NDC Presentation - University Heights

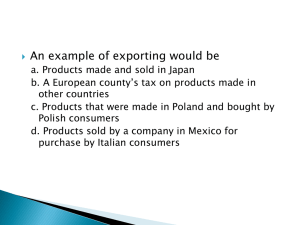

advertisement

Improving Communities Enhancing Lives NDC is the nation’s oldest non-profit provider of community development technical assistance and training A Powerful Mission Increasing the flow of capital for investment, jobs and community development to distressed urban and rural communities throughout the U.S. Partners in Community Development Since 1969 NDC works in partnership with local and state governments and non-profit organizations to help them build their communities and economies The Pub Group in Portland, OR Partners in Community Development Technical Assistance NDC defines, designs and executes development and business finance strategies, programs and projects NDC identifies, secures and structures public and private financing and develops project from concept to completion Bijou Theatre in Bridgeport, CT Partners in Community Development NDC Training & Professional Certification NDC offers courses designed to give participants the skills and knowledge they need to successfully facilitate housing and economic development in the communities where they live and work NDC’s Chuck Depew teaching Mixed-Use Real Estate Finance Partners in Community Development NDC Corporate Equity Fund As an equity investor, NDC finances affordable housing and historic preservation Dublin Road Townhomes in Mankato, MN Partners in Community Development NDC Grow America Fund NDC creates jobs and economic development with direct small business lending with a focus on women and minority-owned businesses Red Barn Pet Products in Long Beach, CA Partners in Community Development NDC Housing and Economic Development Corporation NDC finances and builds community and public facilities on behalf of our client communities Redmond City Hall in Redmond, WA Partners in Community Development HEDC New Markets As one of the leading nonprofit participants in the New Markets Tax Credits program, NDC provides technical assistance and NMTC financing for economic and community development projects YMCA in Albany, NY Evaluating A Project’s Need for Public Gap Financing 11 Evaluating A Project’s Need for Public Gap Financing • A project’s financing gap is defined as the difference between projected costs (uses) and the debt and equity (sources) it can reasonably attract as follows: Project Costs - Bank Loan - Equity = Gap 12 Defining the Financing Gap Project Costs – are they reasonable & adequate? - Bank Loan – maximized? - Equity – fair return without undue enrichment? = Gap – are there public sources available to close? 13 A Fundamental Problem in Real Estate Finance • Project Costs Often Greater Than Completed Value • But...debt and equity are a function of value, not cost • Where project costs exceed fair market value, there will likely be a need for federal, state and/or local economic development resources to get the project done 14 Cost-Value Differential Example Mixed-Use Development: Planned Improvements Residential Units Commercial Retail Space Project Costs $20,000,000 Project Costs Debt (75% of FMV) Other Sources Needed 60 40,000 Fair Market Value $10,000,000 $20,000,000 $7,500,000 $12,500,000 15 Why Do Economic Development Projects Require Public Sector Assistance? • Project Costs > FMV • Investors see inadequate Return on Investment (ROI) • Lenders see unacceptable Level of Risk 16 Investor’s Perspective • Investors are seeking to maximize economic benefits and minimize equity investment • • Looking to invest in projects yielding the highest Return On Investment (ROI) Concerned about the liquidity of the investment (can it be sold to free up equity for next opportunity) 17 Lender’s Perspective • Lenders are risk limiters, not profit maximizers • Lending is a low-margin, high-volume business • No “upside" for lenders • Marginal return on investment (interest) • Expected return of investment (principal) • Fixed returns • Will participate but want to mitigate all risks 18 Project Sources and Uses • Structuring the Project • Sources of funds must be equal to uses of fund • Identify all project costs (uses) • Acquisition • Construction • Soft costs and Reserves • Identify all project sources • Debt • Equity • Public Gap Financing • If uses are greater than sources, find additional sources 19 Sources Bank Equity Sources and Uses Uses (Project Cost Summary) Land Site Improvements Construction – Shell Parking Architect and Engineering Tenant Improvements Legal and Accounting Permanent Loan Fees Construction Loan Fees Organizational Expenses Construction Interest Marketing Property Taxes Lease-up Reserves Developer Fee Contingency Total Project Cost $ 6,000,000 2,335,000 $ 8,335,000 $ 100,000 200,000 5,000,000 50,000 200,000 1,000,000 50,000 90,000 120,000 40,000 300,000 60,000 25,000 600,000 200,000 300,000 $ 8,335,000 20 Lender Underwriting / Debt Capacity • The maximum loan amount will be determined by the lender’s primary underwriting criteria: • Debt Coverage Ratio (DCR) • Loan to Value Ratio (LTV) 21 Permanent Lender Underwriting (cont.) • Debt Coverage Ratio (DCR) DCR = NOI D/S • Measures project's ability to repay loan from revenues (lender's "first way out“) • Higher the DCR, lower the risk • Typical DCRs: 1.10 to 1.35 22 Permanent Lender Underwriting (cont.) • Loan-to-Value Ratio (LTV) LTV = Loan Amount FMV (Fair Market Value) • Measures project's ability to repay loan from sale of the asset (lender's "second way out") • Lower the LTV, lower the risk • Typical historical LTV: 75% 23 Sizing Equity: Three Benefits of Investing in Real Estate • Investors/developers seek three benefits when investing in real estate: • Cash Flow • Tax Benefits • Appreciation • Investors want all three benefits, but cash flow requirement is first because it is the most immediate and tangible benefit National Development Council Benefits of Owning Real Estate (cont.) • Cash Flow Income - Operating Costs - Debt Service = Cash Flow 25 Benefits of Owning Real Estate (cont.) • Tax Benefits – two main benefits • Income tax deferral from depreciation • Income Tax Reduction from Tax Credits • • • • (Historic) Rehabilitation Tax Credits Low-Income Housing Tax Credits New Markets Tax Credits (Renewable Energy) Investment Tax Credit National Development Council 26 Benefits of Owning Real Estate (cont.) • Appreciation Selling Price - Purchase Price = Appreciation in Value 27 28 Time Value of Money • Investors demand a return on their money given their perception of: • • • Risk Inflation Opportunity Costs • These three factors determine the discount rate. The discount rate converts a future value to a present value • The discount rate is the same as the investor's desired rate of return 29 Valuing Investor Benefit 15% Discount Factor After-Tax Cash Flow Total Benefits After Taxes 144 30 574 .870 495 2 144 28 172 .756 130 3 144 26 170 .658 112 4 144 24 168 .572 96 5 144 22 166 .497 82 6 144 20 164 .432 71 7 144 18 162 .376 61 8 144 16 160 .327 52 9 144 14 158 .284 45 10 144 12 156 .247 39 1,440 210 2,050 Year RTC 1 400 400 LIHTCs Discount Factor PV 1,187 PV is what an investor who demands a 15 percent return would be willing to invest in equity to receive the prospective benefits stream outlined above. Filling the Gap: The Public Toolbox • Reduce Development Costs • Discounted or donated properties • Fund infrastructure and site work through general obligation bonds • Reduce Cost of Capital • Lower price and longer term • Make Capital more Readily Available • Subordinated (junior) financing • Stretch debt • Reduce equity • Loan guarantees 30 Filling the Gap: The Public Toolbox (cont.) • Decrease Operating Costs to Expand Borrowing Capacity and Equity Attraction • Tax abatements or Payments in Lieu of Taxes (PILOTs) • Utility savings • Attract outside Equity • State and federal tax credits in exchange for equity • Types of federal credits • • • • Low-Income Housing Tax Credits Historic Rehabilitation Tax Credits New Market Tax Credits Investment (Renewable Energy) Tax Credits 31 Filling the Gap: The Public Toolbox (cont.) • Attract Grants • Less commonly available these days • Always tied to public benefit standards • Monetize Tax Increment • Tax Increment Financing (TIF) • Using future tax increment to finance up-front capital costs, especially infrastructure 32 For More Information Tom Jackson, Director tjackson@nationaldevelopmentcouncil.org New York Office 708 Third Avenue, Suite 710 New York, NY 10017 212-682-1106 0ffice Training Division 927 Dudley Road Edgewood, KY 41017 859-578-4850 Office www.nationaldevelopmentcouncil.org