APPLICABILITY OF TRANSFER PRICING

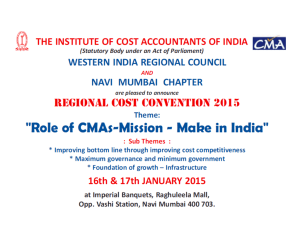

advertisement

M.V.Damania & Co. What is Transfer Pricing? M.V.Damania & Co. Intent of Indian TP Regulations (International transactions) Shifting of Profits India Overseas Associated Enterprise (AE Co.) Indian Co. Tax @ 32.45% Tax @ lower rate approx 10% Shifting of Losses Tax Saving for the Group – Loss to Indian revenue M.V.Damania & Co. International Transaction A transaction between two Associated Enterprises, Either or both of whom are Non - Residents, in the nature of Purchase, sale, lease of Provision of Services Borrowing/Lending of money Tangible/intangible property M.V.Damania & Co. Cost Sharing arrangements Capital related: 26% or more equity holding. Management related: Appointment of one or more EDs >1/2 of the BOD. Control: Wholly dependent know-how etc., 90% or more of raw materials supplied etc. Loan advanced by one enterprise => 51% of the BV of total assets of the other enterprise. One enterprise guarantees => 10% of the total borrowings of the other enterprise. M.V.Damania & Co. Common control Firm/AOP/BOI holds not less than 10 % interest in other Firm/AOP/BOI There exists between 2 enterprises any relationship of mutual interest as may be prescribed. M.V.Damania & Co. A Ltd. (Indian Co.) has taken loan from foreign bank of ` 2.56 crore during F.Y. 2012-13. Book Value of A Ltd. is ` 5 crore as on date of borrowing and on 31st March, 2013 Book Value is ` 6 crore. Are A Ltd. & Bank AEs ? M.V.Damania & Co. SPECIFIED DOMESTIC TRANSACTIONS UNDER INCOME TAX ACT – 1961 M.V.Damania & Co. Intent of TP Regulations… (Domestic transactions) Shifting of expenses India Indian Co. Loss making India Related Enterprise Profit making Tax @ 32.45% Reduced tax due to shifting of profits Tax @ 32.45% No tax or reduced tax due to loss Shifting of income Tax Saving for the Group – Loss to Indian revenue M.V.Damania & Co. Intent of Indian TP Regulations… (Domestic transactions) Particulars (Ordinary Situation) Co. X (SEZ) Co. Y (DTA) Income 500 1000 Income from related party 100 - Expenses 300 800 Expense to related party - 100 Profit/ Loss 300 100 Tax rate applicable 0% 32.45% Tax - 32.45 (100*32.45%) Particulars (Planned Situation) Co. X (SEZ) Co. Y (DTA) Income 500 1000 Income from related party 200 - Expenses 300 800 Expense to related party - 200 Profit/ Loss 400 - Tax rate applicable 0% 32.45% Tax - - M.V.Damania & Co. Loss to Revenue – Tax Saving to the Group Intent of TP Regulations…(Domestic transactions) Particulars (Ordinary Situation) Co. X (DTA) Co. Y (DTA) Income 500 1000 Income from related party 100 - Expenses 700 800 Expense to related party - 100 Profit/ Loss (100) 100 Tax rate applicable 32.45% 32.45% Tax - 32.45 (100*32.45%) Particulars (Planned Situation) Co. X (DTA) Co. Y (DTA) Income 500 1000 Income from related party 150 - Expenses 700 800 Expense to related party - 150 Profit/ Loss (50) 50 Tax rate applicable 32.45% 32.45% Tax - 16.23 (50*32.45%) Present Loss to Revenue* – Tax Saving to the Group * By shifting of income from a profit making company to a loss making company, the group could reduce its tax liability by 16.23 for the current year, though the impact will be reversed in future years given carry forward of losses. M.V.Damania & Co. Overview of Provisions of Section 92BA Inter unit transfer of goods & services by undertakings to which profit-linked deductions apply Expenditure incurred between related parties defined under section 40A SDT Transactions between undertakings, to which profit-linked deductions apply, having close connection M.V.Damania & Co. Any other transaction that may be specified Relationship can exists any time during the year Sec 40A (2)(b) – Related Party Sr.No Payer / assessee Payee (i) Individual Any relative [defined in sec. 2(41) to mean husband, wife, brother, sister, lineal ascendant or descendant] * Definition of Relative u/s 56(2) not relevant (ii) Company any director or relative of such director Firm (includes LLP) any partner or relative of such partner AOP any member or relative of such member HUF any member or relative of such member (iii) Any Assessee any individual having substantial interest in the assessee’s business or relative of such individual (iv) Any assessee a Company, Firm, AOP, HUF having substantial interest in the assessees business or any director, partner, member or relative of such director, partner or member or (newly inserted) any other company carrying on business or profession in which the first mentioned company has substantial interest. A Ltd. (holding co) X Ltd. (subsidiary co) Y Ltd. (subsidiary co) M.V.Damania & Co. Case 1 - Director or any relative of the Director of the taxpayer – Section 40A(2)(b)(ii) Case 2 - To an individual who has substantial interest in the business or profession of the taxpayer or relative of such individual – Section 40A(2)(b)(iii) Assessee (Taxpayer) Director Substantial interest >20% Assessee (Taxpayer) Relative Mr. A Mr. D Mr. C Mr. A Mr. D Relative Covered transactions Holding Structure M.V.Damania & Co. Mr. C Relative Case 4 – Any other company carrying on business in which the first mentioned company has substantial interest – Section 40A(2)(b)(iv) Case 3 – To a Company having substantial interest in the business of the taxpayer or any director of such company or relative of the director – Section 40A(2)(b)(iv) Mr. D A Ltd Assessee (Taxpayer) Substantial interest >20% Substantial interest >20% C Ltd Substantial interest >20% Relative Director Assessee (Taxpayer) Substantial interest >20% Mr. C A Ltd Covered transactions Holding Structure M.V.Damania & Co. B Ltd Case 5 – To a Company of which a director has a substantial interest in the business of the taxpayer or any director of such company or relative of the director – Section 40A(2)(b)(v) Director B Ltd Substantial interest >20% Mr. A Relative Mr. C Mr. D Covered transactions Holding Structure M.V.Damania & Co. Assessee (Taxpayer) Case 6 – To a Company in which the taxpayer has substantial interest in the business of the company – Section 40A(2)(b)(vi)(B) A Ltd Substantial interest >20% Assessee (Taxpayer) B Ltd D Ltd Covered transactions Holding Structure M.V.Damania & Co. Mr C Relative Substantial interest >20% Assessee (Taxpayer) Case 7 – Any director or relative of the director of taxpayer having substantial interest in that person– Section 40A(2)(b)(vi)(B) Substantial interest >20% Mr B A Ltd is a manufacturing Company. A Limited Purchases RM from B Ltd. of Rs. 4.5 Cr and sales FG to B Limited of Rs 5.5cr. B Limited has substantial interest in A Limited. Analyze if the above transaction is covered under SDT for A Limited and B Limited? If in the above case A ltd. Is located in SEZ(special economic zone) area. Is this transactions covered under SDT? M.V.Damania & Co. A Limited (Indian Company) is holding 24 % shares in B Inc.(Overseas Company). Analyze if A Limited and B Inc. are associate enterprise. M.V.Damania & Co. M.V.Damania & Co.