Chapter 5: risk and return

advertisement

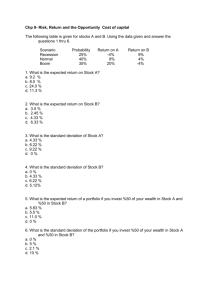

Chapter 5: risk and return•Study objectives –Defining risk and return –Using probability distributions to measure risk –Attitudes toward risk –Risk and return in a portfolio context –Diversification –The Capital-Asset Pricing Model –Efficient Financial Market1.Defining Risk and Return•The return from holding an investment over some period is simply any cash payments received due to ownership, plus the change in market price, divided by beginning price •R=[Dt+(Pt-Pt-1)]/PT-1 •Risk: the variability of returns from those that are expected •Treasury bill corporate bond common stock • risk 2.Using probability distribution to measure risk•Probability distribution: a set of possible values that a random variable can assume and their associated probabilities of occurrence •Why we use probability distributions to measure risk? 2.1Expected return and standard deviation•Expected return: the weighted average of possible returns, with the weights being the probabilities of occurrence n R ( Ri )( Pi ) i 1 n (R R ) (P ) 2 i 1 i i •Standard deviation is the square root of the variance 2.2Use of standard deviation information•Assume that we are facing a normal probability distribution of returns. It is symmetrical and bell-shaped –68% of the distribution falls within one standard deviation (right or left) of the expected return –95% falls within 2 standard deviations; –over 99% falls within 3 standard deviations 2.2The use of standard deviation•It can serve as an absolute measure of return variability---the higher the standard deviation, the greater the uncertainty concerning the actual outcome •We can use it to determine the likelihood that an actual outcome will be greater or less than a particular amount Example•Assume that the return distribution of an investment project is approximately normal with an expected return equal to 9% and a standard deviation of 8.38%. What is the probability that the actual future return will be less than zero • First, determine how many standard deviations 0% is from the mean (9%). Z=(0-0.09)/0.0838=-1.07 •Turning to Appendix Table 5 we can see that the probability 2.3Coefficient of variation•The standard deviation can sometimes be misleading in comparing the risk of projects of different size Investment A Investment B Expected return 0.08 0.24 Standard deviation 0.06 0.08 Coefficient of variation 0.75 0.33 2.3Coefficient of variation•Can we conclude that because the standard deviation of B is larger than that of A, it is the riskier investment? •Relative to the size of expected return, investment A has greater variation •To adjust for the size problem, the standard deviation can be divided by the expected return 3.Attitude toward risk•Most people (except gamblers) are risk averse, so in this book we will take the assumption of risk aversion 4.Risk and return in a portfolio context•Portfolio: a combination of two or more securities or assets •Investors rarely place their entire wealth into a single asset or investment (risky). Rather, they construct portfolio or group of investment 4.1Portfolio return•The expected return of a portfolio is simply a weighted average of the expected return of the securities comprising that portfolio •The weights are equal to the portfolio of total funds invested in each security m R mw j mR j pp j 1 w j wk jk j 1 k 1 4.2Portfolio risk and the importance of covarianceAssume that the portfolio has m securities, what is the standard deviation of a probability distribution of possible portfolio returns?•Covariance is a statistical measure of the degree to which two variables move together jk j k Corrjk ( R ji R j )( Rki Rk ) Pi The mathematical meaning of covariance•Positive covariance shows that, on average, the two variables move together •Zero covariance means that the two variables show no tendency to vary together in either a positive or negative linear fashion •Negative covariance suggest that, on average, the two variables move in opposite directions j k Corrjk j k •Covariance between securities provides for the possibility of eliminating some risk without reducing potential returnExample State of the economy Boom Probability of state 0.3 Rate of return of HI Rate of return of AC 60% 25% Normal Recession •After calculation we know that the expected rate of return for HI and AC is 20% and 15% respectively, and the standard deviation is 30.98% and 7.75% respectively. • The covariance of HI and AC is 0.3(0.6-0.2)(0.25-0.15) +0.4(0.2-0.2)(0.15-0.15)+0.3(-0.2-0.2)(0.05-0.15)=0.012+0+0.012=0.024 • If Mr. Brown spends his money on the two securities evenly, what is the expected return and standard deviation for his portfolio? p 0.52 0.30982 0.52 0.07752 2 0.52 0.024 0.1936 •Expected return=0.5×0.2+0.5×0.15=0.1+0.075=17.5%5.Types of risk•Why shall we classify risk of a company? Because companies can take different measures to deal with different types of risk •It is helpful to group the major source of risk into four categories: general economic risk, inflation and disinflation risk, firm-specific risk, international risk5.1General economic risk•The general economic conditions that affect the operation of business. •The prospect of a recession affects most firms. •Also at work are the monetary and fiscal policies of government, tax adjustment, transfer payments 5.2Inflation and disinflation risk•For business, inflation causes increased uncertainty about pricing policies, financing costs, and costs of labor and material •When firms become accustomed to inflation, disinflation may also be a source of risk. This has been particularly true in the recent years in China as some firms have found that when price level drops dramatically few firms make profits 5.3Firm-specific risk•For convenience, we break this down further into two categories: business risk, financial risk •The general market the firm operates in is a source of risk (business risk). The technological stage of development of the industry, the competition and the degree of fixed versus variable cost of production, and sales and marketing techniques all influence the amount of risk to which a firm is exposed to. Financial risk is the risk when a firm borrow much money from outsiders and when business operation is not in good state, the firm cannot afford to pay the fixed interest and principal due.5.4 International risk•When firms operate in other countries or regions, or export their product, or import materials from outside, they face international risk, such as the fluctuation of exchange rate, international trade policies and other factors 5.5 Systematic and unsystematic risk•Systematic risk is the variability of return on stocks or portfolios associated with changes in return on the market as a whole. •Systematic risk is due to risk factors that affect the overall market---general economic risk and inflation and disinflation risk •Unsystematic risk is risk unique to a particular company or industry; it is independent of economic, political, and other factors that affect all securities in a systematic manner •For most stocks, unsystematic risk accounts for around 50% of the stock’s total risk •As the number of randomly selected stocks held in the portfolio is increased, the total risk of the portfolio is reduced (see figure 5-3 page 102) •The important risk of a stock is its unavoidable or systematic risk. Investors can expect to be compensated for bearing this systematic risk6. Diversification•Diversification is to spread risk across a number of assets or investments •Meaningful diversification is not investing evenly across different securities. Rather, investing in securities that are not perfectly, positively correlated is the best measure to diversify risk. Why? Covariance<σaσb •Figure 5-2 (page 101) effect of diversification on portfolio risk7. The Capital-Asset Pricing Model•Based on the behavior of risk-averse investors, there is an implied equilibrium relation between risk and expected return for each security. •In a market equilibrium, a security is supposed to provide an expected return commensurate with its systematic risk. The greater the systematic risk of a security, the greater the return that investors will expect from the security •This relationship is described in detail in the CAPM7.1The assumption of the Capital-Asset Pricing Model•Capital markets are efficient in that investors are well informed, transactions costs are low, there are negligible restrictions on investment, and no investor is larger enough to affect the market price of a stock •Investors are in general agreement about the likely performance of individual securities and that their expectations are based on a common holding period, say, one year.7.2 The composition of the market•There are two types of investment opportunities with which we will be concerned. –The first is a risk-free security whose return over the holding period is known with certainty. –The second is the market portfolio of common stocks. It is represented by all available common stocks and weighted according to their total aggregate market values outstanding 7.3 The deduction of the CAPM•Because one cannot hold a more diversified portfolio than the market portfolio, it represent the limit to attainable diversification. •Thus, all the risk associated with the market portfolio is unavoidable, or systematic 7.4The characteristic line•Suppose that a security’s expected return is related to its risk, so the comparison of any two securities can be replaced by the comparison of expected return of the two securities • The characteristic line offers a tool for comparison of expected return of securities. A characteristic line is a line that describes the relationship between an individual security’s returns and returns on the market portfolio. The slope of this line is beta7.5 How to draw the characteristic line?•The expected relationship may be based on past experience, in which case actual excess returns for the stock and for the market portfolio would be plotted on the graph, and a regression line best characterizing the historical relationship would be drawn •Figure 5-4 the drawing of characteristic line 7.6 Beta: an index of systematic risk•Beta is simply the slope of the characteristic line •Beta is an index of systematic risk (why). It measures the sensitivity of a stock’s return to changes in returns on the market portfolio. •The beta of a portfolio is simply a weighted average of the individual stock beta in the portfolio •The greater the slope of the characteristic line for a stock, the greater its systematic (figure 5-5 page 105) 7.7 How is unsystematic risk expressed?•See figure 5-4 (page 104). The dispersion of the data point about the characteristic line is a measure of the unsystematic risk of the stock •The wider the relative distance of the points from the line, the greater the unsystematic risk of the stocks (this is to say that the stock’s return has increasingly lower correlation with the return on the market portfolio 7.8 Required rates of return and the Security Market Line•The greater the beta of a stock, the greater the relevant risk of that stock, and the greater the return required. R j R f ( Rm R f ) j •Assume that unsystematic risk is diversified away, the required rate of return for a stock j is:This is called CAPMExample•Assume that the expected return on Treasury securities (risk free) is 8%, the expected return on the market portfolio is 13%, and the beta of Savance Corporation is 1.3. Given this information and using CAPM, we find that the return on Savance stock would be: 0.08+(0.13-0.08) ×1.3=14.5% 7.9 Security market line•Security market line is a line that describes the linear relationship between expected rates of return for individual securities (and portfolios) and systematic risk, as measured by beta. •What is the difference between security market line and the characteristic line? •Figure 5-6 page 107Returns and stock price•The CAPM provides us a means to estimate the required rate of return on a security. This return can then be used as the discount rate in a dividend valuation model (why). •Underpriced and overpriced stocks: in market equilibrium the required rate of return on a stock equals its expected return. What happens when this is not so? Underpriced and overpriced stocks. See figure 5-7 page 110 Challenges to the CAPM•The CAPM is based on several assumptions, and such market imperfections as bankruptcy cost, taxes, and institutional restraints have demolished the foundations of CAPM •Anomalies of small firm and price/earnings •It has been found that common stocks of firms with small market capitalizations provide higher returns than common stocks of firms with high capitalization • Common stocks with low price/earnings and market-to-book-value ratios do better than commons stocks with high ratios Fama and French study•“Beta is dead!” said Fama. Testing stock returns over the 1963-1990 period, they found that the size and market-to-book-value variables are powerful predictors of average stock return. When these variables were used first in a regression analysis, the added beta variable was found to have little additional explanatory power •No theoretical foundations is offered for the findings they discovered. And though beta may not be a good indicator of the returns to be realized from investing in common stocks, beta remains a reasonable measure of risk 8.Efficient financial markets•An efficient financial market exists when security prices reflect all available public information about the economy, about the financial markets, and about the specific company involved •Why it is important? Without it the characteristic line is meaningless. An agreed price does not exist, and a third risk---information risk Three forms of market efficiency•Eugene Fama, a pioneer in efficient markets research, has described three levels to market efficiency: •Weak-form efficiency: current prices fully reflect the historical sequence of prices. In short, knowing past price patterns will not help you improve your forecast of future prices •Semistrong-form efficiency: current prices fully reflect all publically available information, including such things as annual reports and news items •Strong form efficiency: current prices fully reflect all information, both public and private •Unfortunately, Chinese capital market is considered to be weak form efficiency, and even American capital market is only semi-strong efficient. Why? Does market efficient always hold?•Market efficient does not always hold, because we know that stock market levels tend to increase over time in relatively small increments, but when they decline it is often with a vengeance. •Why? A feasible explanation is rational expectation assumption •Perhaps these anomalies are merely the result of an inadequate measurement of risk. There is still a long way to go.