CHAPTER 7

advertisement

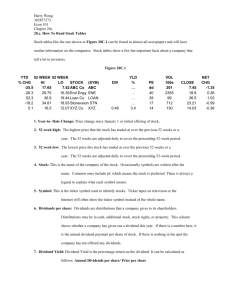

CHAPTER 7 EQUITY MARKETS AND STOCK VALUATION CHAPTER 7 QUIZ CHAPTER ORGANIZATION 7.1 Common Stock Valuation - FinSim Cash Flows Stock valuation is more difficult than bond valuation because the cash flows are uncertain, the life is forever, and the required rate of return is unobservable. The cash flows to stockholders consist of dividends plus a future sale price. Let P0 be the current price of the stock, and assign P1 to be the price in one period. If D1 is the cash dividend paid at the end of the period, then: P0 = (D1 + P1) / (1 + R)1 However, the future sale price depends on the dividends paid after that point. Therefore, you can illustrate that the current stock price is ultimately the present value of all expected future dividends discounted at a rate (R) appropriate to the riskiness of the cash flows: P0 D1 D2 D3 D4 D5 Dinfinity ... 1 2 3 4 5 (1 R) (1 R) (1 R) (1 R) (1 R) (1 R) infinity Growth Stocks You might be wondering about shares of stock in companies such as eBay that currently pay no dividends. Small, growing companies frequently plow back everything and thus pay no dividends. Are such shares worth nothing? It depends. When we say that the value of the stock is equal to the present value of the future dividends, we don't rule out the possibility that some number of those dividends are zero. They just can't all be zero. Imagine a company that has a provision in its corporate charter that prohibits the paying of dividends now or ever. The corporation never borrows any money, never pays out any money to stockholders in any form whatsoever, and never Prepared by Jim Keys 1 sells any assets. Such a corporation couldn't really exist because the IRS wouldn't like it; and the stockholders could always vote to amend the charter if they wanted to. If it did exist, however, what would the stock be worth? The stock would be worth absolutely nothing. Such a company is a financial “black hole.” Money goes in, but nothing valuable ever comes out. Because nobody would ever get any return on this investment, the investment has no value. This example is a little absurd, but it illustrates that when we speak of companies that don't pay dividends, what we really mean is that they are not currently paying dividends. Some Special Cases - There are a few very useful special circumstances under which we can come up with a value for the stock. What we have to do is make some simplifying assumptions about the pattern of future dividends, that is, the forecasted growth rate for dividends. Zero Growth: A share of common stock in a company with a constant dividend is much like a share of preferred stock. The dividend on a share of preferred stock has zero growth and thus is constant through time. For a zero growth share of common stock, this implies that: D0 = D1 = D2 … = D∞ Therefore, the value of the stock is: P0 D D D D D D ... 1 2 3 4 5 (1 R) (1 R) (1 R) (1 R) (1 R) (1 R) infinity Because the dividend is always the same, the stock can be viewed as an ordinary perpetuity with a cash flow equal to D every period. The per-share value is thus given by: P0 = D / R where R is the required return. Example: Suppose a stock is expected to pay a $2 dividend each period, forever, and the required return is 10%. What is the stock worth? P0 = 2 / .10 = $20 Gesto, Inc., has an issue of preferred stock outstanding that pays a $5 dividend every year, in perpetuity. If this issue currently sells for $84.12 per share, what is the required return? R = D / P0 R = $5 / $84.12 = .0594 = 5.94% Constant Growth: Suppose we know that the dividend for some company always grows at a steady rate. Call this growth rate g. If we let D0 be the dividend just paid, then the next dividend, D1, is: D1 = D0(1+g); D2 = D1(1+g); in general Dt = D0(1+g)t Note: this is the same as the future value formula. Prepared by Jim Keys 2 Example: If the current dividend is $2.00 and the expected growth rate is 4%, what is D1? D5? D1 = $2.00(1+.04) = $2.08 D5 = $2.00(1+.04)5 = $2.43 Note: Only D0, the last actual or current dividend, is known with certainty. D1, D2, D3, etc., are all expected values based upon your estimate of g. If the dividend grows at a steady rate, then we have replaced the problem of forecasting an infinite number of future dividends with the problem of coming up with a single growth rate, a considerable simplification. In this case, if we take D0 to be the dividend just paid and g to be the constant growth rate, the value of a share of stock can be written as: As long as the growth rate, g, is less than the discount rate, R, the present value of this series of cash flows can be written very simply as: This dividend growth model, also referred to as the constant growth model, dividend discount model, or the Gordon model, is used to find the value of a stock whose dividend is expected to grow at a constant rate (g) forever. The other basic assumption for the model to hold requires R > g. The value obtained, P0, is the “theoretical” or “intrinsic” value of the stock We would then compare this value to the actual price of the stock observed in the market. We can actually use the dividend growth model to get the stock price at any point in time, not just today. In general, the price of the stock as of time t is: Example: Consider the stock given above. If the required return is 10%, what is the expected price today? In 4 years? P0 = D1 / (R – g) = $2.00(1.05)1 / (.10 - .05) = $2.10 / .05 = $42.00 P4 = D5 / (R – g) = $2.00(1.05)5 / (.10 - .05) = $2.552563 / .05 = $51.05 “How can g ever be assumed to be constant?” The answer lies in the competitive equilibrium model of classical macroeconomics. Since g represents not only the growth rate in dividends but also in earnings and sales, assuming no change in the firm’s cost structure, we are simply assuming that the product market the firm operates in “settles down” to a steady state in which competing firms earn sufficient returns to remain in business, but not large enough to attract outside capital. From a more practical standpoint, firms will often Prepared by Jim Keys 3 attempt to manage their dividend policy so that there is a reasonably constant growth in dividends. “Why do we assume that R > g?” At least two answers are possible. First, R may be less than g in the short-run. The supernormal growth problem is an example of this situation. Second, in equilibrium, high returns on investment will attract capital, which, in the absence of technological change, will ensure that in succeeding periods, higher returns cannot be earned without taking greater risk. But taking greater risk will increase R, so g cannot be increased without raising R. Banya, Inc., just paid a dividend of $2.20 per share on its stock. The dividends are expected to grow at a constant rate of 4 percent per year, indefinitely. If investors require an 11 percent return on Banya stock, what is the current price? What will the price be in three years? In 15 years? The constant dividend growth model is: Pt = Dt × (1 + g) / (R – g) So, the price of the stock today is: P0 = D0 (1 + g) / (R – g) P0 = $2.20 (1.04) / (.11 – .04) P0 = $32.69 The dividend at year 4 is the dividend today times the FVIF for the growth rate in dividends and four years, so: P3 = D3 (1 + g) / (R – g) P3 = D0 (1 + g)4 / (R – g) P3 = $2.20 (1.04)4 / (.11 – .04) P3 = $36.77 We can do the same thing to find the dividend in Year 16, which gives us the price in Year 15, so: P15 = D15 (1 + g) / (R – g) P15 = D0 (1 + g)16 / (R – g) P15 = $2.20 (1.04)16 / (.11 – .04) P15 = $58.87 There is another feature of the constant dividend growth model: The stock price grows at the dividend growth rate. So, if we know the stock price today, we can find the future value for any time in the future we want to calculate the stock price. In this problem, we want to know the stock price in three years, and we have already calculated the stock price today. The stock price in three years will be: P3 = P0(1 + g)3 P3 = $32.69(1 + .04)3 P3 = $36.77 And the stock price in 15 years will be: P15 = P0(1 + g)15 P15 = $32.69(1 + .04)15 P15 = $58.87 Prepared by Jim Keys 4 The next dividend payment by Carroll, Inc., will be $1.90 per share. The dividends are anticipated to maintain a 5.5 percent growth rate, forever. If the stock currently sells for $47.00 per share, what is the required return? R = (D1 / P0) + g R = ($1.90 / $47.00) + .055 R = .0954 or 9.54% Antiques ‘R’ Us is a mature manufacturing firm. The company just paid a $7 dividend, but management expects to reduce the payout by 5 percent per year, indefinitely. If you require a 10 percent return on this stock, what will you pay for a share today? The constant growth model can be applied even if the dividends are declining by a constant percentage, just make sure to recognize the negative growth. So, the price of the stock today will be: P0 = D0 (1 + g) / (R – g) P0 = $7.00(1 – .05) / [(.10 – (–.05)] P0 = $6.65 / .15 P0 = $44.33 Barnard Corp. will pay a dividend of $3.05 next year. The company has stated that it will maintain a constant growth rate of 5 percent a year forever. If you want a 15 percent rate of return, how much will you pay for the stock? What if you want a 10 percent rate of return? What does this tell you about the relationship between the required return and the stock price? Here, we need to value a stock with two different required returns. Using the constant growth model and a required return of 15 percent, the stock price today is: P0 = D1 / (R – g) P0 = $3.05 / (.15 – .05) P0 = $30.50 And the stock price today with a 10 percent return will be: P0 = D1 / (R – g) P0 = $3.05 / (.10 – .05) P0 = $61.00 All else held constant, a higher required return means that the stock will sell for a lower price. Also, notice that the stock price is very sensitive to the required return. In this case, the required return fell by 1/3 but the stock price doubled. Prepared by Jim Keys 5 Nonconstant Growth: The main reason to consider this case is to allow for “supernormal” growth rates over some finite length of time. As we know, the growth rate cannot exceed the required return indefinitely, but it certainly could do so for some number of years. To avoid the problem of having to forecast and discount an infinite number of dividends, we will require that the dividends start growing at a constant rate sometime in the future. Common Stock Valuation under Supernormal Growth (two-stage growth) D (1 g s ) 1 g s P0 0 1 (R g s ) 1 R Ns D 0 (1 g s ) Ns (1 g n ) (1 R) Ns R g n P0 = Intrinsic or theoretical value of the stock D0 = The dollar amount of the last actual dividend on the stock R = Required rate of return on the stock gn = Expected constant growth rate of the dividends on the stock gs = Expected supernormal growth rate of the dividends on the stock Ns = Number of years of initial (supernormal) growth Through the Glass Corp. is growing quickly. Dividends are expected to grow at a 20 percent rate for the next three years, with the growth rate falling off to a constant 6 percent thereafter. If the required return is 13 percent and the company just paid a $3.05 dividend, what is the current share price? With supernormal dividends, we find the price of the stock when the dividends level off at a constant growth rate, and then find the present value of the future stock price, plus the present value of all dividends during the supernormal growth period. The stock begins constant growth after the third dividend is paid, so we can find the price of the stock in Year 3, when the constant dividend growth begins as: P3 = D3 (1 + g) / (R – g) P3 = D0 (1 + g1)3 (1 + g2) / (R – g) P3 = $3.05(1.20)3(1.06) / (.13 – .06) P3 = $79.81 The price of the stock today is the present value of the first three dividends, plus the present value of the Year 3 stock price. The price of the stock today will be: P0 = $3.05(1.20) / 1.13 + $3.05(1.20)2 / 1.132 + $3.05(1.20)3 / 1.133 + $79.81 / 1.133 = $65.64 Alternatively, using the equation above: P0 D0 (1 g s ) 1 g s 1 (R g s ) 1 R P0 Ns $3.05(1.20) 1.20 1 (.13 .20) 1.13 D 0 (1 g s ) Ns (1 g n ) (1 R) Ns R g n 3 $3.05(1.20)3 (1.06) (1.13) 3 .13 - .06 Prepared by Jim Keys 6 P0 = -52.2857(-.19759068) + $79.8089(.69305) P0 = $10.33117 + $55.31158 = $65.64 Use the calculator found at Corporate Finance Live: Components of the Required Return Rearrange P0 = D1 / (R – g) to find R: R = (D1 / P0 ) + g D1 / P0 = Dividend yield g = Capital gains yield R = dividend yield + capital gains yield Prepared by Jim Keys 7 The next dividend payment by Carroll, Inc., will be $1.90 per share. The dividends are anticipated to maintain a 5.5 percent growth rate, forever. If the stock currently sells for $47.00 per share, what is the dividend yield? What is the expected capital gains yield? The dividend yield is the dividend next year divided by the current price, so the dividend yield is: Dividend yield = D1 / P0 Dividend yield = $1.90 / $47.00 Dividend yield = .0404 or 4.04% The capital gains yield, or percentage increase in the stock price, is the same as the dividend growth rate, so: Capital gains yield = 5.5% The total (expected) return on the stock: R = D1 / P0 + g = 4.04% + 5.50% = 9.54% 7.2 Some Features of Common and Preferred Stocks Common Stock Features - Shareholders have the right to elect corporate directors who set corporate policy and select operating management. Large institutions, such as mutual funds and pension funds, used to remain on the sidelines when it came to corporate control. However, several institutions have become much more active in recent years and have worked to force companies to operate in the shareholders best interests. CaPERS, the pension plan for California public employees, has been at the forefront of the corporate governance movement. Management for the fund takes their job as “shareowners” so seriously that they have a section of their web site devoted to corporate governance issues. For more information, see http://www.calpers-governance.org/forumhome.asp. 1. Cumulative voting – when the directors are all elected at once. Total votes that each shareholder may cast equals the number of shares times the number of directors to be elected. In general, if N directors are to be elected, it takes 1 / (N+1) percent of the stock + 1 share to assure a deciding vote for one directorship. Good for getting minority shareholder representation on the board. 2. Straight (majority) voting – the directors are elected one at a time, and every share gets one vote. Good for freezing out minority shareholders. 3. Staggered elections – directors’ terms are rotated so they aren’t elected at the same time. This makes it harder for a minority to elect a director and complicates takeovers. 4. Proxy voting – grant of authority by a shareholder to someone else to vote his or her shares. A proxy fight is a struggle between management and outsiders for control of the board, waged by soliciting shareholders’ proxies. Prepared by Jim Keys 8 Consideration of Carl Icahn’s attempt to gain control of Texaco via a 1988 proxy fight indicates that proxy fights need not be “successful” to benefit shareholders. Icahn amassed a 14% stake in the firm and offered to buy the remainder for $12.4 billion. Rebuffed by management, he launched a proxy fight that he ultimately lost, in large part because management was able to mount a successful public-relations campaign that convinced shareholders that Icahn’s offer was not in their best interests. Nonetheless, as a result of Icahn’s actions, management undertook a massive restructuring program that included a drastic reduction in the firm’s debt load, significantly reduced exploration costs, and the divestiture of assets worth $5 billion. Management’s efforts were so well received in the financial markets that Icahn stated in 1991: “Since the proxy fight, [management] woke up. I wish to hell I’d kept the stock.” After successfully completing your corporate finance class, you feel the next challenge ahead is to serve on the board of directors of Cornwall Enterprises. Unfortunately you will be the only individual voting for you. If Cornwall has 300,000 shares outstanding and the stock currently sells for $63, how much will it cost you to buy a seat if the company uses straight voting? Assume that Cornwall uses cumulative voting and there are four seats in the current election; how much will it cost you to buy a seat now? If the company uses straight voting, the board of directors is elected one at a time. You will need to own one-half of the shares, plus one share, in order to guarantee enough votes to win the election. So, the number of shares needed to guarantee election under straight voting will be: Shares needed = (300,000 shares / 2) + 1 Shares needed = 150,001 And the total cost to you will be the shares needed times the price per share, or: Total cost = 150,001 $63 Total cost = $9,450,063 If the company uses cumulative voting, the board of directors are all elected at once. You will need 1/(N + 1) percent of the stock (plus one share) to guarantee election, where N is the number of seats up for election. So, the percentage of the company’s stock you need will be: Percent of stock needed = 1 / (N + 1) Percent of stock needed = 1 / (4 + 1) Percent of stock needed = .20 or 20% So, the number of shares you need to purchase is: Number of shares to purchase = (300,000 × .20) + 1 Number of shares to purchase = 60,001 And the total cost to you will be the shares needed times the price per share, or: Total cost = 60,001 $63 Total cost = $3,780,063 Prepared by Jim Keys 9 Some firms have more than one class of common stock. Often, the classes are created with unequal voting rights. The Ford Motor Company, for example, has Class B common stock, which is not publicly traded (it is held by Ford family interests and trusts). This class has about 40 percent of the voting power, even though it represents less than 10 percent of the total number of shares outstanding. Other rights usually include: 1. Sharing proportionately in dividends paid 2. Sharing proportionately in any liquidation value 3. Voting on matters of importance (e.g., mergers) 4. The right to purchase any new stock sold – the preemptive right Dividends – return on shareholder capital. 1. Payment of dividends is at the discretion of the board. A firm cannot default on an undeclared dividend, nor be forced to file for bankruptcy because of nonpayment of dividends. 2. Dividends are not tax deductible for the paying firm. 3. Dividends received by individuals are usually considered ordinary income, while dividends received by a corporation are at least 70% tax-exempt. Preferred Stock Features Preferred stock has precedence over common stock in the payment of dividends and in liquidation. Its dividend is usually fixed and the stock is often without voting rights. The stated value is the value paid to preferred stockholders in the event of liquidation. Cumulative dividends – current preferred dividend plus all arrearages (unpaid dividends) to be paid before common stock dividends can be paid. Non-cumulative dividend preferred does not have this feature. 7.3 The Stock Markets Dealers and Brokers Primary market – the market in which new securities are originally sold to investors Secondary market – market in which existing securities trade among investors Broker – one who arranges security transactions among investors Dealer – one who buys and sells security from inventory Bid price – the price at which a dealer is willing to buy a security Ask price – the price at which a dealer is willing to sell a security Spread – the difference between the bid and ask price Organization of the NYSE Exchange member – the owner of a seat on the NYSE. Prepared by Jim Keys 10 Commission brokers – those who execute customer orders to buy and sell stock on the floor of the exchange Specialist – NYSE member who acts as a dealer on the exchange floor, often called a market maker Floor brokers – NYSE members who execute orders for commission brokers on a fee basis SuperDOT – electronic NYSE system allowing orders to be transmitted directly to the specialist Floor Traders – those who trade for their own accounts, trying to anticipate and profit from temporary price fluctuations Order flow – the flow of customer orders to buy and sell securities Specialist’s post – fixed place on the exchange floor where the specialist operates Trading in the crowd – trading that occurs directly between brokers around the specialist’s post The role of the specialist is an interesting one. He is entrusted with the knowledge of pending buy and sell orders (in other words, he knows the shapes of the market supply and demand curves) for the stock he deals in, and he is to provide liquidity and continuity in pricing by buying when the market is selling and selling when the market is buying. Interestingly, while studies performed in the early 1970s indicated that specialists were able to earn excess returns, studies of the crash of 1987 suggest that specialists were unable (and, in some cases, unwilling) to buy as the market crashed on October 19th. And in the April 24, 1998 issue of Money Daily, John Gutfreund, former Salomon Brothers CEO states that he “is not certain that the obligation of the market markers is to anyone other than themselves.” For these reasons, among others, some who study markets question the efficacy of the specialist system. NASDAQ Operations NYSE operations represent a premier example of the trading of “listed” securities. Nasdaq operations, on the other hand, represent the evolution of “over-the-counter” trading of securities that does not rely on a physical market place. Nasdaq – National Association of Securities Dealers Automated Quotation system – computer network of securities dealers who disseminate timely security price quotes to Nasdaq subscribers. ECN – electronic communications network; website that allows trading directly between investors without using either a dealer or a broker Stock Market Reporting – Current quote for Harley-Davidson, Inc.: Yahoo! Finance – Current quote for Harley-Davidson, Inc.: MSN.com Prepared by Jim Keys 11