Time Series and

Forecasting

Chapter 16

McGraw-Hill/Irwin

Copyright © 2012 by The McGraw-Hill Companies, Inc. All rights reserved.

Learning Objectives

LO1 Define the components of a time series

LO2 Compute Moving average, weighted moving average

and exponential smoothing

LO3 Determine a linear trend equation

LO4 Use a trend equation to compute forecasts

LO5 Determine and interpret a set of seasonal indexes

LO6 Deseasonalize data using a seasonal index

LO7 Calculate seasonally adjusted forecasts

LO8 Use a trend equation for a nonlinear trend

16-2

Time Series and its Components

TIME SERIES is a collection of data recorded over a period of time (weekly,

monthly, quarterly), an analysis of history, that can be used by management

to make current decisions and plans based on long-term forecasting. It

usually assumes past pattern to continue into the future

Components of a Time Series

1. Secular Trend – the smooth long term direction of a time series

2. Cyclical Variation – the rise and fall of a time series over periods longer

than one year

3. Seasonal Variation – Patterns of change in a time series within a year

which tends to repeat each year

4. Irregular Variation – classified into:

Episodic – unpredictable but identifiable

Residual – also called chance fluctuation and unidentifiable

16-3

Secular Trend – Examples

16-4

Cyclical Variation – Sample Chart

1991

1996

2001

2006

2011

16-5

Seasonal Variation – Sample Chart

16-6

Irregular variation

Caused by irregular and unpredictable

changes in a times series that are not

caused by other components

Exists in almost all time series

Needs to reduce irregular variation to

make accurate predictions

16-7

The Moving Average Method

Useful in smoothing time series to see its

trend

Basic method used in measuring seasonal

fluctuation

Applicable when time series follows fairly

linear trend that have definite rhythmic

pattern

16-8

Moving Average Method - Constant

duration of cycles

16-9

3-year and 5-Year Moving Averages

Gas Sales

39

37

61

58

18

56

82

27

41

69

49

66

54

42

90

66

100

Data-> Data

Analysis ->

Moving

Average

90

80

70

60

Gas Sales

50

3-period

5-period

40

30

20

10

0

1

2

3

4

5

6

7

8

9

10 11 12 13 14 15 16

16-10

Exponential Smoothing

Overcome some

drawbacks of moving

average:

No

moving averages

for the first and last

time periods.

“Forgets” most of the

previous values.

St = wyt + (1 – w)St-1 (for t ≥ 2)

where:

St = Exponentially smoothed time

series at time t

yt = Time series at time period t

St-1 = Exponentially smoothed time

series at time t–1

w = Smoothing constant, 0 ≤ w ≤ 1

Exponential smoothing

Data-> Data Analysis ->

Exponential smoothing,

damping factor = 1-w

Gas Sales

39

100

37

61

58

18

56

82

27

41

69

49

66

54

42

90

66

90

80

70

60

Gas Sales

50

damping=.8

damping=.3

40

30

20

10

0

1

2

3

4

5

6

7

8

9

10 11 12 13 14 15 16

16-12

Weighted Moving Average

A simple moving average assigns the same

weight to each observation in averaging

Weighted moving average assigns different

weights to each observation

Most recent observation receives the most

weight, and the weight decreases for older data

values

In either case, the sum of the weights = 1

16-13

Weighted Moving Average - Example

Cedar Fair operates seven amusement parks and

five separately gated water parks. Its combined

attendance (in thousands) for the last 17 years is

given in the following table. A partner asks you to

study the trend in attendance. Compute a threeyear moving average and a three-year weighted

moving average with weights of 0.2, 0.3, and 0.5 for

successive years.

16-14

Weighted Moving Average - Example

16-15

Weighed Moving Average – An Example

16-16

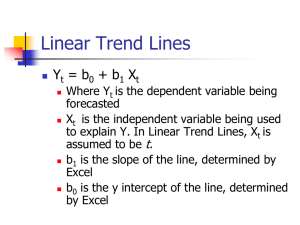

Linear Trend

The long term trend of many business series often

approximates a straight line

Linear Trend Equation : Y a bt

where :

Y read "Y hat" , is the projected value of the Y

variable for a selected value of t

a the Y - intercept

b the slope of the line

t any value of time (coded) that is selected

16-17

Linear Trend Plot

16-18

Linear Trend – Using the Least Squares

Method

Use the least squares method in Simple Linear

Regression (Chapter 13) to find the best linear

relationship between 2 variables

Code time (t) and use it as the independent

variable

E.g. let t be 1 for the first year, 2 for the second,

and so on (if data are annual)

16-19

Linear Trend –An Example

A hotel in Bermuda has

recorded the occupancy

rate for each quarter for

the past 5 years. The

data are shown here.

Year

2006

2007

2008

2009

1010

Rate

0.561

0.702

0.800

0.568

0.575

0.738

0.868

0.605

0.594

0.738

0.729

0.600

0.622

0.708

0.806

0.632

0.665

0.835

0.873

0.670

Quarter

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

16-20

Linear Trend –An Example Using Excel

Rate

1

0.9

y = 0.0052x + 0.6394

0.8

0.7

0.6

0.5

Rate

0.4

Linear (Rate)

0.3

0.2

0.1

0

0

5

10

15

20

25

Insert->Scatter->first option->Right-click on

any marker->Add trendline->At the bottom:

Display Equation on chart

16-21

Seasonal Variation

Fluctuations that coincide with certain seasons;

repeated year after year

Understanding seasonal fluctuations help plan for

sufficient goods and materials on hand to meet varying

seasonal demand

Analysis of seasonal fluctuations over a period of years

help in evaluating current sales

16-22

Seasonal Index

A number, usually expressed in percent, that

expresses the relative value of a season with

respect to the average for the year (100%)

Ratio-to-moving-average method

The method most commonly used to compute the

typical seasonal pattern

It eliminates the trend (T), cyclical (C), and irregular (I)

components from the time series

16-23

Bermuda Hotel example

Quarter

Step (1) – Organize time

series data in column form

Step (2) Compute the 4quarter moving totals

Step (3) Compute the 4quarter moving averages

Step (4) Compute the

centered moving averages

by getting the average of

two 4-quarter moving

averages

Step (5) Compute ratio by

dividing actual rate by the

centered moving averages

Period t

Rate

4-quarter

moving

averages

Centered

moving

averaged

Ratio of

sales to

centered

moving

averages

1

1

0.561

2

2

0.702

0.65775

3

3

0.800

0.66125

0.6595

1.21304

4

4

0.568

0.67025

0.66575

0.853173

1

5

0.575

0.68725

0.67875

0.847145

2

6

0.738

0.6965

0.691875

1.066667

3

7

0.868

0.70125

0.698875

1.241996

4

8

0.605

0.70125

0.70125

0.862745

1

9

0.594

0.6665

0.683875

0.86858

2

10

0.738

0.66525

0.665875

1.108316

3

11

0.729

0.67225

0.66875

1.090093

4

12

0.600

0.66475

0.6685

0.897532

1

13

0.622

0.684

0.674375

0.922335

2

14

0.708

0.692

0.688

1.02907

3

15

0.806

0.70275

0.697375

1.155763

4

16

0.632

0.7345

0.718625

0.879457

1

17

0.665

0.75125

0.742875

0.895171

2

18

0.835

0.76075

0.756

1.104497

3

19

0.873

4

20

0.670

16-24

Seasonal Index – An Example

Year

1

2

2006

3

4

1.21304

0.853173

2007

0.847145 1.066667 1.241996 0.862745

2008

0.86858

1.108316 1.090093 0.897532

2009

0.922335

1.02907

2010

0.895171 1.104497

1.155763 0.879457

Average

0.883308 1.077137 1.175223 0.873227

Index

0.883308 1.077137 1.175223 0.873227

16-25

Actual versus Deseasonalized Sales for Toys International

Deseasonalized Series = Actual series / Seasonal Index

Quarter

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

1

2

3

4

Period t

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

Rate

0.561

0.702

0.800

0.568

0.575

0.738

0.868

0.605

0.594

0.738

0.729

0.600

0.622

0.708

0.806

0.632

0.665

0.835

0.873

0.670

4-quarter Centered

moving

moving

average average

0.66

0.66

0.67

0.69

0.70

0.70

0.70

0.67

0.67

0.67

0.66

0.68

0.69

0.70

0.73

0.75

0.76

0.66

0.67

0.68

0.69

0.70

0.70

0.68

0.67

0.67

0.67

0.67

0.69

0.70

0.72

0.74

0.76

Ratio

1.21

0.85

0.85

1.07

1.24

0.86

0.87

1.11

1.09

0.90

0.92

1.03

1.16

0.88

0.90

1.10

Seasonal

Seasonal adjusted

Index

rate

0.88

0.64

1.08

0.65

1.18

0.68

0.87

0.65

0.88

0.65

1.08

0.69

1.18

0.74

0.87

0.69

0.88

0.67

1.08

0.69

1.18

0.62

0.87

0.69

0.88

0.70

1.08

0.66

1.18

0.69

0.87

0.72

0.88

0.75

1.08

0.78

1.18

0.74

0.87

0.77

16-26

Actual versus Deseasonalized Series

1

0.9

0.8

0.7

0.6

Rate

0.5

Seasonal adjusted rate

0.4

0.3

0.2

0.1

0

1

2

3

4

5

6

7

8

9 10 11 12 13 14 15 16 17 18 19 20

16-27

Seasonally Adjusted Forecast

(1) Obtain the linear equation using the deseasonalized data:

Ŷ= .6371+.0053t

(2) Use the linear equation to predict the dependent variable, rate.

(3) Use the predicted rate times the corresponding seasonal index to obtain

the seasonally adjusted forecast.

Quarterly Forecast for 2011

Estimated Seasonal

rat

Index

Quarterly

Forecast

Quarter

Period

1

21

0.75

0.88

0.66

2

22

0.75

1.08

0.81

3

23

0.76

1.18

0.89

4

24

0.76

0.87

0.67

Ŷ X SI = .76 X .87

Ŷ = .6371+ 0.0053(24)

16-28

Nonlinear Trends

A linear trend equation is used when the data

are increasing (or decreasing) by equal amounts

A nonlinear trend equation is used when the

data are increasing (or decreasing) by

increasing amounts over time

When data increase (or decrease) by equal

percents or proportions plot will show curvilinear

pattern

16-29

Log Trend Equation – Gulf Shores Importers

Example

Graph on right is

the log base 10 of

the original data

which now is linear

(Excel function:

=log(x) or log(x,10)

Using Data Analysis

in Excel, generate

the linear equation

Regression output

shown in next slide

16-30

Log Trend Equation – Gulf Shores Importers

Example

The Linear Equation is :

y 2.053805 0.153357t

16-31

Log Trend Equation – Gulf Shores Importers

Example

Estimate the Import f or the year 2014 using the linear trend

y 2.053805 0.153357t

Substitute into the linear equation above the code (19) f or 2014

y 2.053805 0.153357(19)

y 4.967588

Then f ind the antilog of y 10

^

Y

104.967588

92,809

16-32