Powerpoint

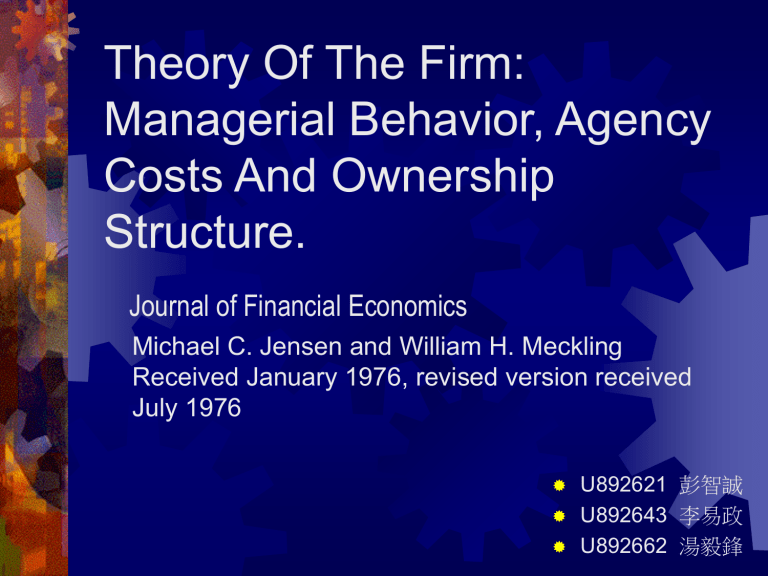

Theory Of The Firm:

Managerial Behavior, Agency

Costs And Ownership

Structure.

Journal of Financial Economics

Michael C. Jensen and William H. Meckling

Received January 1976, revised version received

July 1976

U892621 彭智誠

U892643 李易政

U892662 湯毅鋒

Outline

I.

II.

III.

IV.

V.

VI.

VII.

Introduction

Assumption

Agency cost on equity

Agency cost on debt

Corporate ownership structure

Qualifications and extensions of the analysis

Conclusion

I. Introduction

Property right

Property right is generally effected through contracting individual behavior in organizations.

In this paper, we focus on the contract between the owner and the manager of the firm

Agency cost

Agency relationship is a contract under the principal engage the agent to perform service on their benefits which involves some decision making authority to the agent.

Agency costs include ,

The monitoring expenditures by the principal

The bonding expenditure by the agent

The residual loss

The definition of the firm

The private corporation or firm is simply one form of legal fiction which serves as a nexus for contracting relationships

legal fiction : certain organizations to be treated as individuals

II. Assumption

Permanent assumption

P.1 All taxes are zero

P.2 No trade credit is available

P.3

All outside equity shares are non-voting

P.4

No outside complex financial claims,such as convertible bonds or warrants can be issued

P.5 No outside owner gains utility other than through the wealth and the cash flow

P.6

All dynamic aspect of the multiperiod nature of the problem are ignored

P.7

The manager ’ s wage are held constant throughout the analysis

P.8

There exist a single manager with ownership interest in the firm

Temporary assumption

T.1

The size of the firm is fixed

T.2

No monitoring or bonding activities are possible

T.3

No debt financing through bond, preferred stock, or personal borrowing is possible

T.4

All element of the manager ’ s decision problem included by the presence of uncertainty and the existence of diversifiable risk are ignored

III. Agency cost on equity

No monitoring cost & Fixed the size of firm

V: value of the firm

F: manager ’ s expenditures on nonpecuniary benefit

U: indifference curve of the manager

VF: budget constraint

: fraction of manager ’ s equity

V

V*

D

V ’

V

0

0 F*

B

U

2

F ’ F

0

A

U

1

Slope =

U

3

Slope = -1

Slope =

F

D: optimal set between non-pecuniary and firm value

B: the final set when the fraction of outside equity is(1-

)

V: V*

V

0

F: F*

F

0

V ’

F ’

Theorem

For a claim on the firm of (1-

) the outsider will pay only (1-

)V when he expect the firm to have given the induced change in the behavior of the owner- manager.

W = S

0

+ S i

= S

0

+

V(F,

)

= S

0

+

V ’ = (1-

)V ’ +

V ’

= V ’

Determination of the optimal scale of the firm

W : initial pecuniary wealth

I : access to a project requiring investment outlay

A : the gross agency cost

W+[V(I*)-I*]

Expansion path with 100% ownership by manager

A

W+V*-I*

C

W+V ’ -I ’

D

F* F ’

Slope =

Expansion path with fractional ownership by manager

Slope = -1

MARKET VALUE OF THE STREAM OF MANAGER ’ S

EXPENDITURESON NON-PECUNIARY BENEFITS

The manager ’ s indifference curve is tangent to a line with slope to -

The gross agency costs is equal to

(V*-I*) – (V ’ -I ’ ) = -

(F*-F ’ )

△ V △ I +

△ F = 0

( since V = V - F)

( △ V △ I ) – ( 1 -

) △ F = 0

The role of monitoring activities in reducing agency cost

M : the optimal monitoring expenditure of the outside

( for this case: distance between C & D)

BCE : the opportunity set as the tradeoff constraint facing the owner

V = V – F(M,

) - M

V

V*

V ”

V ’

0

D

U

1

C

M

U

2

E

B

U

3

F* F ” F ’

Slope = -1

F

MARKET VALUE OF MANAGER ’ S EXPENDITURES

ON NON-PECUNIARY BENEFITS

Slope =

Expansion path with monitoring and bonding activities

P1: Expansion path with 100% ownership by manager

P2 : Expansion path with fractional managerial ownership but no monitoring or bonding activities

P3 : Expansion path with fractional managerial ownership and monitoring and bonding activities

W+[V(I*)-I*]

P1

W+V*-I*

W+V ’ -I v

’

C P3

G

D

F* F” F ’

P2

F

MARKET VALUE OF THE STREAM OF MANAGER ’ S

EXPENDITURESON NON-PECUNIARY BENEFITS

v = W + V ” – I ” – M

M = m + b

m : cost of monitoring activities

b : cost of bonding activities

A(m, b,

, I) = ( V* - I* ) – ( V ” – I – M )

IV. Agency cost on debt

Three part of agency cost on debt

The incentive effects associated with highly leveraged firms

The monitoring and the bonding expenditures by the bondholders and the owner-manager

Bankruptcy and reorganization costs

The incentive effects

The opportunity wealth loss caused by the impact of the debt on the investment decision of the firm.

The incentive effects

Bankruptcy behavior is the willingness of the residual claimant to engage in extremely high risk projects when there is no equity at stake.

Under-investment is often find that new investment helps the bondholders at the stockholders ’ expense

The role of monitoring and bonding cost

To limit the managerial behavior which results in reductions in the value of the bonds for the bondholders

V.Corporate ownership structure

Optimal ratio of outside equity and debt

S i

: inside equity

S

0

: outside equity

B : debt

S = S

0

+ S i

; V = S + B

E = S

0

/ ( B + S

0

)

A s0

(E) : agency cost of outside equity

A

B

(E) : agency cost of debt

A

T

(E) : A s0

(E) + A

B

(E)

A t (E*)

A

T

(E) : A s

0

(E) + A

B

(E)

0

As0(E) A

B

(E)

E* = ( S0 / (B + S0))

1.0

Fraction of outside financing obtained from equity

E

Effects of the scale of outside financing

K = ( B + S

0

) / V*

V* : the scale of the firm (constant)

K i

: different level of outside financing

K

1

> K

2

V

1

* > V

2

*

A*

T

(E,K

1

)

A B (E,K 1 )

High outside

Financing

A s0 (E,K 1 )

Low outside

Financing

A s0 (E,K 0 )

A*

T

(E,K

0

)

A B (E,K 0 )

E*(K

0

) E*(K

1

) 1.0

Fraction of outside financing obtained from equity

AT(E*,K,V*)

A*

T

(K,V

1

*)

A

T

(K,V

0

*)

0 K

Total agency costs as a function of the fraction of the firm financed by outside claims for two firm sizes, V

1

* > V

0

*

Risk and the demand for outside financing

The owner-manager will invest 100% of his personal wealth in the firm and then resort to outside financing but in fact he allocate his wealth in diversified ways to reduced the risk. So when he want to reduce this cost he will bear some agency cost( from the issuance of equity and debt)

Optimal amount of outside financing, K*

demand for outside financing

Marginal agency cost:

一 A

T

(E*,K,V*)

K* 1.0

Fraction of firm financed by outside claims

K

VI. Qualifications and extensions of the analysis

Multiperiod and extension of the analysis

Throughout our analysis we are dealing only with a single investment-financing decision and have ignored the future financing-investment decisions . If we take this into account it will have some changes such as the future sales of outside equity and debt, manager ’ s decision, agency cost and etc.

The control problem and outside owner ’ s agency costs

We have assumed that all outside equity is nonvoting . If such equity have voting right, the manager will concern about the effects on his long-run welfare of losing effective control of the firm (the danger of being fired). So to determine an equilibrium distribution of outside equity is necessary.

A note on the existence of inside debt and some conjectures on the use of convertible financial instruments

B i

/ S i

= B

0

/ S

0

B i

/ S i

> B

0

/ S

0

Some other convertible securities such as warrants, convertible bonds, and convertible preferred stock

Monitoring and the social product of security analysts

A large body of evidence exist which indicates that security prices incorporate in an unbiased manner all public available information and much of what might be called “ private information.

”

Furthermore, the security analysis activities will reduce the agency costs associated with the separation of ownership and control they are indeed social productive.

Specification in the use of debt and equity

Our previous analysis of agency costs suggests at least one other testable hypothesis: I.e., that in those industries where the incentive effects of outside equity and debt are widely different . The theory predicts the opposite would be true where the incentive effects of debt are large relative to the incentive effects of equity.