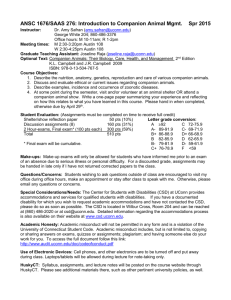

GA Insurance - Background - Department of Human Resources

advertisement

2013-14 Graduate Assistant Plan Changes MAY 16, 2013 LORI VIVIAN, HUMAN RESOURCES MIKE KURLAND, STUDENT HEALTH SERVICES Background GAs eligible for State Employees Health Plan until fall 2003 State officials determined that GAs were ineligible for Employee Plan UConn considered including GAs in the Student Insurance Plan, but elected not to Student Insurance Plan had much lesser benefits State signed an MOU with the University to provide a Graduate Assistant Plan Graduate Assistants Graduate Fellows Students at UCHC State manages GA Plan, with no UConn involvement Develop the annual contributions Determine benefit modifications Solicit bids Select vendors GA Issues with Current Plan Confusion regarding Student Health Insurance and GA insurance GAs often waive student insurance in Student Administration System and assume it is for GA insurance GAs will often receive Aetna student insurance card in the mail (if GA paperwork is processed late); once the card is used, the GA cannot waive the student insurance Network providers only in CT, out-of-network coverage subject to high deductible ($1,000) Non compliant with international student requirements, requires additional insurance Effective date after start of semester, requires gap insurance Open enrollment held in May with June deadline, when many GAs are away from school Financial Concerns State changed funding arrangement to self-insured effective September 1, 2010 Claims/premiums could not be comingled with Employee Plan If claims exceed premium, UConn must pay the carrier the excess claims Unlimited Risk No individual or aggregate stop loss insurance First accounting on claims experience from the State produced in September 2012 State recommended a retroactive premium increase: Medical: 24.5% ($1.7 million), Dental: 8.6% ($200,000) UConn’s deficit for period 9/01/10 – 8/31/2012: $2.3 million Significant increase in UConn premium cost $4.9 million (2010-11) to $7.9 million (2013-14) Administrative Challenges State’s system (CORE-CT) is not designed to handle academic calendar Each enrollment/termination requires individual processing No opportunity for mass processing the 500+ that occur each August No opportunity for data transfer between Student Administration System Nearly every GA enrollment requires retro processing by Payroll Only those paid by the State can be in CORE-CT GA Fellows are administered outside the system UConn GAs are not paid over the summer Premiums collected in advance (18 paychecks versus 26 paychecks), which requires special processing by the State, Payroll, and insurance carriers System is available for open enrollment only once each year (May/June) State Response to Issues Focus is on State Employee Health Plan, no resources available to address GA issues Student Insurance Change History 2007-2008 Plan design had MANY inside maximums and variations (dated plan design) Coverage was limited. Hard to administer and understand for a consumer 2008-2009 Implemented a $50,000 Policy Year Maximum (across the board) $250 In Network / $500 Out of Network Policy Year Deductible (waived at SHS) Labwork not subject to the Policy Year deductibles Referrals required for Storrs students only 90% coverage for In Network claims; 70% for Out of Network Office Visits: $25 copay when In Network; 70% Out of Network Implemented a $5,000 Outpatient Maximum (including Surgeries Implemented a $1,000 RX maximum per policy year with copays of $15/$30 Cover Anesthetist at 90/70 benefit levels Emergency Care Expenses covered at 90/90 benefit levels after a $50 deductible Cover STD screenings Continue to Exclude Annual Physicals, Annual Eye Exams, and coverage for Titers Student Insurance Change History 2009-2010 Implemented a $150 ER Copay Implemented the Hard Waiver Audit Implemented a $100,000 Plan Maximum Removed the Pre-Existing Condition Clause Added coverage for SHS Office Visits Sports Coverage: $2,000 Benefit Under the Medical Plan (paid for by Athletics) 2010-2011 Removed inside Plan Maximum of $5,000 ( surgical, MH etc.) Removed the exclusion for sexual reassignment surgery 2011-2012 Increased Plan Maximum to Unlimited Coverage Increased RX Maximum to Unlimited Coverage Preventative Services covered at 100%(including physical exams, immunizations, etc.) Implemented a $5,000 Out of Pocket Plan Maximum Student Insurance Change History 2012-13 (Affordable Health Care Act) Removed all internal plan maximum amounts and further prospective compliance with Affordable Care Act, including 100% coverage for outpatient contraceptive drugs and device expenses 2013-14 Continued compliance with new Affordable Health Care Act regulations Bid Process Agreement was reached to include GAs in the Student Health Insurance bid process Originally scheduled for 2012-13 year Delayed one year because State information regarding GA experience was unavailable Further delayed because GA claim data was incomplete Expedited bid process Quotes solicited in December Bids received in January Selection committee selected winning vendor in February Presentations to senior management, Grad School, GSS Executive Committee Presented to Board of Trustees at next available meeting (April 24) Winning Bidder Consolidated Health Plan (CHP), utilizing CIGNA network of providers Broker: Bailey Agencies GA vs. Student Insurance Comparison Key Features GA Plan Student Plan (2013-14) Network - Carrier - Service area of network providers - Number of providers - Out of network coverage Anthem Blue Cross Blue Shield CT only 15,000 – 16,000 Available to GAs for additional cost CIGNA Nationwide 700,000 Included Healthcare Services - Network Provided - Office visit copays $10 primary care, $20 specialists, $35 urgent care - Hospital $250 copay, then 100% paid by plan - Emergency room - Outpatient surgery - Laboratory - X-rays - Annual deductible 100% paid by plan 100% paid by plan 100% paid by plan 100% paid by plan None $0 students seen at SHS, $0 adult physical exams, $25 all other 90% paid by plan, 100% paid by plan after student’s 10% reaches $5,000 100% paid by plan if admitted, $150 copay if not admitted 90% paid by plan 90% paid by plan 90% paid by plan $250 (waived if student seen by SHS) Healthcare Services When Using Providers Who Are Not In Network Available only if purchased: 70% paid by plan after GA pays $1,000 annual deductible, 100% paid by plan when GA’s 30% reaches $3,000 70% paid by plan after student pays $500 annual deductible, 100% paid by plan when student’s 30% reaches $5,000 Prescriptions $10 generic $20 preferred brand $30 non-preferred brand $15 generic $30 brand name Medical Evacuation and Repatriation None Included Effective Date of Coverage September 1 (Note: GAs required to have coverage while at school, students without coverage must purchase short-term medical policy) August 15 Annual Cost of New Plan Paid by GA GA Only GA + 1 Family $ 200 $1,440 $1,822 Paid by UConn Total $ 3,730 $ 8,160 $10,328 $ 3,930 $ 9,600 $12,150 Advantages Achieved Economies of scale Enrolled Students: 2400, Enrolled GAs: 1800 Fully insured Liability is limited to premiums Ability to budget Ability to modify plan UConn selects plan design and carriers UConn puts the plan out to bid Simplified Administration Limited in first year, but anticipate significant changes for next year Cost savings Difficult to estimate, but anticipated at approximately $1million Next Steps Finalize details of the plan design Determine the premium collection process Develop enrollment process Continuing GAs Incoming/new GAs Communicate, communicate, communicate Questions