TIME SERIES 1 - Department of Mathematics

advertisement

TIME SERIES

by

H.V.S. DE SILVA

DEPARTMENT OF MATHEMATICS

Contents:

Introduction to time series

Fundamentals of time series analysis

Basic theory of stationary processes

Time series Models:

---

MA model

AR model

ARIMA model

Seasonal Adjustment

Some applications of social and Physical Sciences

References:

• The analysis of time series: Theroy & Practice

- Chatfield , C

• The statistical analysis of time series

- Anderson,T.W.

• Time series

- Kondall, Maurice

• The analysis of time series an introduction

- Chatfield, C.

1. Introduction to time series

A time series is a collection of observations

made sequentially in time.

Examples:

In Economics, daily closing stock prices, weekly interest rates,

monthly price indices and yearly earnings.

In Meteorology, hourly wind speed, daily temperature and

annual rainfall

In Social Sciences annual birth rates, mortality rates, accident

rates and various crime rates.

Ctd…

In Engineering electric signals, voltage and

sound.

In Geophysics ocean waves, earth noise in an

area.

EEG and EKG tracings in Medicine.

In Agriculture annual crop production prices.

1.1 Discrete & Continuous time series

A time series is said to be discrete when

observations are taken only at specific time points.

A time series is said to be continuous when

observations are made continuously.

During this lecture we consider only discrete time series that is

when observations are taken at equal intervals.

1.2 Objectives of Time series Analysis

To understand the variability of the time series.

To identify the regular and irregular oscillations of the

time series.

To describe the characteristics of the oscillations.

To understand physical processes that give rise to each

of these oscillations.

1.3

Components of a time series

A time series is a collection of data obtained by observing a

response variable at periodic points in time. Xt is used to

denote the value of the variable x at time t.

A time series is made up of one or more components of the following :

1.

-

Trend

Measures the average change in the

variable per unit time. In other words

it measures the change in the mean

level of the time series.

Ctd…

2. Seasonal variations

- Periodic variations that occur with some degree of

regulations within a year or shorter.

3. Cyclical variations

- Recurring up and down movement which

are extended over a long period.( usually 2

years or more)

4. Irregular variations

- Random Fluctuations which happen due to errors.

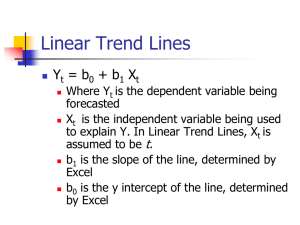

Time series models can be classified into two types:

Additive model & multiplicative model

The four components are combined in the additive time series

model & multiplicative model as follows;

Yt = T+S+C+R(additive)

Yt = T.S.C.R(multiplicative

Where Yt is the actual value

T – trend or long-term movement

S – seasonal movement

C – cyclical movement

R - residual or random movement

(irregular variation)

The components of a time series are easily

Identified and explained pictorially in a time

series plot.

A time series plot is a sequence plot with the

time series variable Yt the vertical axis and time t

on the horizontal axis.

The figure 1.1 shows a trend in the time series values.

The trend component describes the tendency of the

value of the variable to increase or decrease over a

long period of time.

Figure 1.1 : Trend in a time series

A cyclical effect in a time series as shown in the

figure 1.2 describes the fluctuation about the

trend line.

In business the fluctuations are called business

cycles.

figure 1.2 : cyclic variations in a time series

A seasonal variation in a series describes the

fluctuations that recur during specific portions of each

year ( monthly or seasonally), You can see in the figure

1.3 that the pattern of change in the time series within a

year tends to be repeated from year to year producing a

wavelike or oscillating curve.

Figure 1.4 : seasonal variations in a time series

The final component, the residual effect is

what remains after the trend, cyclical and

seasonal components have been removed.

This component is not systematic and may be

attributed to unpredictable influences.

Thus the residual effect represents the

random error component of a time series.

• One of the objectives of time series is to

forecast some future values of the series.

• To obtain forecast some type of model that can

be projected into the future must be used to

describe the time series.

• One of the most widely used models is the

additive model.

Filtering( Smoothing techniques)

• A procedure to remove random variation revealing more

clearly the underlying trend and cyclic components in a set of

time series data, converting one time series to another by

performing a linear operation for the use of forecasting.

Moving Average

- Smooth out (reduce) fluctuations and gives

trend values to a fair degree of accuracy.

- The average value of a number of adjacent time

series values is taken as the trend value for the

middle point.

Using linear regression technique the equation of

the straight line trend can be estimated.

Exponential Smoothing

- This is a very popular scheme to produce a

smooth time series.

- weigh past observations with exponentially

decreasing weights to forecast future values.

Differencing

- This is the common method of filtering.

- A popular and effective method of removing trend from a

time series.

- Differencing of a time series { x } in discrete time t is the

transformation of the series {x } to a new series { x }

where the values x

are the differences between

values of consecutive x .

Time series operators

•

Difference operator

- First difference operator

-Second difference operator

- Higher order difference operator

Lag operator (Backward shift operator)

-Transforms an observation of a time series to the

previous one.

Autocorrelation

This is the correlation(relationship) between members of a time

series.

Autocorrelation coefficient at lag k is given by

Suppose we have a set of n values, {xt}, which

represent measurements taken at different time

periods, t=1,2,3,4,…n, of the closing daily price of a

stock or commodity. The following Figure shows a

typical stock price time series: the blue line is the

closing stock price on each trading day; the red and

black looped lines highlight the time series for 7 and

14 day intervals or ‘lags’, i.e. the sets

{xt,xt+7,xt+14,xt+21,...} and

{xt,xt+14,xt+28,xt+42,...}.

Time series of stock price and volume data

The pattern of values recorded and graphed might show that

commodity prices, exhibits some regularity over time. For

example, it might show that days of high commodity prices are

commonly followed by another day of high commodity prices ,

and days of low commodity prices are also often followed by

days of low commodity prices . In this case there would be a

strong positive correlation between commodity prices on

successive days, i.e. on days that are one step or lag apart. We

could regard the set of “day 1” values as one series, {xt,1}

t=1,2,3…n-1, and set of “day 2” values as a second series {xt,2}

t=2,3…n, and compute the correlation coefficient for these two

series in the same manner as for the r expression above.