Formulas · · · is an arithmetic sequence where a , a

advertisement

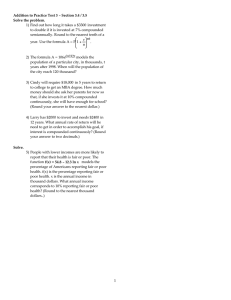

Formulas i Sum of an arithmetic sequence: If a1 , a2 · · · is an arithmetic sequence where at = at−1 + d, then n a1 + a2 + · · · + an = (a1 + an ) 2 ii Sum of a geometric sequence: If a1 , a2 · · · is a geometric sequence where at = dat−1 , then dn − 1 a1 + a2 + · · · + an = a1 d−1 iii Simple interest: S = P (1 + rt). If you invest P dollars into an account that pays a simple interest rate r, after t years your account will be worth S dollars. iv Compound interest: S = P 1 + r nt . n If you invest P dollars into an account that earns an interest rate r, compounded n times each year, after t years your account will be worth S dollars. v AP Y = 1 + r n n − 1 or AP Y = er − 1. The APY of an account is the simple interest rate that yields the same return. vi Future value of an ordinary annuity S = R((1+rc )N −1) , rc where rc = nr , N = nt. Given an account that pays an interest rate r, compounded n times each year, if you deposit a fixed amount of money R into it at the end of each of the n compounding periods, after t years your account will be worth S dollars. vii Future value of an annuity due: S = R h (1+rc )N +1 −1 rc i − R, where rc = nr , N = nt. Given an account that pays an interest rate r, compounded n times each year, if you deposit a fixed amount of money R into it at the beginning of each of the n compounding periods, after t years your account will be worth S dollars. viii Present value of an ordinary annuity: S = R(1−(1+rc )−N ) , rc where rc = nr , N = nt. Given an account that pays an interest rate r, compounded n times each year, if it initially contains S dollars, you will be able to withdraw a fixed amount of money R from it at the end of each of the n compounding periods for t years. ix Present value of an annuity due: S = R(1+rc )(1−(1+rc )−N ) , rc where rc = nr , N = nt. Given an account that pays an interest rate r, compounded n times each year, if it initially contains S dollars, you will be able to withdraw a fixed amount of money R from it at the beginning of each of the n compounding periods for t years. x Present value of a deferred ordinary annuity: P = N = nt. R(1−(1+rc )−N ) , rc (1+rc )m where rc = nr , Given an account that pays an interest rate r, compounded n times each year, if it initially contains S dollars and you don’t withdraw any money during the first m compounding periods, you will be able to withdraw a fixed amount of money R from it at the end of each of the n compounding periods for t years. xi Amortization formula: SN −k = R 1−(1+rc )−(N −k) rc , where rc = nr , N = nt. If you want to pay off a loan by making n payments of R dollars each year for t years, the unpaid balance after making k payments will be of SN −k dollars. Page 2