corp.). These three companies were weighted more heavily in our analysis compared to the remaining three comparables. The six metrics of P/E, P/Forward PEG, EV/EBITDA, EV/EBIT, EV/Forward EBITDA, and EV/Forward Revenue resulted prices ranging from $33.1 to $59.9, and an average implied share price of $44.3. Recommendation Because our comparables analysis resulted in a wider range of values compared to our DCF analysis, we weighted the DCF implied price more heavily in our final implied price calculation, which yielded a fair value estimate of $49.09. We therefore recommend buying 100 shares of MEI at the market price. The last closing price on April 8 was $46.87.