Chapter 6-Problem 2: The return expected from Project

advertisement

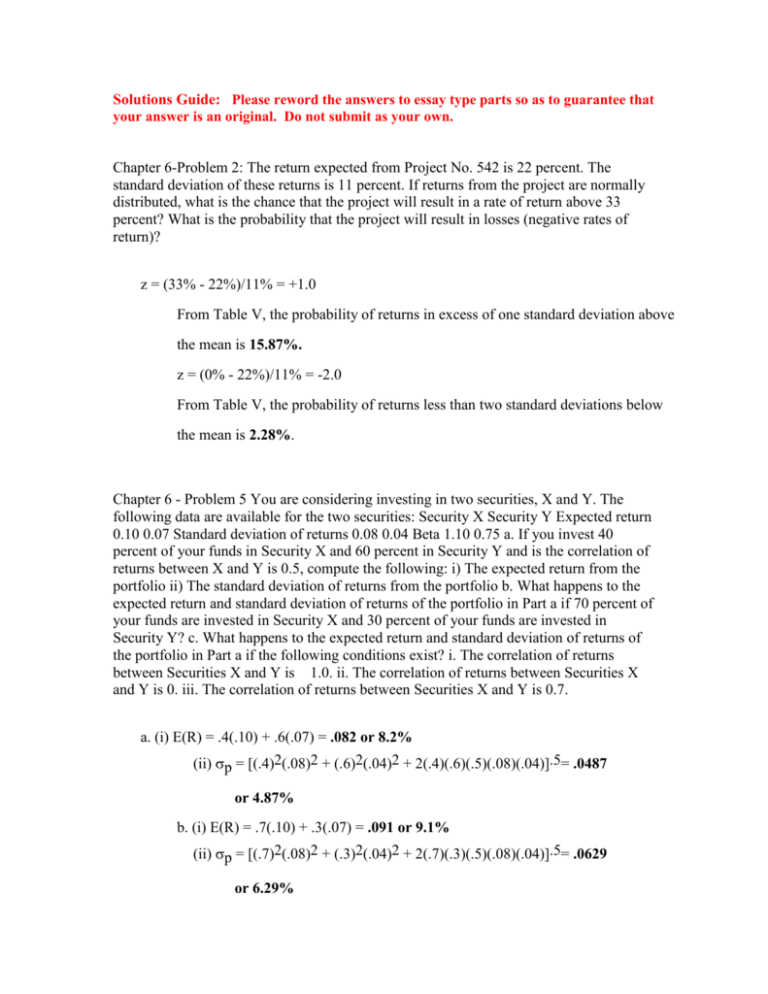

Solutions Guide: Please reword the answers to essay type parts so as to guarantee that your answer is an original. Do not submit as your own. Chapter 6-Problem 2: The return expected from Project No. 542 is 22 percent. The standard deviation of these returns is 11 percent. If returns from the project are normally distributed, what is the chance that the project will result in a rate of return above 33 percent? What is the probability that the project will result in losses (negative rates of return)? z = (33% - 22%)/11% = +1.0 From Table V, the probability of returns in excess of one standard deviation above the mean is 15.87%. z = (0% - 22%)/11% = -2.0 From Table V, the probability of returns less than two standard deviations below the mean is 2.28%. Chapter 6 - Problem 5 You are considering investing in two securities, X and Y. The following data are available for the two securities: Security X Security Y Expected return 0.10 0.07 Standard deviation of returns 0.08 0.04 Beta 1.10 0.75 a. If you invest 40 percent of your funds in Security X and 60 percent in Security Y and is the correlation of returns between X and Y is 0.5, compute the following: i) The expected return from the portfolio ii) The standard deviation of returns from the portfolio b. What happens to the expected return and standard deviation of returns of the portfolio in Part a if 70 percent of your funds are invested in Security X and 30 percent of your funds are invested in Security Y? c. What happens to the expected return and standard deviation of returns of the portfolio in Part a if the following conditions exist? i. The correlation of returns between Securities X and Y is 1.0. ii. The correlation of returns between Securities X and Y is 0. iii. The correlation of returns between Securities X and Y is 0.7. a. (i) E(R) = .4(.10) + .6(.07) = .082 or 8.2% (ii) p = [(.4)2(.08)2 + (.6)2(.04)2 + 2(.4)(.6)(.5)(.08)(.04)].5= .0487 or 4.87% b. (i) E(R) = .7(.10) + .3(.07) = .091 or 9.1% (ii) p = [(.7)2(.08)2 + (.3)2(.04)2 + 2(.7)(.3)(.5)(.08)(.04)].5= .0629 or 6.29% c. Expected returns remain the same. They do not depend on the correlation of returns among securities. (i) xy = +1; p = .056 or 5.6% (by substituting +1 for + 0.5 in part 6. a. (ii) above. (ii) xy = 0; p = .04 or 4% (iii) xy = -.7; p = .023 or 2.3% Chapter 6-Problem 6 You have the following information on two securities in which you have invested: Security Expected Return Standard Deviation Beta Percent Invested (W) Xerox 15% 4.50% 1.2 35% Kodak 12% 3.8 0.98 65% a. Which stock is riskier in a portfolio context? Which stock is riskier if you are considering them as individual assets (not part of a portfolio)? b. Compute the expected return on the portfolio. c. If the securities have a correlation of 0.60, compute the standard deviation of the portfolio. d. Compute the beta of the portfolio. a. From a portfolio risk perspective, Xerox would be considered the riskier stock because it has a larger beta (1.2) than Kodak (0.98). When considering each stock individually, a measure of total risk (adjusted for relative magnitudes of expected returns) is appropriate. This measure would be the coefficient of variation. The coefficient of variation for Xerox is 0.30 (4.5%/15%). The coefficient of variation for Kodak is 0.32 (3.8%/12%), indicating that Kodak is the riskier of the two securities. b. E(R) = .35(15%) + .65(12%) = 13.05% c. p = [(.35)2(4.5%)2 + (.65)2(3.8%)2 + 2(.35)(.65)(.6)(4.5%)(3.8%)].5 = 3.64% d. p = .35(1.2) + .65(.98) = 1.06 Chapter 6-Problem 11 Using Equation 6.17, suppose you have computed the required rate of return for the stock of Bulldog Trucking to be 16.6 percent. Given the current stock price, the current dividend rate, and analysts’ projections for future dividend growth, you expect to earn a rate of return of 18 percent. a. Would you recommend buying or selling this stock? Why? b. If your expected rate of return from the stock of Bulldog is 15 percent, what would you expect to happen to Bulldog’s stock price? a. Because the expected return exceeds the required return, Bulldog's stock should be purchased (because the stock price can be expected to increase.) b. If the expected return were less than the required return, the stock price could be expected to decline. Chapter 6-Problem 19 The current (time zero) price of one share of Farrell Corporation’s common stock is $25. Th e price is expected to increase by $5 over the coming year. The company is not expected to pay a dividend during the year. The standard deviation of the expected price change is $3. The distribution of the end-of-year possible prices is approximately normal. Determine the probability of earning a return greater than 30 percent over the coming year from your investment in Farrell common stock. Expected price change = $5 Standard deviation of price change = $3 The probability of earning more than 30% during the coming year is equal to the probability of a price change greater than 0.3($25) = $7.50 z = ($7.50 - $5.00)/$3.00 = 0.833 From Table V, p(z > 0.833) = 20.33%