file pdf - Borsa Italiana

advertisement

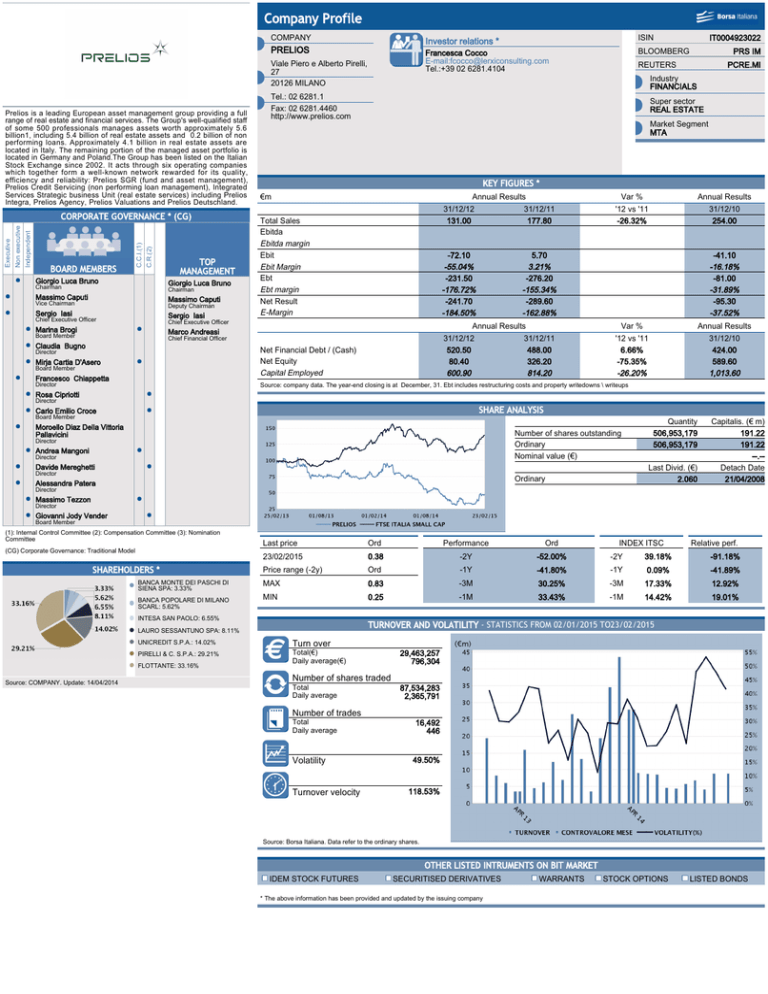

Company Profile COMPANY Investor relations * ISIN PRELIOS Francesca Cocco E-mail:fcocco@lerxiconsulting.com Tel.:+39 02 6281.4104 BLOOMBERG Viale Piero e Alberto Pirelli, 27 20126 MILANO Prelios is a leading European asset management group providing a full range of real estate and financial services. The Group's well-qualified staff of some 500 professionals manages assets worth approximately 5.6 billion1, including 5.4 billion of real estate assets and 0.2 billion of non performing loans. Approximately 4.1 billion in real estate assets are located in Italy. The remaining portion of the managed asset portfolio is located in Germany and Poland.The Group has been listed on the Italian Stock Exchange since 2002. It acts through six operating companies which together form a well-known network rewarded for its quality, efficiency and reliability: Prelios SGR (fund and asset management), Prelios Credit Servicing (non performing loan management), Integrated Services Strategic business Unit (real estate services) including Prelios Integra, Prelios Agency, Prelios Valuations and Prelios Deutschland. C.R.(2) BOARD MEMBERS C.C.I.(1) Independent Non executive Executive CORPORATE GOVERNANCE * (CG) Giorgio Luca Bruno TOP MANAGEMENT Giorgio Luca Bruno Chairman Chairman Massimo Caputi Massimo Caputi Vice Chairman Deputy Chairman Sergio Iasi Sergio Iasi Chief Executive Officer Super sector REAL ESTATE Market Segment MTA KEY FIGURES * €m Annual Results 31/12/12 31/12/11 131.00 177.80 Total Sales Ebitda Ebitda margin Ebit Ebit Margin Ebt Ebt margin Net Result E-Margin -72.10 -55.04% -231.50 -176.72% -241.70 -184.50% Net Financial Debt / (Cash) Net Equity Capital Employed Annual Results 31/12/12 31/12/11 520.50 488.00 80.40 326.20 600.90 814.20 Chief Financial Officer Claudia Bugno Director Mirja Cartia D'Asero Board Member Francesco Chiappetta Director PCRE.MI Industry FINANCIALS Marco Andreasi Board Member PRS IM REUTERS Tel.: 02 6281.1 Fax: 02 6281.4460 http://www.prelios.com Chief Executive Officer Marina Brogi IT0004923022 Var % '12 vs '11 -26.32% Annual Results 31/12/10 254.00 5.70 3.21% -276.20 -155.34% -289.60 -162.88% -41.10 -16.18% -81.00 -31.89% -95.30 -37.52% Var % '12 vs '11 6.66% -75.35% -26.20% Annual Results 31/12/10 424.00 589.60 1,013.60 Source: company data. The year-end closing is at December, 31. Ebt includes restructuring costs and property writedowns \ writeups Rosa Cipriotti Director SHARE ANALYSIS Carlo Emilio Croce Board Member Moroello Diaz Della Vittoria Pallavicini Number of shares outstanding Ordinary Nominal value (€) Director Andrea Mangoni Director Davide Mereghetti Director Last Divid. (€) 2.060 Ordinary Alessandra Patera Quantity 506,953,179 506,953,179 Capitalis. (€ m) 191.22 191.22 --.-Detach Date 21/04/2008 Director Massimo Tezzon Director Giovanni Jody Vender Board Member (1): Internal Control Committee (2): Compensation Committee (3): Nomination Committee (CG) Corporate Governance: Traditional Model SHAREHOLDERS * BANCA MONTE DEI PASCHI DI SIENA SPA: 3.33% BANCA POPOLARE DI MILANO SCARL: 5.62% Last price Ord Performance Ord 23/02/2015 0.38 -2Y -52.00% -2Y 39.18% -91.18% Price range (-2y) Ord -1Y -41.80% -1Y 0.09% -41.89% MAX 0.83 -3M 30.25% -3M 17.33% 12.92% MIN 0.25 -1M 33.43% -1M 14.42% 19.01% INTESA SAN PAOLO: 6.55% Source: COMPANY. Update: 14/04/2014 Relative perf. TURNOVER AND VOLATILITY - STATISTICS FROM 02/01/2015 TO23/02/2015 LAURO SESSANTUNO SPA: 8.11% UNICREDIT S.P.A.: 14.02% Turn over PIRELLI & C. S.P.A.: 29.21% Total(€) Daily average(€) FLOTTANTE: 33.16% INDEX ITSC 29,463,257 796,304 Number of shares traded Total Daily average 87,534,283 2,365,791 Number of trades Total Daily average 16,492 446 A Volatility 49.50% A Turnover velocity 118.53% Source: Borsa Italiana. Data refer to the ordinary shares. OTHER LISTED INTRUMENTS ON BIT MARKET IDEM STOCK FUTURES SECURITISED DERIVATIVES * The above information has been provided and updated by the issuing company WARRANTS STOCK OPTIONS LISTED BONDS