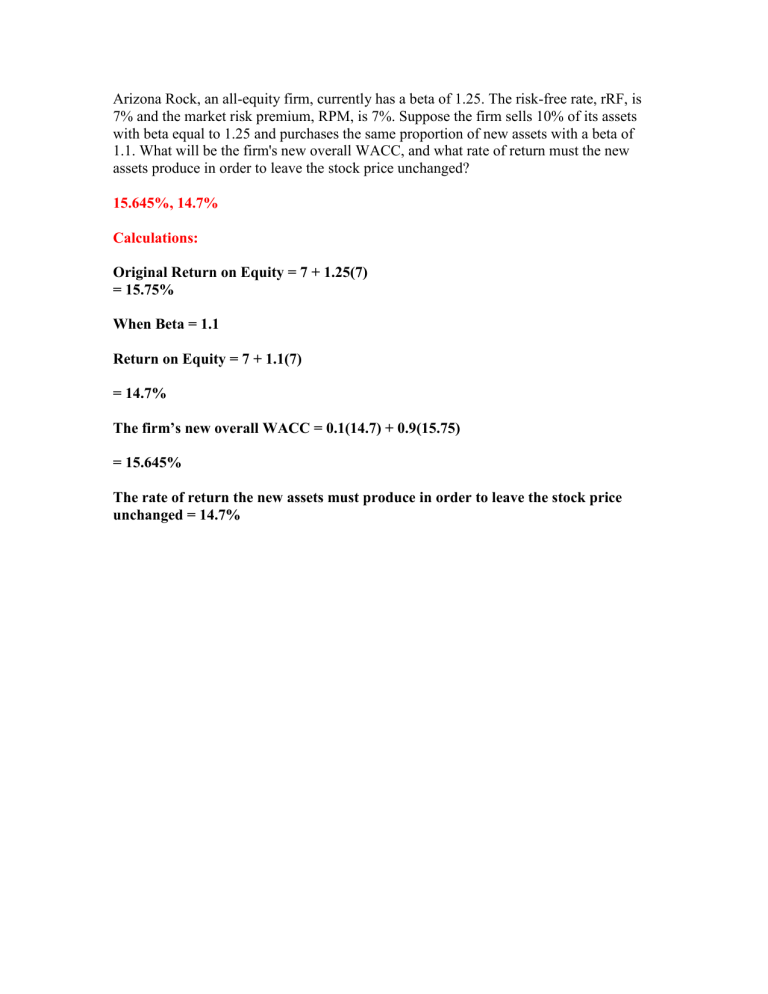

Arizona Rock, an all-equity firm, currently has a beta of 1.25. The risk-free rate, rRF, is 7% and the market risk premium, RPM, is 7%. Suppose the firm sells 10% of its assets with beta equal to 1.25 and purchases the same proportion of new assets with a beta of 1.1. What will be the firm's new overall WACC, and what rate of return must the new assets produce in order to leave the stock price unchanged? 15.645%, 14.7% Calculations: Original Return on Equity = 7 + 1.25(7) = 15.75% When Beta = 1.1 Return on Equity = 7 + 1.1(7) = 14.7% The firm’s new overall WACC = 0.1(14.7) + 0.9(15.75) = 15.645% The rate of return the new assets must produce in order to leave the stock price unchanged = 14.7%