IFM - paperhint

advertisement

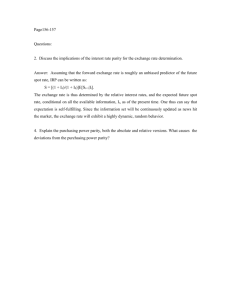

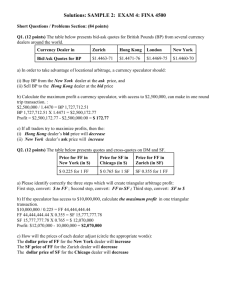

Exchange Rate Theories/International Parity Conditions Mint Parity Theory Mint parity theory explains the determination of exchange rate between the two countries which are a gold standard. In a country which is on gold standard, the currency is either made of gold or is convertible into gold at a fixed rate. There are also no restrictions on the export or import of gold. Mint Parity Theory The rate of exchange between the gold standard countries is determined on a weight to weight basis of the gold countries of their currencies. In other words, the exchange rate is determined by the gold equivalents of the currencies involved. Mint Parity Theory The mint par is an expression of the ratio of weights of gold's used for the coinage of the currencies. For examples before World War 1 England and American were on gold standard. The mint par between these two countries was pound, one of England +4.866 dollars of America. One pound worth fine gold= 4.866 dollars Mint Parity Theory The ratio of weights of metal 1 pound= $4.866 was called the mint parity. The mint par was a fixed rate. It remained so long as the monetary laws of the country remain unchanged. The current or the market rate of exchange, however, fluctuated from time to time due to changes in the balance of payments of the respective countries. International Parity Conditions ■ The forex participants must have to answer some questions like:- What are the determinants of exchange rates? - Are changes in exchange rates predictable? ■ The economic theories that link exchange rates, price levels, and interest rates together are called international parity conditions. ■ Parity conditions form the core of the financial theory that is unique to international finance. Prices and Exchange Rates ■ If the identical product or service can be sold in two different markets, and no restrictions exist on the sale or transportation costs of moving the product between markets, the products price should be the same in both markets. ■ This is called the law of one price. Prices and Exchange Rates ■ A primary principle of competitive markets is that prices will equalize across markets if frictions (transportation costs) do not exist. ■ Comparing prices then, would require only a conversion from one currency to the other: 8 Rr^stRs^rRr ' Absolute PPP ■ If the law of one price were true for all goods and services, the purchasing power parity (PPP) exchange rate could be found from any individual set of prices. ■ By comparing the prices of identical products denominated in different currencies, we could determine the “real” or PPP exchange rate that should exist if markets were efficient. ■ This is the absolute version of the PPP theory. Parity Condition A = S(A/B) *PB Purchasing Power Parity (PPP) -5 Percent change in the spot exchange 6 rate for foreign currency -6 Percent difference in expected rates of inflation (foreign relative to home country) Relative PPP ■ If the assumptions of the absolute version of the PPP theory are relaxed a bit more, we observe what is termed relative purchasing power parity (RPPP). ■ RPPP holds that PPP is not particularly helpful in determining what the spot rate is today, but that the relative change in prices between two countries over a period of time determines the change in the exchange rate over that period. Prices and Exchange Rates ■ More specifically, with regard to RPPP, if the spot exchange rate between two countries starts in equilibrium, any change in the differential rate of inflation between them tends to be offset over the long run by an equal but opposite change in the spot exchange rate. If S*($/£) is the percentage change in the spot exchange rate over a year and P*US and P*UK are the percentage change in the price levels in US and UK then PUS(1+ P*US) = S($/£)(1+ S*($/£)) x PUK (1+ P*UK ) (1+ P*US) = (1+ S*($/£)) x (1+ P*UK ) S*($/£) = (P*US- P*UK )/(1+P*UK ) In approximation S*($/£) = (P*US- P*UK ) The absolute or expectations form of PPP implies that exchange rate differential should be equal to inflation rate differential to avoid any permanent bias, if the markets are efficient. Departure from PPP ■ PPP holds up well over the very long run but poorly for shorter time periods ■ PPP holds better for countries with relatively high rates of inflation and underdeveloped capital markets ■ Restrictions on movement of goods - Import Tariffs - Quotas ■ Price Indexes and non-traded outputs Statistical problems of evaluating PPP S*($/£) = β0+ β1(P*US- P*UK )+µ It is presumed that β0=0 and β1 =1, where µ is the ex-ante regression error # errors in measuring P*US- P*UK # simultaneous determination of S*($/£) and inflation differential. Prices and Exchange Rates ■ Individual national currencies often need to be evaluated against other currency values to determine relative purchasing power. ■ The objective is to discover whether a nation’s exchange rate is “overvalued” or “undervalued” in terms of PPP. ■ This problem is often dealt with through the calculation of exchange rate indices such as the nominal effective exchange rate index. Prices and Exchange Rates The degree to which the prices of imported and exported goods change as a result of exchange rate changes is termed passthrough. ■ Although PPP implies that all exchange rate changes are passed through by equivalent changes in prices to trading partners, empirical research in the 1980s questioned this long-held assumption. ■ For example, a car manufacturer may or may not adjust pricing of its cars sold in a foreign country if exchange rates alter the manufacturer’s cost structure in comparison to the foreign market. Pass-through can also be partial as there are many mechanisms by which companies can compartmentalize or absorb the impact of exchange rate changes. Price elasticity of demand is an important factor when determining pass-through levels. Interest Rate Parity ■ The currency of a country with lower interest rates should be at a forward premium in terms of the currency of the country with the higher rate. ■ In an efficient market with no transaction costs, the interest rate differential should be approximately equal to forward differential. ■ When this is met , the forward rate is said to be interest rate parity and equilibrium Prevails in the money market. Interest Rate Parity contd.. Interest rate parity ensures that return on a hedged (covered) foreign investment will just equal the domestic rate on investment of identical risk, thereby eliminating the possibility of money machine. Fisher Effect ■ The Fisher Effect states that nominal interest rates in each country are equal to the required real rate of return plus compensation for expected inflation. ■ This equation reduces to (in approximate form): i = r + TT Where i = nominal interest rate, r = real interest rate and TT = expected inflation. ■ Empirical tests (using ex-post) national inflation rates have shown the Fisher effect usually exists for short-maturity government securities (treasury bills and notes). Interest Rates & Exchange Rates ■ The relationship between the percentage change in the spot exchange rate over time and the differential between comparable interest rates in different national capital markets is known as the international Fisher effect ■ “Fisher-open”, as it is termed, states that the spot exchange rate should change in an equal amount but in the opposite direction to the difference in interest rates between two countries. Currency Yield Curves & The Forward Premium Interest yield Eurodollar yield curve 10.0 % 9.0 % 8.0 % 7.0 % 6.0 % 5.0 % Euro Swiss franc yield curve 4.0 % 3.0 % 2.0 % 1.0 % 30 60 90 120 Days Forward 150 180 Interest Rate Parity (IRP) Start i $ = 8.00 % per annum (2.00 % per 90 days) End ► $1,000,000 ► x 1.02 -------- $1,020,000 $1,019,993* t S = SF 1.4800/$ F90 = SF 1.4655/$ ▲ Dollar money market Swiss franc money market SF 1,480,000 ------ ► x 1.01 ----------------- ► SF 1,494,800 i SF = 4.00 % per annum (1.00 % per 90 days) •Note that the Swiss franc investment yields $1,019,993, $7 less on a $1 million investment. Covered Interest Arbitrage ■ The spot and forward exchange rates are not, however, constantly in the state of equilibrium described by interest rate parity. ■ When the market is not in equilibrium, the potential for “risk-less” or arbitrage profit exists. ■ The arbitrager will exploit the imbalance by investing in whichever currency offers the higher return on a covered basis. ■ This is known as covered interest arbitrage (CIA). Covered Interest Arbitrage (1+r$)=Fn($/£)/($/£) *(1+r£) Covered Interest Arbitrage (CIA) Eurodollar rate = 8.00 % per annum Start $1,000,000 ► x 1.04 ----- + End $1,040,000~LArbitrage $1,044,638X Potential Dollar money market S =¥106.00/$ 180 days F180 = ¥ 103.50/$ Yen money market ¥ 106,000,000 > x 1.02 ------Euroyen rate = 4.00 % per annum ► ¥ 108,120,000 Uncovered Interest Arbitrage ■ A deviation from covered interest arbitrage is uncovered interest arbitrage (UIA). ■ In this case, investors borrow in countries and currencies exhibiting relatively low interest rates and convert the proceed into currencies that offer much higher interest rates. ■ The transaction is “uncovered” because the investor does no sell the higher yielding currency proceeds forward, choosing to remain uncovered and accept the currency risk of exchanging the higher yield currency into the lower yielding currency at the end of the period. Uncovered Interest Arbitrage S*($/£) = r*US- r*UK Interest Differential should be equal to expected rate of change in spot rate Uncovered Interest Arbitrage (UIA): The Yen Carry Trade Investors borrow yen at 0.40% per annum Start ¥ 10,000,000 --------------- ► x 1.004 --------------- ► Japanese yen money market 360 days S =¥120.00/$ End ¥ 10,040,000 Repay ¥10,500,000 Earn ¥ 460,000 Profit t S360 = ¥120.00/$ A US dollar money market $ 83,333,333 ► x 1.05 --------------- ► Invest dollars at 5.00% per annum $ 87,500,000 Interest Rates and Exchange Rates ■ The following exhibit illustrates the conditions necessary for equilibrium between interest rates and exchange rates. ■ The disequilibrium situation, denoted by point U, is located off the interest rate parity line. ■ However, the situation represented by point U is unstable because all investors have an incentive to execute the same covered interest arbitrage, which is virtually risk-free. Interest Rate Parity (IRP) and Equilibrium Percentage premium on foreign currency (¥) Percent difference between foreign (¥) -4 and domestic ($) interest rates u International Parity Conditions in Equilibrium (Approximate Form) Forward rate as an unbiased predictor ( E ) Purchasing power parity (A) Forecast change in spot exchange rate +4% (yen strengthens) / Forward premium on foreign currency +4% (yen strengthens) \ Interest rate parity ( D) Forecast difference in rates of inflation -4 % International Fisher Effect (C) B Difference in nominal interest rates -4 % (less in Japan) (less in Japan) / Fisher effect (B) Forward Rate as an Unbiased Predictor for Future Spot Rate Exchange rate t1 t2 t3 t4 S1 t 1 t 2 t 3 t 4 ► Illustration 1 The following are the quotes available at the market: Spot $ / € 0.8775 / 0.8777 3 months Forward 0.0015 / 0.0010 3 months interest rates are: $ 2.25/2.50% per annum; € 3.50/3.75% per annum Verify whether there is any scope for covered interest arbitrage. What should be the amount borrowed to make an arbitrage profit of $ 1000, if there is scope for arbitrage. Illustration 2 A FII invested in Indian capital market on December 01, 2000. When the Mumbai stock exchange sensex was quoting at 3800. The rupee-dollar spot exchange rate at that time was Rs./$ 46.30 / 33. The FII sold the investment on November 30, 2001. When Sensex was quoting at 3250, to take back the amount in dollars. The spot rate quoted on November 30, 2001 was Rs./$ 48.02/05. Inflation rate in India was 6%, and in US was 2.5% during the same period. Compute nominal and real rate of return to FII. Compute the real return to an Indian investor who invested Rs.100,000 in the capital market for the same period. Illustration 2 A FII invested in Indian capital market on December 01, 2000, $1000. The rupee-dollar spot exchange rate at that time was 46.30. The FII sold the investment on November 30, 2001 forRs 58000. The spot rate quoted on November 30, 2001 was Rs./$ 48.02. Inflation rate in US was 2.5% during the same period. Compute nominal and real rate of return to FII.