Chapter 8 Notes – Part 1 – Banking Name: Today's Objectives Begin

advertisement

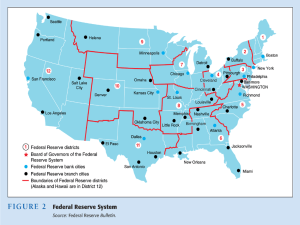

Chapter 8 Notes – Part 1 – Banking Name: ___________________________ Today’s Objectives • Begin Notes on Chapter 8 – Banking • You will… – Begin to understand how banks work – Figure out how to Bank yourself What are the 3 major functions of money? 1. 2. 3. What is purchasing power and why is it important? What are the 6 characteristics of money? 1. Give an example that would fit for each area. 2. 3. 4. 5. 6. What is something that could be used right now to replace our current currency that fits all the categories? What did people use for money in the past and why would that be an issue today? What is commodity money? What is fiat money? What is the difference between commodity money and fiat money? What are some of the different types of financial institutions (banks)? What is the main goal of any financial institution (bank)? What are some of the services offered by financial institutions? What do banks use as an incentive to savers, and as a fee for borrowers that allows them to profit? How do financial institutions use interest to profit? In what other ways can a bank profit from its borrowers and savers? Processing Activities – Use your notes from above to answer the questions below. Be sure to work with a partner if needed. 1. In your opinion, what are some of the negatives to the current currency we have in the United States? 2. Think about creating your own currency and what it would look like and how it would function. How would you go about improving the current US currency that we have? 3. What services do you, or your parents, currently use through a financial institution? List them below? 4. How would your life, or your parents’ life, be different if you did not have some of these services? 5. Suppose you are running a bank and you are looking to figure out your profits for the year. You know that you PAY 2% interest a year to your savers, and you GAIN 6% interest from your borrowers. Using the information given, and the formula below, figure out what you are PAYING or GAINING in each scenario at your bank. Interest Formula Interest = (Principle Investment) x (Interest Rate) X (time) a. Johnny has a savings account at your bank and has $10000 in his account – what will you pay him in 1 years’ time? What would you pay him after 2 years? What about after 10 years? b. Johnny also needs to buy a new car and took out a loan for $20000 for 7 years – how much will Johnny actually end up paying back to the bank? What is the profit for the bank then? Chapter 8 Note Sheet – The Federal Reserve Today’s Objectives – Continue Chapter 8 Notes Name: _________________________________ What is the Federal Reserve? What is the goal of the Fed? How do they achieve that goal? What is the most common tool of the Fed for controlling the economy? How else does the Fed function on a daily basis? FEDERAL RESERVE STRUCTURE How is the Fed structured? (3 groups) and what do they do? H How do we know where each bill was made? So why do people save less than they used to? What is the main use for savings that people do save? What are people’s 3 main sources of people’s retirement? Why should people create budgets? Chapter 8 Notes Continued Name: ________________________________ Today’s Objectives Look at the different types of investments Learn how simple and compound interest work Calculate your possible retirement needs Why should people create a budget for their money? What reasons do people have for saving money? What is principle? What are the two types of interest? How does simple interest differ from compound interest and which will give you a larger return on your investment? What does the Time Value Rule say about the value of money? What is an example of this rule? What is the “Rule of 72” and how does it work? Calculate the following information to get how many years it would take your investment to double. 1. Your $10,000 principle investment at 2% interest 2. Your $10,000 principle investment at 4% interest 3. Your $10,000 principle investment at 8% interest Label which line represents COMPOUND and which is SIMPLE. What are some other types of investments and give some information about each. TYPE OF INVESTMENT GOVERNMENT BACKED SAVINGS (3 TYPES) DETAILS ABOUT THE NVESTMENT RISK OF INVESTMENT POSSIBLE REWARD FROM INVESTMENT 1. 2. 3. What are four things that every investor should consider when figuring out where to invest their money? 1. 2. 3. 4.