Exercises and solutions--Cash flow statement

advertisement

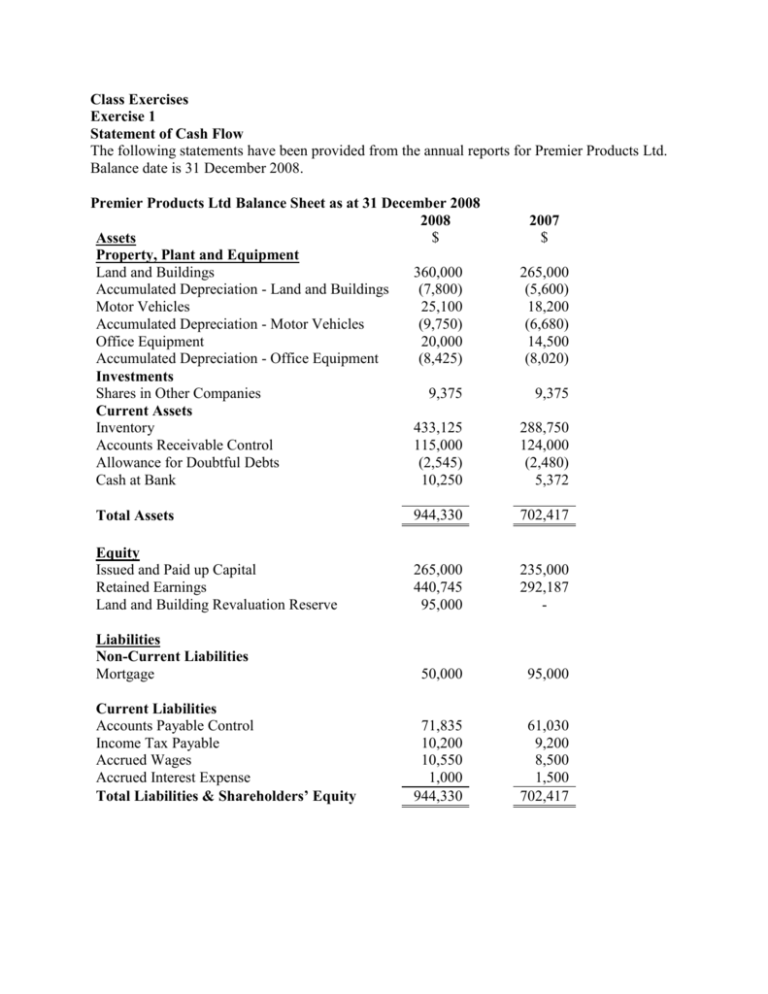

Class Exercises Exercise 1 Statement of Cash Flow The following statements have been provided from the annual reports for Premier Products Ltd. Balance date is 31 December 2008. Premier Products Ltd Balance Sheet as at 31 December 2008 2008 $ Assets Property, Plant and Equipment Land and Buildings 360,000 Accumulated Depreciation - Land and Buildings (7,800) Motor Vehicles 25,100 Accumulated Depreciation - Motor Vehicles (9,750) Office Equipment 20,000 Accumulated Depreciation - Office Equipment (8,425) Investments Shares in Other Companies 9,375 Current Assets Inventory 433,125 Accounts Receivable Control 115,000 Allowance for Doubtful Debts (2,545) Cash at Bank 10,250 2007 $ 265,000 (5,600) 18,200 (6,680) 14,500 (8,020) 9,375 288,750 124,000 (2,480) 5,372 Total Assets 944,330 702,417 Equity Issued and Paid up Capital Retained Earnings Land and Building Revaluation Reserve 265,000 440,745 95,000 235,000 292,187 - 50,000 95,000 71,835 10,200 10,550 1,000 944,330 61,030 9,200 8,500 1,500 702,417 Liabilities Non-Current Liabilities Mortgage Current Liabilities Accounts Payable Control Income Tax Payable Accrued Wages Accrued Interest Expense Total Liabilities & Shareholders’ Equity Premium Products Ltd Income Statement for the year ended 31 December 2008 $ Sales Less: Cost of Goods Sold Gross Profit Dividends Received Less: Expenses Depreciation Advertising Audit Fees Discount Allowed Doubtful Debts Printing and Postage Wages Loss on sale of Office Equipment Other Operating Expenses Total Expenses Net Profit before Interest and Tax less Interest Expense less Taxation Profit after Tax $ 1,472,501 972,528 499,973 2,250 502,223 7,375 42,750 9,000 2,100 65 1,050 167,700 100 6,025 236,165 266,058 15,000 251,058 65,000 186,058 Additional information: Office Equipment was sold for $13,200 during the year. There were no other sales of property, plant and equipment. Required: 1. Prepare the ‘Cash from Operating Activities’ section from the Statement of Cash Flow for Premier Products Limited using the direct method. All workings must be shown. [Note: Ignore GST implications. You are not required to prepare the other sections of the Statement of Cash Flow.] 2. In the Property, Plant and Equipment section of the Balance Sheet, an increase of $5,500 is shown in the value of Office Equipment. Explain the changes to the Office Equipment account that have probably taken place during the year. 3. In studying the financial statements for Premier Products Ltd the owner noticed that the total equity has increased substantially. While she is pleased with this result, she is concerned that the business has made only a slight improvement in its cash position. Explain to the owner the change in total equity, detailing why this has not resulted in a corresponding increase in the cash balance. Support your answer with appropriate calculations. Exercise 2 Your business completes year end financial statements for a range of clients. The Income Statement and Balance Sheet for one of your clients, Mt. Albert Bookstores appears below. Mt Albert Bookstores Income Statement for the year ended 30 September 2008 $’000 $’000 $’000 Sales $175,000 Total revenue $175,000 Less COS 126,300 Gross Profit 48,700 Less expenses Other expenses 17,000 Interest expense 1,500 Bad debts 2,000 Depreciation expense 3,000 Loss on Sale of Assets 2,000 25,500 Net profit before tax 23,200 Tax expense 7,000 Net profit after tax $16,200 Mt. Albert Bookstores Balance Sheet as at 30 September 2008 2008 2007 $’000 $’000 Current Assets Accounts Receivable Inventory Prepayments Non Current Assets Property, Plant & Equipment Less:Accumulated Depreciation Total Assets Current Liabilities Bank overdraft Accounts Payable Non Current Liabilites Term loan Equity Capital Retained earnings Total Liabilities and Equity 43,500 63,000 2,000 108,500 63,000 55,000 2,000 120,000 84,000 16,000 68,000 176,500 82,000 23,000 59,000 179,000 6,500 34,000 40,500 10,000 31,000 41,000 30,000 15,000 60,000 46,000 106,000 60,000 63,000 123,000 176,500 179,000 Additional Information Property, Plant and Equipment purchased during the year amounted to $17,000,000 Accumulated depreciation on the asset sold amounted to $10,000,000. REQUIRED: Prepare a Statement of Cash Flow (using the direct method) for the year ended 30 September 2008. Show all workings. Out of Class Exercises Exercise 1 The following information has been extracted from Lowe Dairy Products Company’s Balance Sheet and Income Statement for the years ended 31 March 2005 and 31 March 2006. 2005 2006 Sales $689,000 $785,000 Cost of Goods Sold 470,000 534,000 Gross Profit 219,000 251,000 Wages Expense 57,000 90,000 Rent expense 46,000 60,000 Interest expense 18,000 32,000 Income tax expense 20,000 26,000 Depreciation expense 6,000 8,000 Loss on disposal of equipment 7,000 Gain on sale of long-term investments (12,000) Dividends 10,000 13,000 Profit 63,000 27,000 Non-Current Assets, at cost Land 207,000 257,000 Plant & Equipment 215,000 198,000 Accumulated Depreciation 61,000 60,000 Long-term Investments 33,000 25,000 Current Assets Cash 41,000 36,000 Prepaid Asset – Rent 25,000 28,000 Accounts Receivable 49,000 73,000 Inventory 102,000 114,000 Current Liabilities Accounts Payable 41,000 57,000 Interest Payable 20,500 22,000 Income Tax Payable 23,500 20,000 Wages Payable 25,000 24,000 Non-Current Liabilities Long-term loan 240,000 250,000 Issued Ordinary Capital 205,000 215,000 Retained Earnings 56,000 83,000 Note:Purchased land for $50,000 cash, sold long-term investments costing $8,000 for cash $20,000, and purchased plant during the year for $5,000. Required: (a) Prepare a Statement of Cash Flow using the Direct Method (ignore GST implications). (b) Prepare a note of reconciliation for the operating activities using the indirect method. Exercise 2 The financial statements for Patty’s Premium Products Ltd are provided below: Patty’s Premium Products Ltd Income Statement for the Year Ended 31 March 2006 Sales $175,000 Less: Cost of Sales 87,000 Gross Profit $88,000 Less: Operating Expenses $29,000 Wages 23,000 52,000 Net Profit before Tax 36,000 Less Tax 10,800 Net Profit after Tax $25,200 Patty’s Premium Products Ltd Balance Sheet as at: 31 March 2006 31 March 2005 Assets: Cash at Bank Accounts Receivable Inventory Prepayments Plant and Machinery Accumulated Depreciation $2,500 41,500 63,000 4,000 94,000 (16,000) $189,000 $ (1000) 54,000 55,000 2,000 82,000 (13,000) $179,000 Liabilities and Owners’ Equity: Accounts Payable $33,500 $ 30,000 Wages Due 500 1,000 Mortgage 30,000 15,000 Issued Capital 60,000 60,000 Retained Earnings 65,000 73,000 $189,000 $179,000 Required: (a) Prepare a Statement of Cash Flow using the Direct Method (ignore GST implications). (b) The statement of cash flow is divided into three separate categories of activities. Discuss how this layout will assist users to assess the cash flows of the business. Exercise 3 Davey’s Farming Products Ltd provided the following information: Davey’s Farming Products Ltd Income Statement for the year ended 31 December 2006 $ $ Sales 260,000 Cost of Goods sold 170,000 Gross Profit 90,000 Income Tax Expense 5,000 Interest Expense 2,000 Wages Expense 42,000 Depreciation Expense 9,000 Other Operating Expenses 14,000 72,000 Net Profit $18,000 Davey’s Farming Products Ltd Comparative Balance Sheet at 31 December 2006 2005 Assets Cash 10,000 8,000 Accounts Receivable 28,000 35,000 Inventory 29,000 26,000 Prepaid Expenses 2,000 4,000 Plant 100,000 75,000 Accumulated Depreciation (30,000) (21,000) 139,000 127,000 Liabilities & Shareholders Equity Accounts Payable 5,600 8,000 Wages Payable 2,400 1,700 Income Tax Payable 1,000 1,300 Bonds Payable 20,000 Issued Capital 60,000 60,000 Retained Profits 50,000 56,000 139,000 127,000 Additional information: Plant was purchased for cash, bonds payable were issued for cash and cash dividends of $24,000 were declared and paid during the financial year. Required: Prepare a Statement of Cash Flow using the Direct Method (ignore GST implications). Suggested Solutions to Out of Class Exercises Exercise 1 (a) Lowe Dairy Products Company Statement of Cash Flow For the year ended 31 March 2006 CASH FLOW FROM OPERATING ACTIVITIES Cash was provided from: Receipts from Customers (785+49-73)* Cash was applied to: Payments to suppliers (534+114-102+41-57)* 530,000 Payments to employees (90+25-24)* 91,000 Payments for other expenses (60+28-25)* 63,000 Interest payments (32+20.5-22)* 30,500 Income tax (26+23.5-20)* 29,500 744,000 $17,000 NET CASH INFLOW (OUTFLOW) FROM OPERATING ACTIVITIES CASH FLOWS FROM INVESTING ACTIVITIES Cash was provided from: Proceeds from sale of long term investment Proceeds from sale of equipment 761,000 20,000 6,000 26,000 Cash was applied to: Purchase of land Purchase of plant 50,000 5,000 55,000 $(29,000) NET CASH INFLOW (OUTFLOW) FROM INVESTING ACTIVITIES CASH FLOW FROM FINANCING ACTIVITIES Cash was provided from: Proceeds from taking out a loan Proceeds from issuing shares 10,000 10,000 20,000 Cash was applied to: Payment of dividends to share holders NET CASH INFLOW (OUTFLOW) FROM FINANCING ACTIVITIES 13,000 $7,000 Net increase (decrease) in cash add Opening cash balance equals Closing cash balance (5,000) 41,000 36,000 Note: Amounts in brackets with * refer to $000s Exercise 2 (a) Patty’s Premium Products Ltd Statement of Cash Flow For the year ended 31 March 2006 CASH FLOW FROM OPERATING ACTIVITIES Cash was provided from: Receipts from Customers (175+54-41.5)* Cash was applied to: Payments to suppliers (87+30-33.5 +63-55)* Payments to employees (23+1-0.5)* Payments for other expenses (29+4-2-3)* Tax 187,500 91,500 23,500 28,000 10,800 153,800 $33,700 NET CASH INFLOW (OUTFLOW) FROM OPERATING ACTIVITIES CASH FLOW FROM INVESTING ACTIVITIES Cash was applied to: Purchase of plant & machinery (94-82)* NET CASH INFLOW (OUTFLOW) FROM INVESTING ACTIVITIES CASH FLOW FROM FINANCING ACTIVITIES Cash was provided from: Proceeds from increased mortgage (30-15)* Cash was applied to: Dividends paid (25.2+73-65)* NET CASH INFLOWS (OUTFLOWS) FROM FINANCING ACTIVITIES Net increase (decrease) in cash add Opening cash balance equals Closing cash balance 12,000 (12,000) 15,000 33,200 (18,200) 3,500 (1,000) 2,500 Note: Amounts in brackets with * refer to $000s (b) The Statement of Cash Flow is separated into three categories of activities: operating, financing, and investing activities. Operating cash flows are generally the result of the provision of goods and services. Investing cash flows are the result of any purchases or sales of assets and investments, including those used to generate economic benefits over more than one future accounting period. Financing cash flows are associated with equity and debt financing activities. The three categories provide information about the major economic activities that use cash in the organisation; this information can assist decision-makers by providing a more complete picture of the organisation’s economic position and activities. Exercise 3 Davey’s Farming Products Ltd Statement of Cash Flow For the year ended 31 December 2006 CASH FLOW FROM OPERATING ACTIVITIES Cash was provided from: Receipts from Customers (260+35-28)* Cash was applied to: Payments to suppliers (170+29-26 +8-5.6)* Payments to employees (42+1.7-2.4)* Payments for other expenses (14+2-4)* Interest Expense Tax Expense (5+1.3-1)* 267,000 175,400 41,300 12,000 2,000 5,300 236,000 $31,000 NET CASH INFLOW (OUTFLOW) FROM OPERATING ACTIVITIES CASH FLOWS FROM INVESTING ACTIVITIES Cash was applied to: Purchase of plant & machinery (100-75)* NET CASH INFLOW (OUTFLOW) FROM INVESTING ACTIVITIES CASH FLOWS FROM FINANCING ACTIVITIES Cash was provided from: Proceeds from bond Cash was applied to: Dividends paid NET CASH INFLOWS (OUTFLOWS) FROM FINANCING ACTIVITIES Net increase (decrease) in cash add Opening cash balance equals Closing cash balance Note: Amounts in brackets with * refer to $000s 25,000 (25,000) 20,000 24,000 (4,000) 2,000 8,000 $10,000