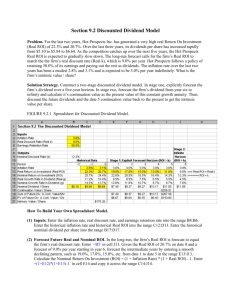

The Dividend Discount Model

advertisement

Lecture 7: Valuing Stocks This chapters introduces valuations techniques for equity (stocks). The Dividend Discount Model provides an excellent measure of a stock’s intrinsic value. 7-1 The Stock Market The two principal stock exchanges in the US are the New York Stock Exchange & NASDAQ •Primary market – Market for the sale of new securities by corporations. •Secondary Market – Market in which previously issued securities are traded among investors. •Initial Public Offering (IPO) – First offering of stock to the general public. •Primary Offering – Occurs when a corporation sells shares in the firm. 7-2 Primary vs. Secondary Markets: Example Shannon sells 100 shares of Google stock from her portfolio for $500 per share to help pay for her son Domenic’s college education. How much does Google receive from the sale of its shares? Does this transaction occur on the primary or secondary market? 7-3 Bid Price/Ask Price Bid Price: The prices at which investors are willing to buy shares. Ask Price: The prices at which current shareholders are willing to sell their shares. Example: If an investor wishes to purchase 100 shares of Apple with a bid price of $253.40 and an ask price of $253.48, how much could the investor expect to pay for the shares? Answer: $253.80 7-4 Terminology Investors use a number of methods to determine the quality of a company’s shares. •Market cap (market capitalization) – The total value of a company’s outstanding shares. •P/E Ratio – Ratio of stock price to earnings per share. •Dividend Yield – The ratio of dividends paid and share price. Tells the investor how much dividend income they can expect for every $1 invested in the stock. 7-5 Basic Terminology: Example You are considering investing in a firm whose shares are currently selling for $50 per share with 1,000,000 shares outstanding. Expected dividends are $2/share and earnings are $6/share. What is the firm’s Market Cap? P/E Ratio? Dividend Yield? M ark et C ap italizatio n $ 5 0 1, 0 0 0, 0 0 0 $ 5 0, 0 0 0, 0 0 0 P /E R atio $50 8 .3 3 $6 D ivid en d Y ield $2 .0 4 4 % $50 7-6 Measures of Value Three ways to value a firm: •Book Value – Net worth of the firm according to the balance sheet. •Liquidation Value – Net proceeds that could be realized by selling the firm’s assets and paying off its creditors. •Market Value – The value of the firm as determined by investors who would be willing to purchase the company. • Unlike book value and liquidation value, market value treats the firm as a going concern. • To help identify sources of value, financial managers sometimes construct marketvalue balance sheets. •Market Value Balance Sheet – Balance sheet showing market rather than book values of assets, liabilities, and shareholders’ equity. 7-7 Going-Concern Value The difference between a company’s actual value and its book or liquidation value is called its going-concern value. Refers to three factors: •Extra earning power – A company may have the ability to earn a higher rate of return on assets; the value of these assets will be higher than their book value. •Intangible assets – Many assets can’t be quantified on the balance sheet; for example a company’s brand and its managerial expertise. •Value of future investments – If investors believe a company will potentially make very profitable investments in the future, they will pay more for the company’s stock today. 7-8 Price and Intrinsic Value • Intrinsic Value – Present value of future cash payoffs from a stock or other security. • Note: the intrinsic value represents the “fair” price of the stock. If investors by the stock for 𝑽_𝟎, their expected rate of return will precisely equal the discount rate. 7-9 Price and Intrinsic Value Example: What is the intrinsic value of a share of stock if expected dividends are $2/share and the expected price in 1 year is $35/share? Assume a discount rate of 10%. 7-10 Expected Return 7-11 Expected Return: Example What should be the price of a stock in one year if it sells for $40 today, has an expected dividend per share of $3, and an expected return of 12%? 7-12 The Dividend Discount Model P0 Div 1 (1 r ) 1 Div 2 (1 r ) 2 ... Div H PH (1 r ) H w here : H T im e H orizon D iv i D ividend in the i th period. r R equired R ate of R eturn 7-13 The Dividend Discount Model Consider three cases: 1. No growth 2. Constant Growth 3. Nonconstant Growth 7-14 The Dividend Discount Model Case 1: No Growth What should the price of a share of stock be if dividends are projected at $5/share, the discount rate is 10%, and growth is 0%? • In the case where a company reinvests no earnings into the firm (thus achieving no growth), the dividend discount model says that the firm’s shares should sell for the present value of a constant, perpetual stream of dividends. 7-15 The Dividend Discount Model • Constant-growth Dividend Discount Model – Version of the dividend discount model in which dividends grow at a constant rate. Also known as the Gordon growth model Case 2: Constant Growth Example: What should the price of a share of stock be if the firm will pay a $4 dividend in 1 year that is expected to grow at a constant rate of 5%? Assume a discount rate of 10%. 7-16 The Dividend Discount Model Case 3: Nonconstant Growth P0 Div 1 (1 r ) 1 Div 2 (1 r ) 2 ... Div H (1 r ) PV of dividends from year 1 to horizon H PH (1 r ) H PV of stock price at horizon • If we set “H” to the year in which we expect growth rate to change, we can use the dividend discount model to estimate the present value of these dividends. 7-17 Nonconstant Growth Dividend Discount Model Example: A firm is expected to pay $2/share in dividends next year. Those dividends are expected to grow by 8% for the next three years and 6% thereafter. If the discount rate is 10%, what is the current price of this security? 7-18 Required Rates of Return Estimating Expected Required Rates of Return: Example: What rate of return should an investor expect on a share of stock with a $2 expected dividend and 8% growth rate that sells today for $60? • Even if immediate dividends or expected growth rates are different, stocks with the same risk should offer the same expected total rate of return. • Another way of writing this relationship is this: 𝑟=(dividend yield)+(growth rate) 7-19 Sustainable Growth Rate If a firm earns a constant return on its equity and plows back a constant proportion of earnings, then the growth rate g is: g R eturn on E quity P low back R ate = R O E b w here : b earnings dividends earnings Example: Suppose a firm that pays out 35% of earnings as dividends and expects its return on equity to be 10%. What is the expected growth rate? g .10 (1 .35) .065 6.5% • Note: Plowback Ratio = 1 – Payout Ratio 7-20 Valuing Growth Stocks Present Value of Growth Opportunities (PVGO) – Where: EPS = Earnings per share PVGO = Present Value of Growth Opportunities • Present Value of Growth Opportunities (PVGO) – Net present value of a firm’s future investments. 7-21 Valuing Growth Stocks: Example Suppose a stock is selling today for $55/share and there are 10,000,000 shares outstanding. If earnings are projected to be $20,000,000, how much value are investors assigning to growth per share? Assume a discount rate of 10%. 7-22 Methods of Analysis Investors have many strategies for trying to beat the market consistently. •Technical Analysis – Investors who attempt to identify undervalued stocks by searching for patterns in past stock prices. •Fundamental Analysis – Investors who attempt to find mispriced securities by analyzing fundamental information, such as accounting performance and earnings prospects. 7-23 Technical Analysis Technical analysts try to achieve superior returns by spotting and exploiting patterns in stock prices. •Technical Analysis – Investors who attempt to identify undervalued stocks by searching for patterns in past stock prices. •Random walk – Security prices change randomly, with no predictable trends or patterns. • They are equally likely to offer a high or low return on any particular day, regardless of what has occurred on previous days. 7-24 Technical Analysis Returns on NYCI on two successive weeks, 1970-2010 Are successive security prices related?. 7-25 Fundamental Analysis Fundamental analysts are paid to uncover stocks for which price does not equal intrinsic value. What happens in a market with many talented and competitive fundamental analysts? 7-26 Efficient Market Hypotheses Is the US stock market a highly efficient market? •Efficient Market – Market in which prices reflect all available information. •Weak-form Efficient – A market in which prices already reflect all the information contained in past prices. •Semistrong-form Efficient – A market in which prices reflect not just the information contained in past prices but also all publicly available information. •Strong-form Efficient – A market where prices impound all available information. • In a strong-form efficient market, no investor, however hardworking, could expect to earn superior profits. 7-27 Market Anomalies There are a number of market anomalies that seem to puzzle efficient market theorists, including: •The Earnings Announcement Puzzle: • In an efficient stock market, a company’s stock price should react instantly at the announcement of unexpectedly good or bad earnings. • However, stocks with the best earnings news typically outperform the stocks with the worst earnings news during the following six months (See Figure 7.11 in the text). • This suggests that investors underreact to the earnings announcement and become aware of the full significance only as further information arrives. •The New-Issue Puzzle: • When firms issue stock to the public, investors typically rush to buy and these investors usually realize immediate capital gains. • However, these early gains often turn into losses for the investor. •Bubbles: • There are sometimes cases where market prices as a whole become difficult or impossible to justify. • Historical examples: • The Japanese Nikkei, 1985-2009 • Japanese real estate bubble, 2005 • US dot-com bubble, 1995-2002 Behavioral Finance Some believe that deviations in prices from intrinsic value can be explained by behavioral psychology, in two broad areas: 1. Attitudes toward risk--People generally dislike incurring losses, yet they are more apt to take bigger risks if they are experiencing a period of substantial gains. 2. Beliefs about probabilities--Individuals commonly look back to what has happened in recent periods and assume this is representative of future outcomes. 7-29