Chapter 10: Operating Leverage

advertisement

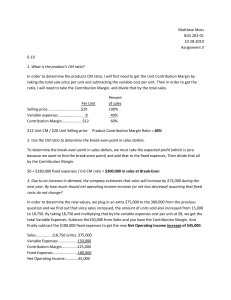

Chapter 10 Managerial Accounting Operating Leverage Prepared by Diane Tanner University of North Florida Cost Structure and Risk What is cost structure? The relative proportion of fixed and variable costs in an company Higher proportions of fixed costs compared to variable costs More sensitive to changes in sales More risk Higher proportions of variable costs compared to fixed costs Less sensitive to changes in sales Less risk 2 Cost Structure Example CopyDisk and ZoomCopy are both in the business of reproducing mass quantities of DVDs. CopyDisk depends on hourly workers to insert disks into the copier, while ZoomCopy uses costly equipment that automatically inserts DVDs to be copied. As a result, ZoomCopy has higher fixed costs compared to its total costs, while CopyDisk has proportionally higher variable costs. Which cost structures is more risky? ZoomCopy is more risky, because its additional equipment will generate more depreciation, a fixed cost. 3 4 Comparing Cost Structures Income statements from two equally profitable companies appear below: Sales Less variable expenses Contribution margin Less fixed expenses Net operating income Company A Company B $130,000 $130,000 60,000 81,000 70,000 49,000 52,000 31,000 $ 18,000 $ 18,000 Cost structures with higher fixed costs compared to those with lower fixed are more risky Cost Structure Effect on Sales Increase Sales Less variable expenses Contribution margin Less fixed expenses Net operating income Company With 10% A Increase $130,000 $143,000 60,000 66,000 70,000 77,000 52,000 52,000 $ 18,000 $ 25,000 Company With 10% B Increase Sales $130,000 $143,000 Less variable expenses 81,000 89,100 Contribution margin 49,000 53,900 Less fixed expenses 31,000 31,000 Net operating income $ 18,000 $ 22,900 Company A’s cost structure leads to a larger increase in net operating income. Profit Increase $7,000 or 38.88% Profit Increase $4,900 or 27.22% 5 Operating Leverage Relates to the proportional level of fixed versus variable costs in a firm’s cost structure General rules The higher the degree of fixed costs The more operating leverage a company has The more risk a company possesses Creating greater profit and loss swings as sales increase or decrease 6 7 Measuring Operating Leverage A measure of how sensitive net operating income is to percentage changes in sales A risk indicator Degree of Operating Leverage Company A $70,000 = 3.89 $18,000 = Contribution Margin Net Operating Income Company B $49,000 = 2.72 $18,000 Higher degree of operating leverage indicates higher proportion of fixed costs and higher risk. The End 8