The following table is given for stocks A and B

advertisement

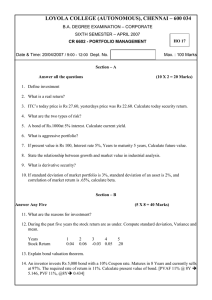

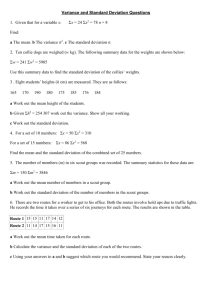

Chp 9- Risk, Return and the Opportunity Cost of capital The following table is given for stocks A and B. Using the data given and answer the questions 1 thru 6. Scenario Recession Normal Boom Probability 25% 40% 35% Return on A -4% 8% 20% Return on B 9% 4% -4% 1. What is the expected return on Stock A? a. 9.2 % b. 8.0 % c. 24.0 % d. 11.3 % 2. What is the expected return on Stock B? a. 3.0 % b. 2.45 % c. 4.33 % d. 6.33 % 3. What is the standard deviation of Stock A? a. 4.33 % b. 6.22 % c. 9.22 % d. 0 % 4. What is the standard deviation of Stock B? a. 0 % b. 4.33 % c. 6.22 % d. 5.12% 5. What is the expected return of a portfolio if you invest %50 of your wealth in Stock A and %50 in Stock B? a. 5.83 % b. 5.5 % c. 11.0 % d. 0 % 6. What is the standard deviation of the portfolio if you invest %50 of your wealth in Stock A and %50 in Stock B? a. 0 % b. 5 % c. 2.1 % d. 10 % CHP 09 Calculate the expected return, variance, and standard deviations for investments in either stock A or stock B, or an equally weighted portfolio of both. Scenario Recession Normal Boom Probability 25% 40% 35% Return on A -4% 8% 20% Return on B 9% 4% -4% Answer: Stock A: Expected return = (.25 x –4%) + (.40 x 8%) + (.35 x 20%) = 9.2% Variance = .25(-4% - 9.2%) + .4(8% - 9.2%)2 + .35(20% - 9.2%)2 = 43.56 + .58 + 40.82 = 84.96 Standard deviation = (84.92)2 = 9.22% Stock B: Expected return = (.25 x 9%) + (.40 x 4%) + (.35 x -4%) = 2.45% Variance = .25(9% - 2.45%) + .4(4% - 2.45%)2 + .35(-4% - 2.45%)2 = 10.73 + .96 + 14.56 = 26.25 Standard deviation = (26.25)2 = 5.12% Portfolio: Expected return = (.5 x 9.2%) + (.5 x 2.45%) = 5.83% Variance = .25(((-4% + 9%) x. 5) – 5.83%)2 + .4(((8% + 4%) x.5) – 5.83%)2 + .35 ((20% - 4%) x.5) – 5.83%)2 = 2.77 + .01 + 1.65 = 4.43 Standard deviation = (4.43)2 = 2.1% Note that the standard deviation of the portfolio is considerably less than that of either Stock A or Stock B.