Methode Electronics. | Executive Summary Cindy Anggraini, Rahul

advertisement

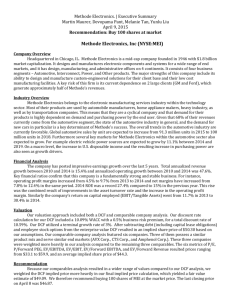

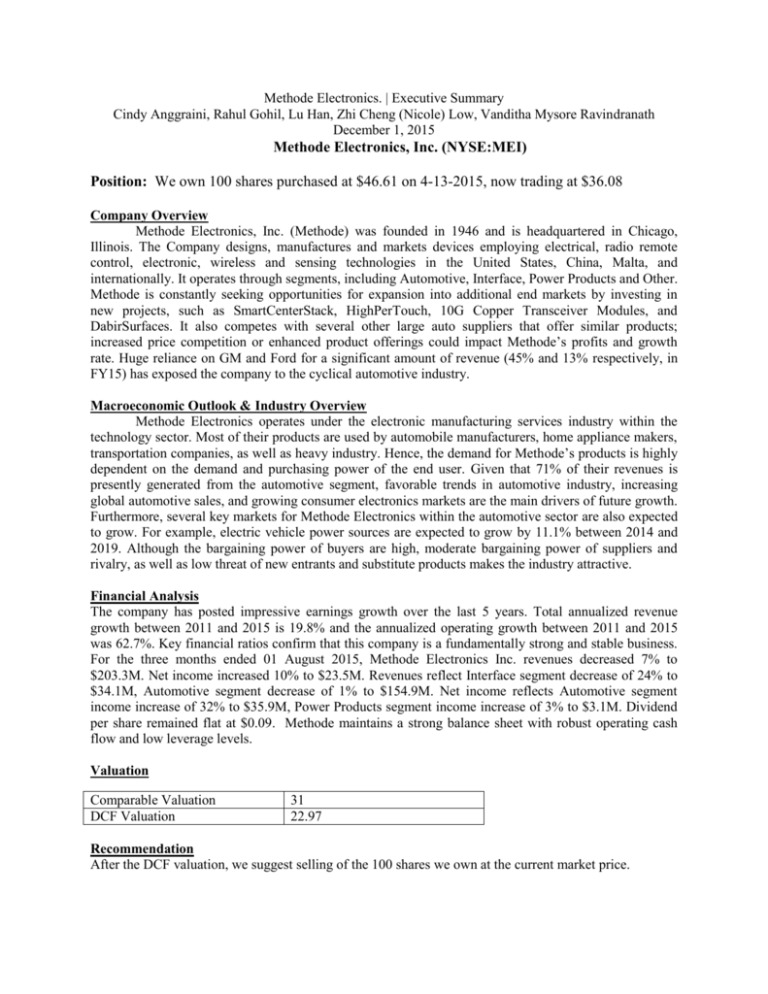

Methode Electronics. | Executive Summary Cindy Anggraini, Rahul Gohil, Lu Han, Zhi Cheng (Nicole) Low, Vanditha Mysore Ravindranath December 1, 2015 Methode Electronics, Inc. (NYSE:MEI) Position: We own 100 shares purchased at $46.61 on 4-13-2015, now trading at $36.08 Company Overview Methode Electronics, Inc. (Methode) was founded in 1946 and is headquartered in Chicago, Illinois. The Company designs, manufactures and markets devices employing electrical, radio remote control, electronic, wireless and sensing technologies in the United States, China, Malta, and internationally. It operates through segments, including Automotive, Interface, Power Products and Other. Methode is constantly seeking opportunities for expansion into additional end markets by investing in new projects, such as SmartCenterStack, HighPerTouch, 10G Copper Transceiver Modules, and DabirSurfaces. It also competes with several other large auto suppliers that offer similar products; increased price competition or enhanced product offerings could impact Methode’s profits and growth rate. Huge reliance on GM and Ford for a significant amount of revenue (45% and 13% respectively, in FY15) has exposed the company to the cyclical automotive industry. Macroeconomic Outlook & Industry Overview Methode Electronics operates under the electronic manufacturing services industry within the technology sector. Most of their products are used by automobile manufacturers, home appliance makers, transportation companies, as well as heavy industry. Hence, the demand for Methode’s products is highly dependent on the demand and purchasing power of the end user. Given that 71% of their revenues is presently generated from the automotive segment, favorable trends in automotive industry, increasing global automotive sales, and growing consumer electronics markets are the main drivers of future growth. Furthermore, several key markets for Methode Electronics within the automotive sector are also expected to grow. For example, electric vehicle power sources are expected to grow by 11.1% between 2014 and 2019. Although the bargaining power of buyers are high, moderate bargaining power of suppliers and rivalry, as well as low threat of new entrants and substitute products makes the industry attractive. Financial Analysis The company has posted impressive earnings growth over the last 5 years. Total annualized revenue growth between 2011 and 2015 is 19.8% and the annualized operating growth between 2011 and 2015 was 62.7%. Key financial ratios confirm that this company is a fundamentally strong and stable business. For the three months ended 01 August 2015, Methode Electronics Inc. revenues decreased 7% to $203.3M. Net income increased 10% to $23.5M. Revenues reflect Interface segment decrease of 24% to $34.1M, Automotive segment decrease of 1% to $154.9M. Net income reflects Automotive segment income increase of 32% to $35.9M, Power Products segment income increase of 3% to $3.1M. Dividend per share remained flat at $0.09. Methode maintains a strong balance sheet with robust operating cash flow and low leverage levels. Valuation Comparable Valuation DCF Valuation 31 22.97 Recommendation After the DCF valuation, we suggest selling of the 100 shares we own at the current market price.