Terminal Growth Rate

advertisement

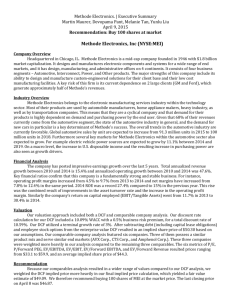

United Natural Foods, Inc. Covering Analyst: Matthew Miller Email: Miller24@uoregon.edu Business Overview › Founded 1996 from merger of two regional distribution companies › First nationwide distributor of natural, organic and specialty products › First firm in U.S. certified by QAI Scale of Operations › U.S. & Canada › 27,000 customers › 26 distribution centers › 65,000 SKU’s › 4,800 suppliers Products as Percent of Revenue 5% 4% 6% Grocery/General Produce/Perishables 12% 51% Frozen Bulk/Food Service Personal Care Nutritional 23% Wholesale Industry › Revenue projected to decline by 1.5% in 2013 › Low margins › Competition from direct distribution Natural & Organic Products Industry › Growing at about 10% per year › Expected to continue at 9% or higher › Growth driven by demand for healthy and environmentally sustainable products Comparables › Growth › Beta › Margins › Industry Similarities › Market Capitalization Comparables › Whole Foods Market – 30% › Costco – 30% › Core-Mark – 20% › Hain Celestial – 10% › Sysco – 10% Comparables Valuation Multiple EV/Revenue EV/Gross Profit EV/EBIT EV/EBITDA EV/(EBITDA-Capex) P/E Price Target Current Price Overvalued Implied Price Weight 88.71 0.00% 64.89 0.00% 52.25 33.00% 49.39 33.00% 56.44 0.00% 53.50 34.00% $51.73 52.49 (1.44%) DCF Analysis › Revenue Model – 4 segments › › › › Supernatural Conventional Natural Products Retailers Other › Revenue growth driven by continued demand for healthy, safe & sustainable products Percent of Revenue by Segment 2012 5% 24% 35% Natural Product Retailers Supernatural (WFM) Conventional Supermarkets Other 36% Revenue Mix Over Time 100% 90% Other 80% 70% Conventional 60% 50% Supernatural (WFM) 40% 30% Natural Products Retailers 20% 10% 0% 2012A 2013E 2014E 2015E 2016E 2017E 2018E Percent of Revenue by Segment 2018 5% 28% 28% Natural Products Retailers Supernatural (WFM) Conventional Other 39% DCF Assumptions › Cogs increasing as a % of revenue › Gross margin decreasing › SG & A decreasing as a % of revenue › Operating margin expanding 9-12 bps DCF Valuation › Implied price of DCF: $38.10 › Overvalued by 27.42% DCF Valuation › Possible reasons – Beta – Market Risk Premium Sensitivity Analysis of Beta Implied Price Adjusted Beta Terminal Growth Rate 38 2.0% 2.5% 3.0% 3.5% 4.0% 0.65 45.49 50.40 56.93 66.00 79.49 0.75 38.25 41.58 45.81 51.35 58.92 0.85 32.82 35.19 38.10 41.75 46.48 0.95 28.61 30.35 32.43 34.98 38.14 1.05 25.25 26.56 28.11 29.95 32.18 Sensitivity Analysis of Market Risk Premium Implied Price Market Risk Premium Terminal Growth Rate 38 2.0% 2.5% 3.0% 3.5% 4.0% 5% 49.50 55.45 63.54 75.22 93.53 6% 39.66 43.27 47.90 54.03 62.53 7% 32.82 35.19 38.10 41.75 46.48 8% 27.80 29.44 31.38 33.74 36.66 9% 23.97 25.14 26.51 28.12 30.05 Implied Price Final Price Implied Price Weight DCF Implied Price $38.10 25.00% Comparables Implied Price $51.73 75.00% Price Target $48.32 Current Price $52.49 Overvalued (7.94%) Portfolio Position # of shares Tall Firs Svigals 350 40 Cost Basis/share $34.87 $34.85 Current Price $52.79 $52.79 Return 51.14% 51.48% Note › United Natural Foods reports 1st quarter earnings Nov 30 – Expected Revenue: $1.381 Bn Recommendation › Based upon my DCF & comparables analysis, I found United Natural Food’s stock to be overvalued. Therefore, I recommend a sell for both the Tall Firs and Svigals portfolios. Questions?