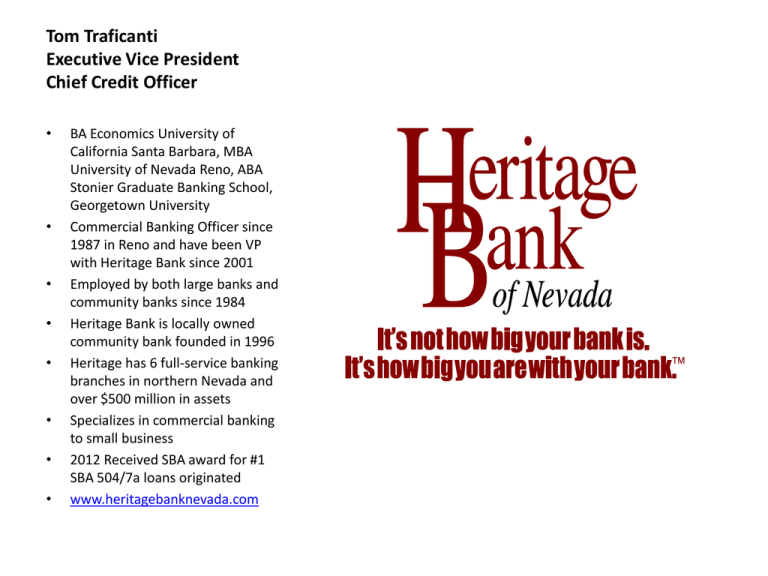

Tom Traficanti

advertisement

Tom Traficanti Executive Vice President Chief Credit Officer • • • • • • • • BA Economics University of California Santa Barbara, MBA University of Nevada Reno, ABA Stonier Graduate Banking School, Georgetown University Commercial Banking Officer since 1987 in Reno and have been VP with Heritage Bank since 2001 Employed by both large banks and community banks since 1984 Heritage Bank is locally owned community bank founded in 1996 Heritage has 6 full-service banking branches in northern Nevada and over $500 million in assets Specializes in commercial banking to small business 2012 Received SBA award for #1 SBA 504/7a loans originated www.heritagebanknevada.com Interest Rate History (Prime Rate) http://research.stlouisfed.org/fred2/ What’s normal? Excess Bank Liquidity QE1,2,3-4ever? Multiplier Effect Lending not increasing money supply What is preventing banks from making more loans? • Not enough loan demand from qualified borrowers • Tightened lending standards after Great Recession • Uncertainty about regulatory changes affecting both banking industry and small business • General uncertainty about sustainability of recovery, low interests rates and federal debt A banker will lend you an umbrella as long as it’s not raining… Sources of Loans for Small Business • • • • • • • • Commercial Banks Credit Unions Bank/CU Loans with SBA Guarantee Alternative Microloan Programs and State Programs Factoring Receivables and Private Lenders Vendors / Suppliers or Customers Friends / Family Private Lending with Equity Participation or Venture Capital Types and Structures of Loans Business Credit Offered By Banks • Term loans for purchase/refinance of fixed assets (Both conventional and SBA 7a) • Term loans for purchase/refinance of real estate (Owner Users and Investors) • Special loan programs for purchase of “owner user” commercial real estate (SBA 504) • Revolving Lines of Credit • Letters of Credit • Construction loans • Business Credit Cards, Debit Cards and Business Overdraft Lines Qualifying for Business Loan Primary and secondary repayment sources The traditional “5 Cs” of Lending: • Character/Credit History – Bank evaluates experience and history of principal owner, personal credit report (FICO Score) and business credit report (D&B, Experian). • Capacity – Cash flow projection is substantiated by least 2-3 years of performance. Bank calculates a debt/income or debt service coverage ratio. • Collateral – Banks assigns “liquidation values” and “advance rates” for each type of asset. • Capital – Bank calculates debt/equity ratio and looks for “outside” net worth and liquidity of principal owner. • Conditions - Bank evaluates how funds are used, other conditions surrounding the request and conditions (covenants) for granting loan. Innovations (Good and Bad for Small Business) • Credit Scoring Models – Used by most banks for smaller (under $100,000 or greater) and rely significantly on credit scores. • Credit Monitoring both business and personal – credit bureaus now provide instant updates to lenders for granting and reducing credit availability. • Collateral Valuation Monitoring – Updated appraisals, home values and other asset values are monitored regularly and may adjust credit availability. • Internet and Mobile Banking – Additional risks and responsibilities are associated with ACH and other electronic banking. Lessons Learned (Bankers may consider when applying for loan) • Cash and cash flow is more important than income. Regularly update cash flow projections. • Be sure to have checks and balances for employees with access to your money and credit. • Monitor closely the concentration and collectability of receivables. • Have backup plan for disruption by primary vendors and suppliers. • Stay on top of changes in industry and economy and proactive changes even if it hurts. • Building business credit and a relationship with banker is a step by step process that grows with your business.