First Choice Health PowerPoint Presentation

advertisement

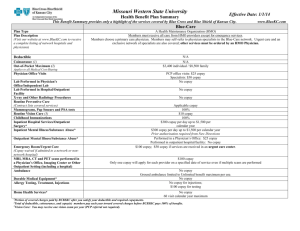

2015 Open Enrollment 2015 – Benefits Highlights Benefits Administration: First Choice Health (medical, dental & vision) PPO (Preferred Provider Organization) Network: First Choice Health (Northwestern US) First Health – outside of First Choice service area Pharmacy Benefits Administrator/Network: MedImpact FSA (Flexible Spending Account) Administration: HealthEquity 24 Hour Nurse Line Maternity Program No changes to medical benefits or premiums Health Care Reform & the ASD plan: The ASD plan is considered Grandfathered, so certain Health Care Reform provisions aren’t applicable to our medical plan, such as copays being required for Preventive Services and contraceptives. 2015 MEDICAL BENEFITS Who is First Choice? First Choice Health is a Northwest based company, established in 1985. Headquartered in Seattle, with offices in Beaverton, Boise, Billings, Anchorage and Spokane. We provide claims administration, service, provider network access and more to just under one million people in the Northwestern US. First Choice Health Provider Network Effective January 1, 2015 the Ashland School District’s medical plan will use First Choice Health as their provider network and the First Health network for out of area care. To find a provider you can visit www.fchn.com, click on Find A Doctor, Hospital or Facility and search the entire FCH PPO Network. If you or an enrolled family member is under the care of a non-network physician continuity of care arrangements may be appropriate for you. Fill out a transition planning request form for assistance. Medical Plan – Definitions Health benefits have a terminology all their own. As we discuss your benefits the following terms will be used frequently: Deductible: A deductible is a portion of money that you pay before the plan begins to pay benefits. Your plan only has a deductible if you choose to go out of the provider network Copay: A fee paid directly to a provider, facility or pharmacy at time of service. New! Copays due accrue toward your annual out of pocket maximum. Coinsurance: The portion of the bill you are responsible to pay. Out of Pocket Maximum: caps your member responsibility for in-network services. Prior Authorization: certain services require medical review in order to determine medical necessity. View the Prior Authorization listing at www.fchn.com or in your Open Enrollment Guide posted on the district website. 2015 Medical Plan Fast Facts No changes to medical plan benefits, deductibles or copays Updated Prior Authorization list New ID cards will be mailed to your home in late December. Each enrolled member will receive a card. Is your acupuncturist, chiropractor or naturopath not in the First Choice Health network? First Choice is working on adding Ashland area alternative providers to our network. In the meantime, visits to any out of network alternative provider will be paid at the in-network benefit level for dates of service between January 1 and February 28, 2015. Medical Benefits – Plan Specifics FCHA Network Out of Network Deductible $0 $300 Individual $900 Family Coinsurance 80% 50% Office Visit 100% after $25 copay 50% after deductible Preventive Office Visit 100% after $25 copay 50% after deductible Emergency Room 80% after $100 copay (copay waived if admitted) Inpatient Hospital 80% 50% after $250 copay per confinement. Deductible applies. What Happens When I? FCHA Network Out of Network Type of Service: You’ll Pay: You’ll Pay: Need to go to the doctor… $25 copay Deductible* & 50% of all additional charges Am hospitalized… 20% of the cost up to the Out of Pocket Maximum Deductible*, $250 per confinement copay & 50% of all additional charges Visit the ER… $100 copay then 20% of the cost up to the Out Of Pocket Maximum $100 copay then 20% of all additional charges Get my annual exam… $25 copay Deductible* & 50% of all additional charges Have outpatient surgery… 20% of the cost up to the Out of Pocket Maximum Deductible* & 50% of all additional charges *Annual Deductible $300 Individual/$900 Family How is Alternative Care Covered? FCHA Network Type of Service: You’ll Pay: Out of Network You’ll Pay: Acupuncture Chiropractic – 20 visit Limit /Calendar Year Massage Therapy 12 visit Limit /Calendar Year Prescription must be submitted with the claim. $25 copay $300 annual deductible* & 50% of all additional charges Naturopathic Care Alternative Care Enhancements: *The annual deductible indicated is the overall medical plan deductible. • In-network providers are expected to receive a higher reimbursement rate than previously provided by the Aetna plan. • Invite your provider to particpate in our network, have them call Paul with 503.597.4158 or pbarner@fchn.com 2015 PRESCRIPTION BENEFITS Prescription Benefit Highlights Local MedImpact Participating Pharmacies: Ashland Drug Phoenix Pharmacy Walgreens Bi-Mart Savon Safeway Rite Aid Wal-Mart Medicap Pharmacy Fred Meyer 90 day fills (Pharmacy & Mail Order): 90 day supply of your prescriptions are available at participating Choice90 pharmacies. You can also get a 90 day supply through the MedImpact mail order program. Generic vs. Brand Name: Members pay the difference in cost between the brand and generic medication(s) anytime there is a genetic available and a brand name medication is chosen when your prescribing physician allows for a generic substitution. Prescription Benefit Copays 30 Day Supply 90 Day Supply 90 Day Supply (Choice90 retail) (mail order) Generic $15 copay $45 copay $30 copay Preferred Brand $30 copay $90 copay $60 copay Non-Preferred Brand $45 copay $135 copay $90 copay How are specialty drugs (Copaxone, Embrel, etc.) covered by the plan? Specialty drugs are covered by the plan when obtained through the Diplomat Specialty Pharmacy. Specialty Drugs may require prior-authorization and/or have quantity limits. Copays for Specialty Drugs align with the Generic/Preferred/Non-Preferred copay tiers. How are compound drugs covered by the plan? Compound drugs are covered by the plan at the applicable tier copay. Pre-Authorization is required for compound drug charges greater than $400. Please keep in mind: If the cost of your drug is less than the tier copay you will pay the lower amount. Transitioning Your Prescriptions In order to minimize disruption to your prescription drug needs we recommend: 1. Fill any existing prescriptions you have in December. 2. Notify your pharmacist that your pharmacy benefits administrator will change to MedImpact as of January 1, 2015. 3. Your plan is waiving the prior authorization requirement during the month of January 2015 for a first refill. This is to allow your provider time to complete the prior authorization process before your second refill. This exception does not apply to new medications. 4. If you use the mail order program: Obtain a new 90 day prescription from your health care provider. After January 1, 2015 enroll in the Walgreen’s mail-order prescription program via phone or online. 2015 DENTAL & VISION 2015 Dental Benefits FCHA Network Out of Network Annual Deductible $50 Individual $150 Family (Waived for Preventive Services) Annual Maximum $1,500 Per Covered Individual Class A Expenses – Preventive 100% 100% of allowed amount & Diagnostic Class B Expenses – Basic 80% 80% of allowed amount 50% 50% of allowed amount Services (fillings, root scaling)* Class C Expenses - Major Services (crowns, dentures)* *Obtaining a benefits pre-determination is recommended prior to beginning extensive dental services. No changes to dental benefits in 2015. 2015 Vision Benefits FCHA Network Out of Network Annual Routine Vision Exam 100% Vision Hardware* 100% up to $350 per calendar year Vision Hardware includes: Eyeglass lenses, frames, contact lenses and contact lens fitting. *For those with vision hardware coverage. No changes to vision benefits for 2015. 100% SPECIAL PROGRAMS 24/7 Nurse Line & Health Information Library Available around the clock to answer your health questions! Have a sick child at 2 am? Unsure if you should go to the doctor or Emergency Room? Looking for an answer to a health question? Call the 24/7 Nurse Line to speak with a Registered Nurse who can answer your health questions at no cost to you. You can also access the Health Information Library, with information on over 1,500 health topics available in English & Spanish. Maternity Management For a healthy pregnancy and a healthy baby. Available at no cost to you – even if you aren’t a first time mom! One on one support from a Registered Nurse Regular telephone sessions with your nurse Sessions provide educational information and ways to minimize risks to you and your baby Your nurse can assist you with managing your diet, exercise and other ways to maintain a healthy pregnancy Continuity of Care Are you receiving ongoing treatment or do you have a previously scheduled surgery with a provider who is not in the First Choice Health PPO Network? The Continuity of Care Program may be right for you; please complete the Transition Planning Request form if: You are pregnant You have an upcoming planned major surgery You are in the process of receiving post-operative follow up care within the period defined by a global/bundled fee You are undergoing a high dose chemotherapy regimen for a cancer condition You are undergoing treatment following an organ transplant or waiting on an organ transplant You are undergoing home health care, home IV infusion therapy, using rental Durable Medical Equipment (DME) or oxygen You are in a long term care facility After Medical Review your approved services will be covered at the in-network benefit level through March 31, 2015 in most cases. Maternity benefits may be paid at the in-network benefit level for a longer period. ONLINE TOOLS First Choice e-Tools Did you know? First Choice’s member website offers you the ability to access your plan and medical claim information online. Create an account to: Find a provider (local or national) View enrollment status Print a temporary ID card/Order a new card Sign up for e-EOBs Review medical plan documents Review claims information & EOBs Email customer service Download forms Please visit www.myFirstChoice.fchn.com Landing Page Eligibility & Benefits Navigate here to: Update your email address Verify your eligibility Check your plan deductible, out of pocket and other benefits Order/view your ID card Claims Navigate here to: View claims Download copies of EOBs Move your claim history to an excel file via cut & paste Filter by date, family member and claim type Find a Provider Navigate here to: Search for providers in the First Choice Health Network Search for providers in the First Health Network Customer Service Navigate here to: Contact Customer Service View forms: Claim HIPAA Health Resources Navigate here to: View online Health Tools Access Health Links What YOU Need To Do – Wrapping Up Everyone: Complete the First Choice Health Enrollment Application – Not making any changes? You still need to complete a form! Complete the Health Equity Enrollment Application for the FSA program – Even if you aren’t enrolling, we need your declination to participate on file Complete Premium Withholding Form Turn all forms in to Human Resources by November 21, 2014 Reminders: Complete Transition of Care Form Are you receiving care from an out of network provider? This program could benefit you. Get a refill of your current prescriptions by the end of December. Remind your providers that any claims for 2014 dates of service need to be submitted to Aetna prior to December 31, 2015 or 15 months from the date of service, whichever is earlier. First Choice Health requires all claims be filed within 12 months of the date of service. 2015 FLEXIBLE SPENDING ACCOUNT When you choose to participate in the ASD Flexible Spending Account Program you can set aside pre-tax dollars to: • Cover medical, dental or vision expenses not covered by your health plan. • Pay for non-medical dependent care expenses. 2015 Contribution Limits: $2,500 Healthcare FSA $5,000 Dependent Care FSA $300 Minimum Contribution How an FSA Works 1. 2. 3. Sign Up Review your medical expenses for the last year and estimate your expenses for 2015. Determine the amount you would like to contribute to your FSA on a pre-tax basis Contribute ASD will arrange to have the determined amount of your pre-tax earnings contributed to your FSA. Use Your Funds When you incur a qualified expense, you can either pay with the HealthEquity Visa debit card or submit the expenses through the HealthEquity online tool for reimbursement. Save your receipts! You’ll need them to submit reimbursements or to validate debit card expenses. Plan Wisely When Setting Aside FSA Funds The FSA is a tax-preferred account and federal guidelines are very specific about what happens to funds that are not spent by the end of the plan year. Healthcare FSA: Annual rollover of up to $500 is allowed You are eligible to roll funds over to the next year even if you decide not to make additional contributions. Example: Lisa set aside $1,400 in 2014 for Healthcare expenses. She spent $1,100. Lisa decides that she won’t contribute additional funds to the FSA in 2015. Lisa has $300 that will roll over to the 2015 plan year. Healthcare FSA accounts with a balance of more than $500 will forfeit amounts over $500 Dependent Care FSA: No rollover is available. Unused contributions are forfeited. Qualified FSA Expenses: Acupuncture Alcoholism Ambulance Amounts not covered under another health plan Annual physical examination Artificial limbs/teeth Birth control pills/prescription contraceptives Body scans Breast reconstruction surgery following mastectomy for cancer Chiropractor Contact lenses Crutches Dental treatments Eyeglasses/eye surgery Hearing aids Long-term care expenses Medicines (prescribed, not imported from other countries) Nursing home medical care Nursing services Optometrist Orthodontia Oxygen Stop-smoking programs Surgery, other than unnecessary cosmetic surgery Telephone equipment and repair for hearing-impaired Therapy Transplants Weight-loss program (if prescribed by a physician for a specific disease) Wheelchairs Wigs (if prescribed) Examples of Non-Qualified Expenses: Concierge services Diaper service Elective cosmetic surgery Future medical care Hair transplants Non-prescribed drugs Nutritional supplements Health club memberships Insurance Premiums FSA Features Convenient access Debit card Online - http://healthequity.com/ HealthEquity free mobile app 24/7 telephone assistance Use your HealthEquity account to Check your balance Review transactions Review claims Enroll in direct deposit reimbursement Submit new claims or documents Send payments and reimbursements Mobile App Features Available for iOS and Android • • • • • On-the-go access for all account types Take a photo of documentation with phone and link to claims and payments Ability to directly pay provider via online tools or request reimbursement from your FSA account Manage debit card transactions View claims status