Tuesday, March 20, 2007 Ch 8-2

Tuesday, March 20, 2007 Ch 8-2

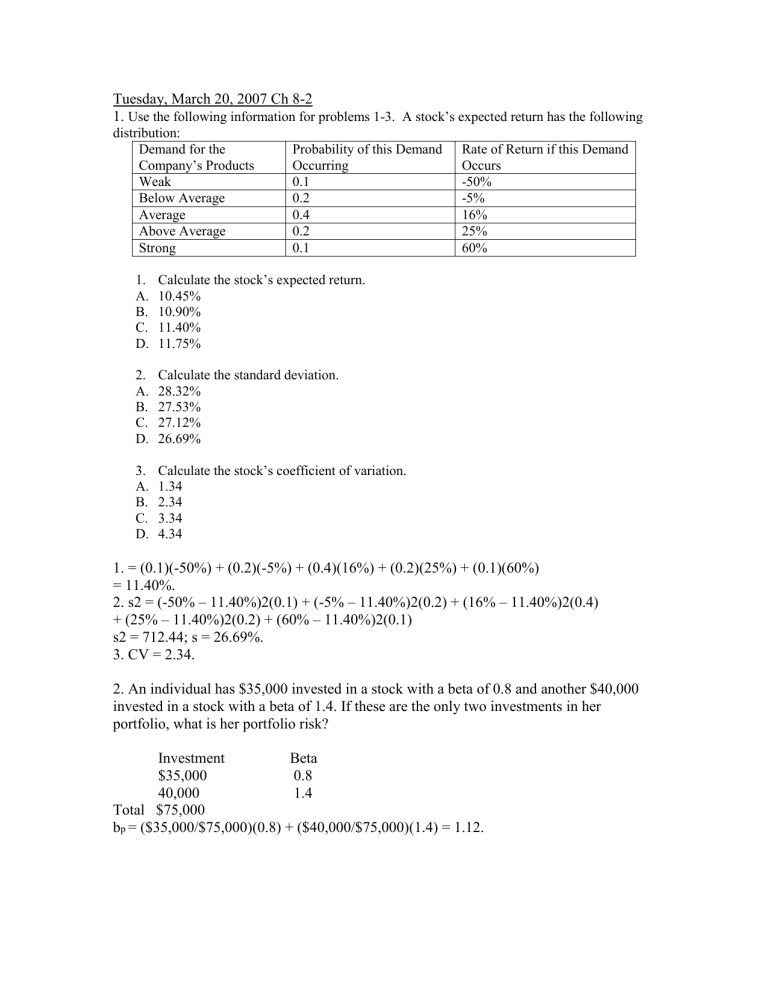

1. Use the following information for problems 1-3. A stock’s expected return has the following distribution:

Demand for the

Company’s Products

Weak

Below Average

Average

Probability of this Demand

Occurring

0.1

0.2

0.4

Above Average

Strong

0.2

0.1

1.

Calculate the stock’s expected return.

A.

10.45%

B.

10.90%

C.

11.40%

D.

11.75%

2.

Calculate the standard deviation.

A.

28.32%

B.

27.53%

C.

27.12%

D.

26.69%

3.

Calculate the stock’s coefficient of variation.

A.

1.34

B.

2.34

C.

3.34

D.

4.34

Rate of Return if this Demand

Occurs

-50%

-5%

16%

25%

60%

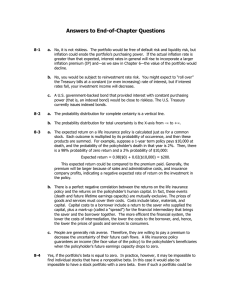

1. = (0.1)(-50%) + (0.2)(-5%) + (0.4)(16%) + (0.2)(25%) + (0.1)(60%)

= 11.40%.

2. s2 = (-50% – 11.40%)2(0.1) + (-5% – 11.40%)2(0.2) + (16% – 11.40%)2(0.4)

+ (25% – 11.40%)2(0.2) + (60% – 11.40%)2(0.1) s2 = 712.44; s = 26.69%.

3. CV = 2.34.

2. An individual has $35,000 invested in a stock with a beta of 0.8 and another $40,000 invested in a stock with a beta of 1.4. If these are the only two investments in her portfolio, what is her portfolio risk?

Investment Beta

$35,000

40,000

0.8

1.4

Total $75,000 b p

= ($35,000/$75,000)(0.8) + ($40,000/$75,000)(1.4) = 1.12.

3. Assume that the risk-free rate is 6 percent and the expected return on the market is 13 percent. What is the required rate of return on a stock with a beta of 0.7? r

RF

= 6%; r

M

= 13%; b = 0.7; r = ? r = r

RF

+ (r

M

– r

RF

)b

= 6% + (13% – 6%)0.7

= 10.9%.

4. Assume that the risk-free rate is 5 percent and the market risk premium is 6 percent.

What is the expected return for the overall stock market? What is the required return on a stock with a beta of 1.2? r

RF

= 5%; RP

M

= 6%; r

M

= ? r

M

= 5% + (6%)1 = 11%. r when b = 1.2 = ? r = 5% + 6%(1.2) = 12.2%.

5. A stock has a required return of 11%; the risk-free rate is 7%; and the market risk premium is 4%. a. What is the stock’s beta? b. If the market risk premium increased to 6%, what would happen to the stock’s required rate of return? Assume that the risk-free rate and the beta remain unchanged a. r = 11%; r

RF

= 7%; RP

M

= 4%. r = r

RF

+ (r

M

– r

RF

)b

11% = 7% + 4%b

4% = 4%b b = 1. b. r

RF

= 7%; RP

M

= 6%; b = 1. r = r

RF

+ (r

M

– r

RF

)b

= 7% + (6%)1

= 13%.

6. ERCI Corporation is a holding company with four main subsidiaries. The percentage of its capital invested in each of the subsidiaries, and their respective betas, are as follows

Subsidiary Percentage of Capital Beta

Electric Utility

Cable Company

60%

25

0.70

0.90

Real Estate Development

International/special projects

10

5

1.30

1.50 a. What is the holding company’s beta? b. If the risk-free rate is 6% and the market risk premium is 5%, what is the holding company’s required rate of return? a. b = (0.6 X 0.70) + (0.25 X 0.90) + (0.1 X 1.30) + (0.05 X 1.50) beta = 0.85 b. rRF = 6%; RPm = 5%; b = 0.85 r = 6% + (5%)(0.85) r = 10.25%

7. Calculate the required rate of return for Manning Enterprises, assuming that investors expect a

3.5% rate of inflation in the future. The real risk-free rate is 2.5% and the market risk premium is

6.5%. Manning has a beta of 1.7, and its realized rate of return has averaged 13.5% over the past

5 years. rF = r* + IP = 2.5% + 3.5% = 6% r s

= 6% + (6.5%)1.7 = 17.05%.

The risk-free rate is compromised of 1. a real inflation-free rate, r*; and, 2. an inflation premium