File

advertisement

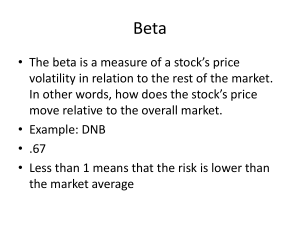

Stock Market Intro • • • *Contest opens February 21st, and ends June 7th *One winner from each class will be chosen Quiz on Friday Feb 15 - how to calculate simple & compound interest Bull Market When prices rise by 20% or more Upswing of market Ended in 2000 Bear Market When stock index drops 20% or more Recession/large downturn What to look for in a stock Historical average return of 10% or more Price/Earnings ratio vs projected return Current news about the company Trends in the stock value Look at new highs & lows Dividend history – dividends with steady increases mean healthy cash flow Cash position – are there enough current assets to cover current liabilities? If not, this could mean trouble Beta Beta is level of volatility or RISK of a stock 1 = risk is equal to the stock market Greater than 1 is higher risk than the stock market Less than 1 is lower risk than the stock market Keep in mind, more volatile stocks may go up or down suddenly more often than less volatile stocks Stock market assignment: Presentations are Tuesday Feb 19th Must be traded on the Nasdaq, NYSE, or TSX EXAMPLE OF PRESENTATION (yours must include 3 stocks) Toyota Motor Company Stock Ticker symbol: TM TM is traded on the NYSE Beta – 0.72 As the beta is less than 1, this stock is a low risk P/E (price/earnings) Ratio: $33.31 General Motors - $10.38 Ford (F) – $2.96 EPS (earnings per share): $3.09 General Motors - $2.66 Ford (F) - $4.41 Historical return (3 year) Based on prices at the end of each year 2012 return: 42% (Dec 31 2012 $97.34 – Jan 2 2012 $68.51)/68.51 2011 return: -20% (Jan 2 2012 $68.51 – Jan 3 2011 $82.46)/82.46 2010 return: -3% (82.46 – Jan 4 2010 $85.76)/85.96 3 Month Performance Recommendation: BUY Although, based on the P/E ratio, the TM stock is more expensive than other car companies on the NYSE… The low beta indicates a low risk The Earning Per Share for this stock are much higher than other respective car companies, so you will pay more for this stock The 3 month trend chart indicates an upward trend line Therefore I would recommend including some Toyota Motor Company (TM) stocks in your portfolio in the short term, but due to the low risk and high price, I predict it will not be a very high RETURN on your investment Notes for presentations Practice! Wear BUSINESS CASUAL ATTIRE! Nice jeans (no rips, dark wash) or dress pants Sweater or dress shirt & tie NO t-shirts, sweatpants, hoodies You may bring cue-cards or notes, but try not to read directly off of the slide Use LESS WORDS and expand on your slide points while talking Keep the presentations to 5 minutes or less Make eye contact with audience