ACC 2460 – Fall 2001

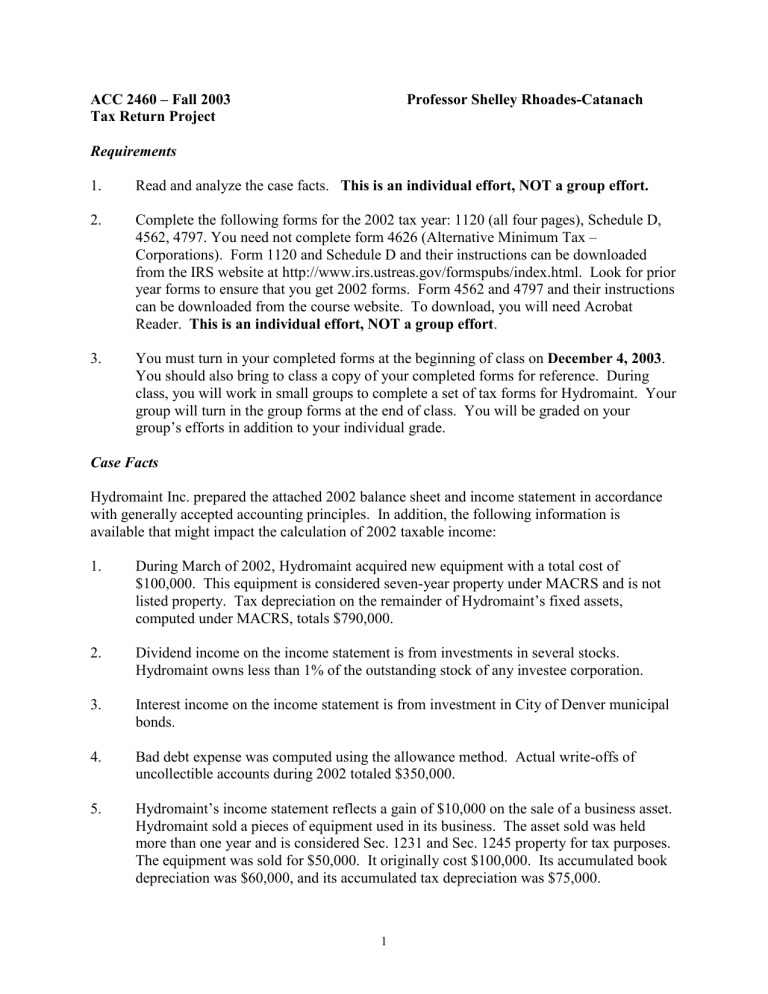

ACC 2460 – Fall 2003

Tax Return Project

Requirements

Professor Shelley Rhoades-Catanach

1.

Read and analyze the case facts. This is an individual effort, NOT a group effort.

2. Complete the following forms for the 2002 tax year: 1120 (all four pages), Schedule D,

4562, 4797. You need not complete form 4626 (Alternative Minimum Tax –

Corporations). Form 1120 and Schedule D and their instructions can be downloaded from the IRS website at http://www.irs.ustreas.gov/formspubs/index.html. Look for prior year forms to ensure that you get 2002 forms. Form 4562 and 4797 and their instructions can be downloaded from the course website. To download, you will need Acrobat

Reader. This is an individual effort, NOT a group effort .

3. You must turn in your completed forms at the beginning of class on December 4, 2003 .

You should also bring to class a copy of your completed forms for reference. During class, you will work in small groups to complete a set of tax forms for Hydromaint. Your group will turn in the group forms at the end of class. You will be graded on your group’s efforts in addition to your individual grade.

Case Facts

Hydromaint Inc. prepared the attached 2002 balance sheet and income statement in accordance with generally accepted accounting principles. In addition, the following information is available that might impact the calculation of 2002 taxable income:

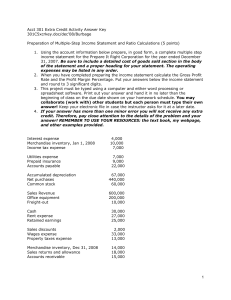

1. During March of 2002, Hydromaint acquired new equipment with a total cost of

$100,000. This equipment is considered seven-year property under MACRS and is not listed property. Tax depreciation on the remainder of Hydromaint’s fixed assets, computed under MACRS, totals $790,000.

2. Dividend income on the income statement is from investments in several stocks.

Hydromaint owns less than 1% of the outstanding stock of any investee corporation.

3. Interest income on the income statement is from investment in City of Denver municipal bonds.

4. Bad debt expense was computed using the allowance method. Actual write-offs of uncollectible accounts during 2002 totaled $350,000.

5.

Hydromaint’s income statement reflects a gain of $10,000 on the sale of a business asset.

Hydromaint sold a pieces of equipment used in its business. The asset sold was held more than one year and is considered Sec. 1231 and Sec. 1245 property for tax purposes.

The equipment was sold for $50,000. It originally cost $100,000. Its accumulated book depreciation was $60,000, and its accumulated tax depreciation was $75,000.

1

6.

Hydromaint’s income statement reflects total loss on sales of investment assets of

$(5,000). Detailed information for the assets producing this loss is as follows:

Stock

150 shares Clay Corp.

100 shares Gold Inc.

Date Acquired Cost Date Sold Sales Proceeds

7/2/94 $50,000 4/1/02 $75,000

4/2/98 50,000 11/6/02 20,000

7. During the year, Hydromaint was sued by a former employee for negligence. As part of its year-end audit, Hydromaint’s auditors determined that it was probable the company would be held liable for damages in this lawsuit. Included in “other current liabilities” on the balance sheet is a contingent liability of $120,000 representing Hydromaint’s expected damage payment. The related expense is included in “other operating expenses” on the income statement.

8. Hydromaint’s income statement reflects book income tax expense of $2,090,000, all of which is federal income tax expense. Hydromaint paid federal estimated tax payments totaling $2,000,000.

9. Hydromaint paid $2,500,000 of dividends to its shareholders during 2002. The corporation has earnings and profits greater than the current dividend distributions.

10. Hydromaint’s inventory is purchased for resale, and valued at cost. The rules of Sec.

263A do not apply to Hydromaint in valuing its inventory.

11. Hydromaint’s employer ID number is 98-7654321.

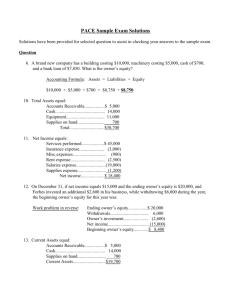

Assets

Cash

Hydromaint Inc.

Balance sheet as of December 31, 2001 and 2002

2001

Accounts receivable

2002

$ 435,309 $ 930,494

1,065,905 1,178,000

Less: allowance for bad debts

Merchandise inventory

Raw materials and work in process inventory

(118,200)

2,042,933

880,000

(178,200)

2,400,450

1,200,000

Supplies inventory

Investment assets

Land

Buildings and equipment

Less: accumulated depreciation

Other assets

Total Assets

75,521

120,000

350,000

167,000

75,000

350,000

5,117,286 4,967,286

(1,211,880) (1,891,880)

1,164,926 1,254,200

$ 9,921,800 $10,452,350

Liabilities and Equity

2

Accounts payable

Current portion of long-term debt

Other current liabilities

Long-term payables

Common stock

Preferred stock

Additional paid-in capital

Retained earnings

Total Liabilities and Equity

$ 1,896,291 $ 1,000,500

15,000

214,659

921,170

15,000

221,000

906,170

208,000

700,000

2,987,000

2,979,680

208,000

700,000

2,987,000

4,414,680

$ 9,921,800 $10,452,350

Hydromaint Inc.

Statement of Income for the year ended December 31, 2002

Sales of goods and services $ 28,000,000

Cost of goods and services sold

Gross profit

Dividend income

Interest income

Loss on sale of investments

Gain on sale of business assets

Depreciation expense

(15,500,000)

12,500,000

90,000

5,000

(5,000)

10,000

(850,000)

Interest expense

Officers salaries

Salaries and bonuses paid to sales personnel

Salaries and wages paid to administrative personnel

Bad debt expense

Property taxes

State income taxes

Charitable contributions

Employee benefits

Premiums on key-man life insurance

Meals and entertainment expenses

Other administrative costs

Repairs and maintenance

Research and development

Income before taxes

Income tax expense (federal)

Net income

(500,000)

(600,000)

(700,000)

(500,000)

(410,000)

(400,000)

(150,000)

(50,000)

(250,000)

(50,000)

(150,000)

(770,000)

(395,000)

(800,000)

6,025,000

(2,090,000)

$ 3,935,000

3