PPTX - State Employees` Insurance Board

advertisement

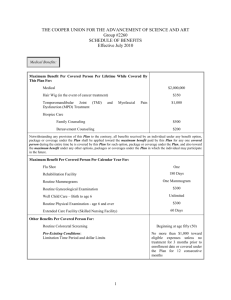

State Employees’ Insurance Board 2013 Benefits Conference AGENDA Registration (Wellness Nurses Available)……………………………………………………………………9:00 AM Welcome……………………………………………………………………………………………….……….....10:00 AM I. LGHIP Overview/Healthcare Reform-Page 2.………………………………………………….……..10:10 AM SEIB II. Voluntary Benefit Options……………………………………………………………………………….10:50 AM Great West Retirement Solutions Alabama Retired Employees’ Association III. LGHIP Benefit Summary-Page 12……………………………………………………………………..11:10 AM SEIB Lunch (On your own)……………………………………………………………………………..………..….12:00 PM IV. Retirement Benefits Overview…….………………………………………………………..………......1:30 PM Retirement Systems of Alabama V. Voluntary Benefit Options…..…………………………………………………………………………..2:00 PM LTC Global Retirement Systems of Alabama VI. Retirees…………………………………………………………………………………………………..…2:20 PM Social Security VII. Wellness-Page 33…………………………………………………………………………..………........2:55 PM SEIB Program Concludes……………………………………………………………………………………..………3:25 PM LOCAL GOVERNMENT HEALTH INSURANCE PLAN BENEFIT AND HEALTHCARE REFORM SUMMARY 2 3 LGHIP Advisory Committee Vicky Hicks Allen Calhoun-Cleburne MH Board Appointed By: SEIB Chairman Term expires February 11, 2014 Carolyn Sutley Enterprise Housing Authority Appointed By: SEIB Chairman Term expires February 11, 2014 Charles Sankey, Commissioner Roger Rendleman Crenshaw County Commission Lee County Administrator Appointed By: Executive Director of the Association Appointed By: Executive Director of the Association of of County Commissions of Alabama County Commissions of Alabama Term expires February 11, 2015 Term expires February 11, 2015 Vacant Appointed By: ARSEA Executive Director Ken Smith City of Decatur, Personnel Appointed By: Executive Director of the Alabama League of Municipalities Term expires February 11, 2015 Mayor William E. Blackwell City of Ozark Appointed By: Executive Director of the Alabama League of Municipalities Term expires February 11, 2015 William Ashmore, SEIB CEO 4 2014 Premium and Benefit Changes Benefits Physician Office Visit Copay Hospital Deductible Emergency Room Copay Out Of Pocket Maximums Individual Family Premiums 5% increase $30-$35 $100-$200 $100-$200 $6,250 $12,500 5 Premium History (Rates shown include dental coverage) Year Preferred in Transition Preferred Standard 2010 Individual Family $367 $892 Individual Family $367 $922 Individual $400 Family $1,008 2011 Individual Family $378 $919 Individual $400 Family $1,008 Individual $412 Family $1,039 2012 Individual Family $378 $919 Individual $400 Family $1,008 Individual $412 Family $1,039 2013 Individual Family $378 $919 No longer available ----------- Individual $412 Family $1,039 2014 Individual Family $396 $963 No longer available ----------- Individual Family $432 $1089 LOCAL GOVERNMENT HEALTH INSURANCE PLAN HEALTHCARE REFORM 6 7 Summary of Health Care Reform Patient Protection and Affordable Care Act (PPACA) Signed into law on March 23, 2010 Health Care and Education Affordability Reconciliation Act of 2010 signed into law. “Grandfathered Plans” Plans that were in existence on March 23, 2010 LGHIP will lose grandfathered status on January 1, 2014 Provide preventative services and women’s health with no copay 8 Summary of Health Care Reform To Date Lifetime Coverage Limits Prohibited LGHIP must eliminate the $1 million lifetime limit on coverage of essential benefits but can allow certain restrictive annual limits until 2014. Pre-existing Condition Exclusions Prohibited for Dependents LGHIP must eliminate pre-existing condition exclusions for children under the age of 19. Dependent Coverage Expanded up to Age 26 LGHIP must provide coverage for adult dependent children up to age 26, if the child is not eligible to enroll in other employer provided coverage. LGHIP cannot require qualified young adults to pay more than similarly situated dependents enrolled in the plan. Health Care Reimbursement Account Maximum contribution capped at $2,500 annually Over-the-Counter drugs must be pre-approved 9 Health Care Reform Changes Effective October 1, 2013 Open enrollment for Marketplace* Coverage may become effective as early as January 1, 2014. *For more information on the Marketplace, click here. 10 Healthcare Reform Changes Effective January 1, 2014 Pre-existing condition exclusion for all enrollees prohibited. LGHIP currently has a 270 waiting period less credit for time served under other group coverage. Coverage Eligibility Employees must be offered coverage within 90 days of employment. Marketplace Subsidy LGHIP members who fall between 100%-400% of the FPL may qualify to receive credit for participation in the Marketplace. Individual Mandate Everyone, unless exempted by law, is required to maintain health insurance. 11 Healthcare Reform Changes Effective January 1, 2018 Excise tax on “Cadillac” Plans which cost of coverage exceeds $10,200 on individual and $27,500 on family coverage LGHIP cost of coverage is currently well below these levels. Local Government Health Insurance Plan Benefit Summary 12 Blue Cross Blue Shield of Alabama Blue Card PPO 13 14 What you need to know about a PPO Using a PPO provider/facility saves money Contracted allowed amount accepted Higher benefit level in most cases Using a non-PPO provider/facility costs more Some services are covered at 80% (versus 100%) Member incurs charges over the allowed amount Some services are non-covered Please visit www.bcbsal.org for a full list of PPO providers. 15 Inpatient Hospital $200 per admission $50 copay per day for days 2-5 All hospital admissions require preadmission certification except maternity. Emergency admissions require certification within 48 hours of admission. For preadmission certification, call 1-800-551-2294 If preadmission certification is not obtained, no benefits are available 16 Outpatient Hospital Surgery $100 facility copay per visit Diagnostic $100 facility copay Medical Emergency $200 facility copay Accidental X-Rays & Tests Injury Covered at 100% of the allowance with no deductible or copay required if services are provided within 72 hours of the accident 17 Routine Physician Care Physician $35 per office visit Nurse Practitioner Copay $20 per office visit Lab Office Copay Copay $3 per test 18 Major Medical Calendar $200 per person each calendar year; Maximum of three deductibles per family Annual Year Deductible Out-of-Pocket Maximum Individual Family $6,250* $12,500* *All out-of-pocket expenses include copays, deductibles, and coinsurance. 19 Prescription Drugs Generic drugs* $5 copay per prescription; 60-day supply on maintenance drugs** Brand name drugs* Covered at 80% of the allowance, subject to the $200 calendar year deductible * No benefits are available for prescriptions purchased at a non-Participating Pharmacy. ** The generic copay expense does not apply to the annual deductible. Please visit www.bcbsal.org for a list of participating pharmacies, and maintenance drug list. 20 Baby Yourself “Baby Yourself,” SEIB’s Maternity Management Program offers assistance in identifying high-risk pregnancies and managing them to prevent complications at the time of delivery. As soon as a pregnancy is confirmed, the patient or the doctor should call BCBS at 1.800.551.2294. By participating in “Baby Yourself” and notifying BCBS before the end of the second trimester, your $200 deductible and applicable daily copay(s) will be waived. A BCBS nurse will contact the member’s physician to obtain additional clinical information. Blue Cross Blue Shield of Alabama Dental 21 22 Deductible $25 per person each calendar year; maximum of three deductibles per family. This deductible applies to basic and major services only. 23 Diagnostic & Preventive Covered at 100% of the preferred dental fee schedule, with no deductible. Two routine cleanings per year One set of x-rays per year 24 Basic & Major Services Covered at 50% of the preferred dental fee schedule, subject to a $25 annual deductible. $1,500 annual maximum for all covered services. These services include: Fillings Oral Surgery Periodontics Endodontics Prosthodontics 25 Orthodontics $25 annual deductible Covered at 50% of the Preferred Dental Fee Schedule Lifetime maximum of $1,000 per person for Dependent Children 19 and under only Southland Benefit Solutions Dental Voluntary Insurance Coverage 26 27 Premium Premium is $40 per month, regardless of number of dependents Separate enrollment is required in Southland dental Will operate as primary or secondary dental coverage 28 Deductible $25 per person each calendar year; maximum of three deductibles per family NOTE: Only applies to Basic & Major Services for family coverage only 29 Diagnostic & Preventive Covered at 100% of reasonable and customary charges with no deductible. Services include, but are not limited to 2 routine cleanings per year 1 set of x-rays per year 30 Basic & Major Services Individual Coverage Family Coverage Covered at 80% of reasonable and customary charges with no deductible $1,250 annual maximum for all covered services Covered at 60% of reasonable and customary charges subject to a $25 annual deductible $1,000 annual maximum per member for all covered services Services include, but are not limited to Fillings Oral Surgery Periodontics Endodontics Crowns Southland Benefit Solutions Vision Voluntary Insurance Coverage 31 32 Southland Vision Benefits Premium is $20 per month, regardless of number of dependents. This will coordinate with the SEIB Discount Routine Vision Care Network. Examination 40.00 Frames Single Vision Bifocals Trifocals Lenticular 60.00 50.00 75.00 100.00 125.00 Contacts 100.00 Plan provides either contacts or lenses and frames, but not both in any plan year. It is the responsibility of the member to submit a claim for either lenses or contacts and the payment will be made based on the date the claim is received. LGHIP WELLNESS PROGRAM WELLNESS 33 34 Wellness Screenings Members are screened for the following risk factors Blood pressure At risk if systolic reading is 160 or higher or your diastolic reading is 100 or higher Cholesterol At risk if 250 or higher Glucose At risk if 200 or higher Body mass index At risk if 35 or higher 35 At-Risk Members If determined at-risk, the member will receive a copay waiver and physician referral form for follow-up visit with their physician. 36 A Few Things You Should Know Local Government units that have 80% or greater wellness participation will receive a $10 premium discount per active employee each month. Employees may participate through a worksite wellness screening or by having a provider screening form completed by their health care provider. Units with 30% or more employee participation in a wellness screening may qualify for the “Preferred” rate category. 37 Tobacco Cessation Program Members and their covered spouse may receive a reimbursement of 80% of the cost of a non-covered tobacco cessation product, up to $150 lifetime maximum. 38 Physician Weight Management Program Covered LGHIP members can receive 80%, up to $150 annually, for non-covered weight management programs that are overseen by a physician. 39 Reimbursement Process To receive reimbursements for both tobacco cessation and weight management, receipts should be: Mailed: PO Box 304900, Montgomery, AL 36130-4900 Faxed: (334) 517-9980 Be sure to include name, contract number, and date of birth on all correspondence. LGHIP Payroll and Personnel Officer Assistance Plan Information and Forms 40 41 Enrollment and Plan Forms For enrollment forms and plan summaries, visit the SEIB website at www.alseib.org. 42 LGHIP Benefits Blue Cross Blue Shield Health Benefits Summary Blue Cross Blue Shield Dental Benefits Summary Southland National Dental and Vision Summary of Benefits 43 Enrollment Forms Enrollment Form (LG01) Change Form (LG02) Cancellation Form (LG03) Declination of Coverage (LG04) Southland National Enrollment Form (LG07) Southland National Plan Change Form (LG08) Southland National Cancellation Form (LG09) 44 Benefit and Claims Forms Blue Cross Blue Shield Prescription Claim Form Blue Cross Blue Shield Medical Expense Claim Form Provider Screening Verification Form Blue Cross Blue Shield Direct Deposit Enrollment Form Southland National Cancer and Hospital Indemnity Claim Form Southland Dental Claim Form Southland Vision Claim Form 45 SEIB Wellness Benefits, Forms and Programs Wellness Screening Schedule Tobacco Cessation Program Physician Administered Weight Management Program Provider Screening Form (LG12) 46 LGHIP Benefit Advisors Tonya Campbell 866-841-0978 tcampbell@alseib.org Connie Grier 877-500-0581 cgrier@alseib.org