Presentation

advertisement

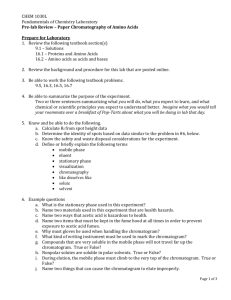

FOREX RISK MANAGEMENT BY CA. BHUPESH ANAND FCA, ACMA, FCS, DIP-IFRS(LONDON) CERTIFIED VALUER, MIND TRAINER A. FOREX ARITHMATIC B. FOREX RISK C. FOREX RISK MANAGEMENT FOREX ARTHMATIC DIRECT QUOTE INDIRECT QUOTE BANK RATE SPOT RATE – FORWARD RATE CROSS RATES RULE (1) RULE (2) RULE (3) RULE (4) RATES PREMIUM OF BASE CURRENCY DISCOUNT OF BASE CURRENCY THEORIES OF EXCHANGE RATE INTEREST RATE PARITY THEORY PURCHASING POWER PARITY THEORY IRVING FISHER’S THEORY ARBITRAGE TWO POINT GEOGRAPHICAL THREE POINT TIME INTEREST RATES DEPOSIT BORROWING RATES RATE LOWER - HIGHER EXCHANGE MARGIN RBI RBI BANK BANK EXPORTER IMPORTER TYPES OF FOREX RISK TRANSACTION RISK TRANSLATION RISK ECONOMICAL RISK POLITICAL RISK HEDGING TOOLS INTERNATIONAL HEDGING TOOLS LEASING LAGGING NETTING FOREIGN CURRENCY ACCOUNTS HOME CURRENCY INVOICING EXTERNAL HEDGING TOOLS FORWARD CONTRACTS FUTURE CONTRACTS OPTION CONTRACTS SWAP CONTRACTS MONEY MKT. HEDGING FORWARD CONTRACTS FIXED DATE FORWARD CONTRACT OPTIONS IN FORWARD CONTRACTS OPTIONS IN FORWARD CONTRACTS CANCELLATION EXTENSION EARLY DELIVERY OPTIONS IN FORWARD CONTRACTS DELTA ONE CANCELLATION EXTENSION EARLY DELIVERY Q-I S.B.I. has booked a forward purchase contract for USD 1,00,000 due 14th March, 2003 @ Rs. 48.25. On maturity, the customer fails to deliver the dollars and requests for cancellation of the contract. Spot rate on 14th March,2003 USD = Rs. 48.6525/Rs. 48.7325. What amount of gain/loss will be payable to/receivable from customer? Q-2 A sum of £ GBP 73,500 is due from a sheffield customer on March 1 Accordingly you arrange to enter into a forward contract at Rs. 74.22 =1 £ you hear on February 27 that the payment will be delayed by 2 months until May 1.The spot rate for march 1 Rs. 74.35 - 50 and that 2 months forward are quoted at Rs. 74.25 - 38 Determine, the cost if any of rollover. Q-3 You are working for a bank,Your bank entered into forward contract with the customer for purchase of US D 500,000 delivery 30 September; contract rate Rs. 40.000. ON 1 July the customer approached the bank with delivery of US D 500,000 which were delivered against the forward contract. On this date the rates were as follows : Spot 41.28 - 41.33 Forward 30 September 41.80 - 41.89 It accepts deposits for 3 months @ 8% per annum. What amount of loss/gain will be receivable from/payable of customer? Q-4 Consider the following INR/SGD direct quote of ICICI Mumbai : 26.50 - 26.75 (a) What is the cost of buying Rs. 55,000? (b) How much would you receive by selling 92,000 rupees? (c) What is the cost of buying SGD 7,450? (d) What is your receipt if you sell SGD 18,340? Q-5 The spot rate for € is Rs.50-52. the forward rate is 53-56. Compute swap points, spot and forward spreads. Q-6 Spot 1 $ = Rs. 46.00 / 46.10 1 month forward = .10 /.11 2 month forward = .12 / .13 3month forward = .14 / .15 Calculate 1 month, 2 months and 3 months forward rates. Q-7 The following information pertains to exchange rates quoted in London for spot and forward. Currency Spot Swap points Swap points 1- months forward 3- months forward Canadian dollar 1.8640 - 8650 40 - 30 c dis 0.90 - 80 dis Euro 1.4468 - 72 10 - 20 c prem 45 - 55 prem US $ 1.5865 - 70 20 - 30 prem 25 - 35 prem Calcualte the cost or value in sterling to customer, who wishes to (a) Sell Canadian dollars 19,200 spot. (b) Buy Euro 34,250 one month forward. (c) Sell US $ 93,750 three months forward. Q-8 The spot Danish Krone rate is $0.15986 and the three month forward rate is $0.1590. The three month treasury bill rate in the United States is 6.25% p.a. and in Denmark 7.50% p.a. (i) Calculate forward premium or discount on Danish Krone. (ii) Are the forward rates and interest rate in equilibrium? (iii) Work out the forward rate if the forward premium or discount are not in equilibrium.] Q-9 Assuming no transaction costs, suppose £ 1 = $2.4110 in New York,$ 1 = FF3. 997 in Paris, and FF 1 = £ 0.1088 in London. How would you take profitable advantage if you had £ 50.000? Q-10 Management of an Indian company is contemplating to import a machine from USA at a cost of US$ 15,000 at today’s spot rate of $ 0.0227272 per Rupee. Finance manager opines that in the present foreign exchange market scenario, the exchange rate may shoot up by 10% after two months and accordingly he proposes to defer import of machine. Management thinks that deferring import of machine will cause a loss of Rs.50,000 to the company in the coming two months. THANK YOU