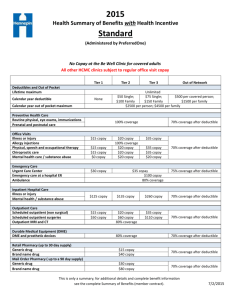

Preventive Care

advertisement

Waco ISD 2013 Open Enrollment GHC24354 02/12 Agenda 1. 2013 Medical Benefits 2. Vision Plan 3. Humana Resources 2 2013 Medical Plans 3 Humana NPOS HDHP with HSA Coverage In-Network Co-insurance Out of Pocket Max 80% $5,950 Individual $11,900 Family *Out of Pocket Max includes Deductibles Deductibles $4,000 Individual $8,000 Family Preventive Care Annual Routine Physical Exams Well-Child Care / Immunizations Routine Well-Woman Visits Mammography Routine Lab and X-Ray Preventive Endoscopy Preventive Prostate screenings 100% No deductible Physician Services Primary Care Physician Specialists 80% after deductible and $40 copay 80% after deductible and $55 copay Hospital Services Inpatient Outpatient 80% after deductible 80% after deductible Emergency Room 80% after deductible and $250 Copay Urgent Care 80% after deductible and $100 Copay 4 How the High Deductible Health Plan works • • The High Deductible Health Plan has two key components: – Integrated deductible: medical and prescription costs apply to the same deductible – Coinsurance: once the deductible is met, the plan pays coinsurance – a percentage of your health care costs Other High Deductible Health Plan features: – For family coverage, costs for all covered members apply to same aggregate deductible – Includes coverage for preventive care services at no cost regardless of whether the deductible is met Background on Health Savings Accounts • A Health Savings Account, or HSA, is a financial account used to pay for qualified medical expenses. • HSAs combine the benefits of both traditional and Roth 401(k)s and IRAs for medical expenses. • Taxpayers receive a 100% income tax deduction on annual contributions, they may withdraw HSA funds tax-free to reimburse themselves for qualified medical expenses, and they may defer taking such reimbursements indefinitely without penalties. • HSAs are unique—“IRAs on Steroids”—with triple tax advantages: – Tax-deductible contributions – Tax-free accumulation of interest and dividends tax-free, and – Tax-free distributions for qualified medical expenses. • 2013 Max Contribution: Individual $3250 / Family $6450 • Catch up Contribution (if age 55 or older) additional $1000 per year 6 Contributing money to an HSA • It’s a fund you can use to cover your qualified healthcare costs • Humana oversees the administration of both your plan and the HSA, which is managed by our partner bank, UMB • Receive a Humana Access card to use as payment for qualified expenses • You, your employer, and anyone else can contribute to your account • Once money goes into the account, it’s yours forever • Unused money carries over from year to year (unlike FSA - use it or lose it) • If you leave your current employer, HSA funds can stay in the same account or roll into another HAS • HSA contributions are credited to account monthly, not lump sum at beginning of year like an FSA • IRS Rule - You cannot contribute to an HSA unless you are enrolled in an HDHP * Please refer to IRS.gov or your Humana enrollment packet for detailed tax and HDHP/HSA information. Humana NPOS 70/50 Copay Plan Coverage In-Network Co-insurance Out of Pocket Max 70% $5,000 Individual $10,000 Family *Out of Pocket Max calculates separately and does not include Copays/Deductibles Deductibles $8,000 Individual $16,000 Family Preventive Care Annual Routine Physical Exams Well-Child Care / Immunizations Routine Well-Woman Visits /Mammography Routine Lab and X-Ray Preventive Endoscopy Preventive Prostate screenings 100% No deductible Physician Services Primary Care Physician Specialists 100% after $50 copay 100% after $100 copay Hospital Services Inpatient / Outpatient 70% after deductible Emergency Room 70% after deductible Urgent Care 100% after $50 Copay at a Concentra Facility 70% after deductible for non-Concentra Facility 8 Humana NPOS Simplicity Plan Copays Only – No Deductibles or Coinsurance! Coverage In-Network Copay / Out of Pocket Maximum $6000 Individual / $12,000 Family Preventive Care $0 Copay Annual Routine Physical Exams Well-Child Care / Immunizations Routine Well-Woman Visits Mammography Routine Lab and X-Ray Preventive Endoscopy Preventive Prostate screenings Physician Services for inpatient/outpatient hospital, emergency and surgical (Facility Charges subject to separate copay) Office Visits/Urgent Care Primary Care Physician $50 Copay per visit Convenient Care Clinic Concentra Urgent Care Facility Specialists/Other Specialist Office Visits Chiropractic care, physical, occupational, cognitive, speech and audiology therapy (visit limitations apply) Urgent Care at NON- Concentra Facility Inpatient Hospital Stays Outpatient Surgical Services (Facility) Emergency Room $100 Copay per visit $125 Copay per visit $1500 Copay per day for the first 3 days $1500 Copay per visit $600 Copay per visit 9 Humana NPOS 80/50 Copay Plan Coverage In-Network Co-insurance Out of Pocket Maximum 80% $5,000 Individual $10,000 Family *Out of Pocket Max calculates separately and does not include Copays/Deductibles Deductibles $2,500 Individual $5,000 Family Preventive Care Annual Routine Physical Exams Well-Child Care / Immunizations Routine Well-Woman Visits Mammography Routine Lab and X-Ray Preventive Endoscopy Preventive Prostate screenings 100% No deductible Physician Services Primary Care Physician Specialists 100% after $30 copay 100% after $45 copay Hospital Services Inpatient / Outpatient 80% after deductible Emergency Room 100% after $150 copay Urgent Care 100% after $30 Copay at a Concentra Facility 10 100% after $75 non-Concentra Facility Pharmacy Benefits Plan Coverage NPOS 80/50 HDHP with HSA RX4 Copay After Deductible Level 1 - $10 Level 2 - $40 Level 3 - $70 Level 4 – 25% NPOS 70/50 Copay Plan Simplicity Plan NPOS 80/50 Copay Plan RX4 Level 1 - $10 Level 2 - $40 Level 3 - $70 Level 4 – 25% Right Source Mail Order RX 2.5 Copays for 3 Month Supply 11 Women’s Preventive Care Updates for 2013 Coverage In-Network Contraceptive methods and counseling includes : Covered at 100% in network only All FDA approved contraceptive methods, sterilization including vasectomies, and patient education and counseling. Prescription is required, includes over the counter contraceptives *Brand name contraceptives are covered at 100% only when no generic alternative is available in that class/category Breastfeeding support, supplies and counseling to include costs for renting breastfeeding equipment 12 Vision Plan Automatically included to ALL Waco ISD Humana medical members at no additional cost! 13 14 Pharmacy Tools Access RightSource Rx registration and maintenance information Compare drug costs and view alternative medications View prior authorization requirements Locate local pharmacies Maximize your benefit Physician Finder • Go to www.humana.com • Under Resources and & Support tab, click on “Find a Doctor” • Under Type of Coverage, ensure Employer Group Plan is selected, input zip code • For network, please select National Point of ServiceOpen Access • Agree to terms, select parameters and go! Concentra in Waco Save Money on Urgent Care 17 Humana Vitality Comprehensive wellness program Integrates rewards with health and wellness Provides the tools and support necessary to help Humana members live healthier lives. Humana Vitality members rewarded for making healthier choices, i.e. attending preventive screenings, exercising regularly and quitting smoking. Clinical Program available for Humana Members Programs available: Asthma Diabetes Heart Disease Pregnancy Renal Failure Ask a Humana representative today about getting involved in these programs Get Engaged: Member Communications Humana will be reaching out to members using various communication methods: Phone Calls directly to member’s homes Email communication regarding preventive reminders, clinical programs available, etc. Plan Professor Newsletters Member Welcome Guide Maximize your benefit Smart EOB Questions 21